NNN dividend – National Retail Properties Increases Quarterly Dividend to $0.55

April 15, 2023

Trending News 🌥️

National Retail Properties ($NYSE:NNN), a real estate investment trust (REIT) that primarily invests in single-tenant net leased retail properties, has announced an increase of its quarterly dividend to $0.55 per share. As a REIT, National Retail Properties is focused on acquiring and managing commercial retail properties that generate long-term, stable cash flows. Its portfolio includes properties leased to nationally recognized tenants including Walgreens, Home Depot, and Starbucks, among others.

The company’s stock is publicly traded on the New York Stock Exchange under the ticker symbol NNN. With the increased dividend, investors are likely to remain bullish on National Retail Properties’ stock in the near future.

Dividends – NNN dividend

Over the last three years, the company has had a consistent annual dividend per share of $2.16, giving investors a dividend yield of 4.9%. This consistent dividend yield makes National Retail Properties an attractive investment for those who are keen to invest in stocks with a solid dividend returns. As such, it is worth considering National Retail Properties as a potential investment.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NNN. More…

| Total Revenues | Net Income | Net Margin |

| 773.05 | 334.11 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NNN. More…

| Operations | Investing | Financing |

| 578.36 | -777.63 | 34.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NNN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.15k | 4.02k | 22.72 |

Key Ratios Snapshot

Some of the financial key ratios for NNN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 61.2% |

| FCF Margin | ROE | ROA |

| – | – | – |

Stock Price

Despite the announcement, NRP’s stock opened at $43.0 and closed at $42.5, down by 0.6% from the previous closing price of $42.8. Live Quote…

Analysis

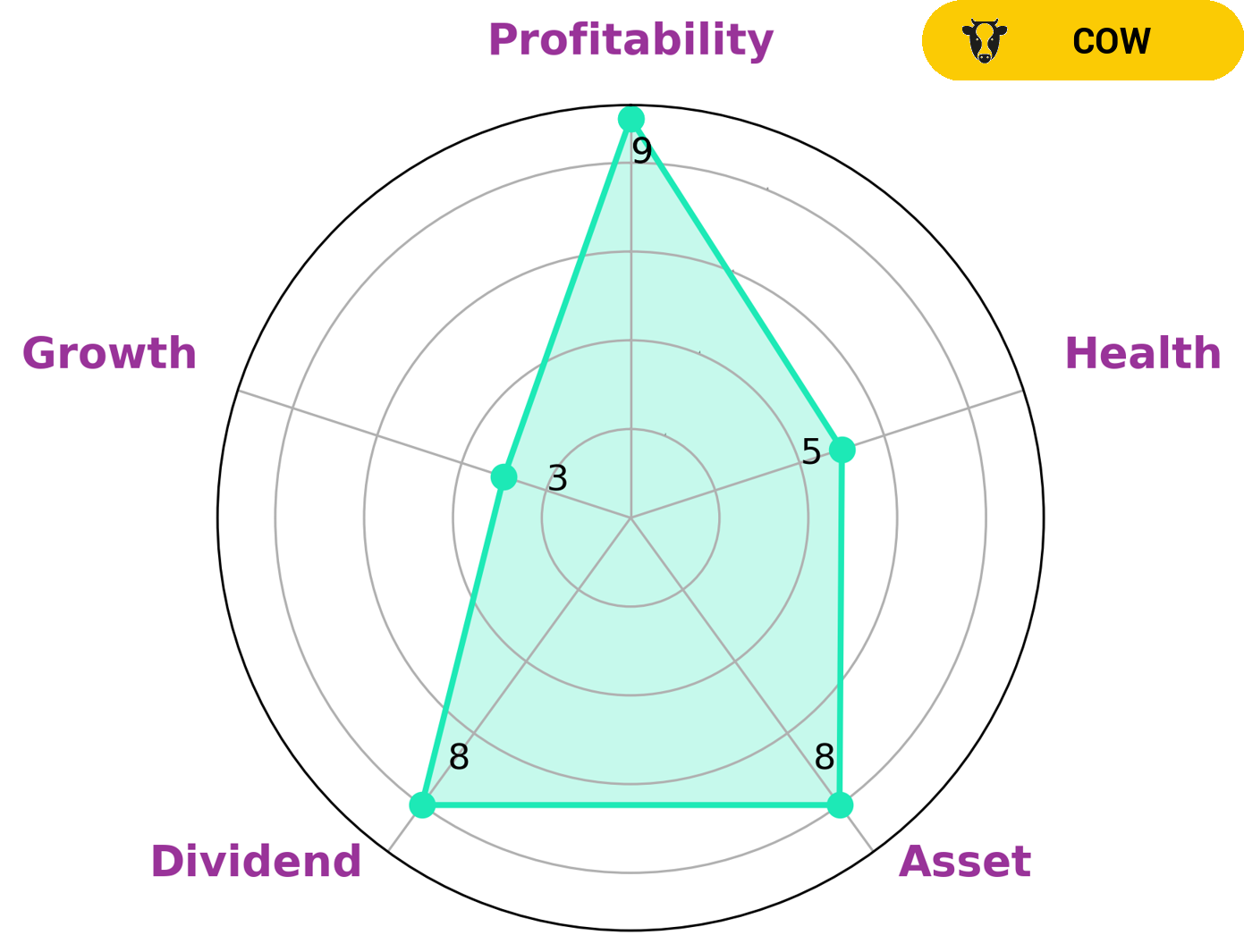

At GoodWhale, we analyze the financials of companies to provide investors with insights. After assessing the financials of NATIONAL RETAIL PROPERTIES, we have classified it as a ‘cow’ business – one that has the track record of paying out consistent and sustainable dividends. This makes it an attractive proposition for investors who are looking for a steady and reliable income stream. NATIONAL RETAIL PROPERTIES performs strongly in terms of assets, dividend, and profitability, but weakly in terms of growth. The company has an intermediate health score of 5/10 when considering its cash flows and debt, suggesting it may be able to pay off debt and fund future operations. More…

Peers

The company’s portfolio consists of freestanding retail properties, strip centers, neighborhood centers, and malls. National Retail Properties Inc. has a market capitalization of $8.6 billion and its stock is traded on the New York Stock Exchange. The company’s competitors include STORE Capital Corp, Realty Income Corp, and W.P. Carey Inc.

– STORE Capital Corp ($NYSE:STOR)

As of 2022, STORE Capital Corp has a market cap of 8.92B. The company is a leading provider of capital to the US middle market, with a focus on durable, service-based businesses. STORE Capital has a diversified portfolio of over 1,800 investments in 47 states, across more than 340 different industries.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation is a real estate investment trust which focuses on the ownership of commercial real estate in the United States. Its portfolio includes office buildings, retail properties, warehouses, and distribution centers. The company has a market capitalization of $35.49 billion as of 2022.

– W.P. Carey Inc ($NYSE:WPC)

W.P. Carey Inc is a publicly traded real estate investment trust (REIT) that provides financing solutions for commercial real estate owners and operators. The company has a market cap of 14.58B as of 2022. The company operates through two segments: Real Estate Ownership and Real Estate Investment Management. The Real Estate Ownership segment acquires, owns, leases, and operates commercial real estate properties. The Real Estate Investment Management segment provides investment management services to institutional and private investors.

Summary

National Retail Properties is a real estate investment trust (REIT) that invests in high-quality retail properties located throughout the United States. This dividend increase reflects the company’s strong financial performance and its commitment to providing long-term value for shareholders. Investors looking for a strong dividend yield and a consistent income stream should consider investing in National Retail Properties’ stock.

Recent Posts