Northland Power stock dividend – Northland Power Inc Declares 0.1 Cash Dividend

June 11, 2023

🌥️Dividends Yield

On May 26 2023, Northland Power ($TSX:NPI) Inc declared a 0.1 CAD cash dividend per share to its shareholders. This is the same amount the company has offered for the past three years, resulting in dividend yields of 2.81%, 3.04% and 2.83% respectively for 2021 to 2023. The average dividend yield being 2.89% is quite attractive, particularly when compared to other dividend stocks.

For those interested in dividend stocks, Northland Power Inc is a viable option due to their consistent and attractive yields. The ex-dividend date for this particular dividend has been set at May 30 2023, meaning shareholders must own the stock before this date in order to qualify for the dividend payout.

Stock Price

The company’s stock opened at CA$29.6 and closed at CA$29.8, representing an increase of 0.4% from the previous closing price of CA$29.6. The announcement of the dividend was well received by shareholders, with the stock price rising modestly on the news. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Northland Power. More…

| Total Revenues | Net Income | Net Margin |

| 2.38k | 658.5 | 16.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Northland Power. More…

| Operations | Investing | Financing |

| 1.68k | -1.04k | -931.23 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Northland Power. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.03k | 9.22k | 17.77 |

Key Ratios Snapshot

Some of the financial key ratios for Northland Power are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.1% | 2.7% | 55.6% |

| FCF Margin | ROE | ROA |

| 49.7% | 18.6% | 5.9% |

Analysis – Northland Power Intrinsic Value Calculator

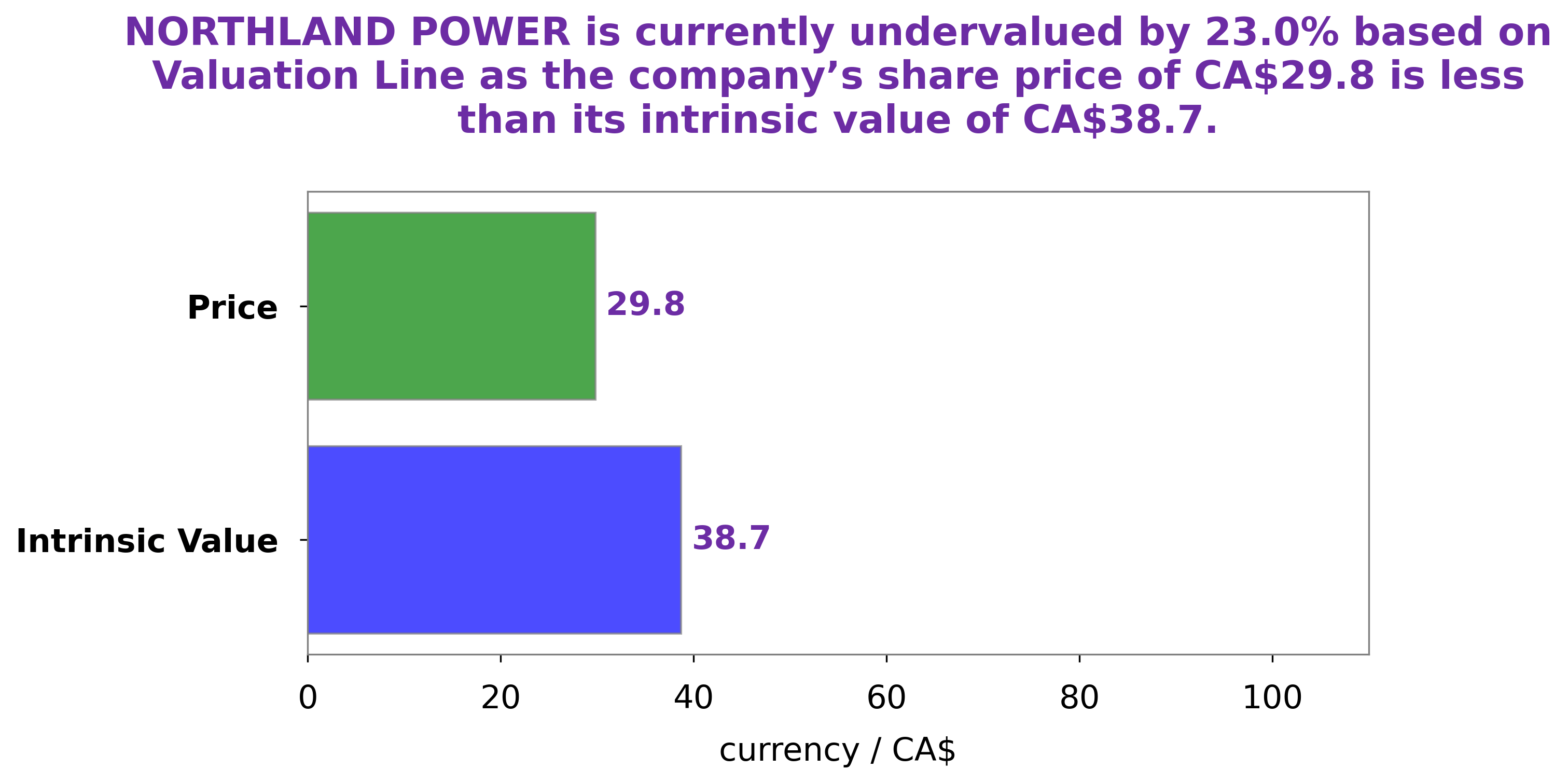

At GoodWhale, we have conducted an analysis of NORTHLAND POWER‘s financials. Our proprietary Valuation Line has calculated the intrinsic value of NORTHLAND POWER shares to be around CA$38.7. At the moment, NORTHLAND POWER stock is trading at CA$29.8, representing a 23.1% undervaluation. This provides investors with an attractive opportunity to invest in the company. More…

Peers

The company has a diversified portfolio of assets including wind, solar, biomass, and hydroelectric power. Northland Power is one of the largest providers of renewable energy in Canada and is a leading developer of new renewable energy projects. The company’s competitors include Brookfield Renewable Partners LP, Brookfield Renewable Corp, Atlantica Sustainable Infrastructure PLC.

– Brookfield Renewable Partners LP ($TSX:BEP.UN)

As of 2022, Brookfield Renewable Partners LP has a market cap of 10.7B and a Return on Equity of 15.58%. The company owns and operates a diversified portfolio of renewable power generation assets across North America, South America, Europe and Asia.

– Brookfield Renewable Corp ($TSX:BEPC)

As of 2022, Brookfield Renewable Corp had a market cap of 7.02B and a Return on Equity of 31.39%. The company is a global leader in the renewable energy sector and owns and operates a diversified portfolio of renewable power assets across North America, South America, Europe and Asia.

– Atlantica Sustainable Infrastructure PLC ($NASDAQ:AY)

The company’s market cap is $2.93B as of 2022 and its ROE is 10.83%. The company is involved in the development, financing, and operation of sustainable infrastructure projects. These projects include energy generation and storage, water and wastewater treatment, and transportation. The company’s goal is to provide clean, reliable, and affordable energy and water solutions to its customers.

Summary

NORTHLAND POWER is a stock that is attractive to investors seeking a consistent dividend yield. Over the past three years, the company has paid an average dividend of 1.2 CAD per share, giving an average yield of 2.89%. This has ranged from 2.81% to 3.04%, showing that investors can expect a reliable return on their investment in NORTHLAND POWER. The dividend yield and consistency make it an attractive option for investors looking for stable returns and steady growth.

Recent Posts