NLY dividend yield calculator – Annaly Capital Management Declares 0.65 Cash Dividend

March 22, 2023

Dividends Yield

Annaly Capital Management ($NYSE:NLY) Inc. has declared a 0.65 cash dividend on March 15 2023. This dividend is part of the company’s dividend policy of issuing an annual dividend per share of 3.52 USD over the past 3 years, with dividend yields of 13.68% each year. It is clear that those in the market for dividend stocks could find ANNALY CAPITAL MANAGEMENT to be a viable option, as it offers an average dividend yield of 13.68%. The ex-dividend date for this particular cash dividend is March 30 2023, meaning that stockholders of record as of this date will be eligible for the payout.

The company has had a consistent dividend policy over the past 3 years, providing investors with a reliable and attractive annual dividend yield of 13.68%. Those looking for a dividend stock may want to consider investing in ANNALY CAPITAL MANAGEMENT.

Price History

The company opened the trading session at a price of 18.6 USD and closed at 18.7 USD, representing a 1.3% decrease from the last closing price of 18.9 USD. This announcement has brought optimism to the market as it shows the stability of Annaly’s stock and its ability to generate returns for its investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NLY. More…

| Total Revenues | Net Income | Net Margin |

| 1.95k | 1.61k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NLY. More…

| Operations | Investing | Financing |

| 5.37k | -14.53k | 9.39k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NLY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 81.85k | 70.48k | 31.88 |

Key Ratios Snapshot

Some of the financial key ratios for NLY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

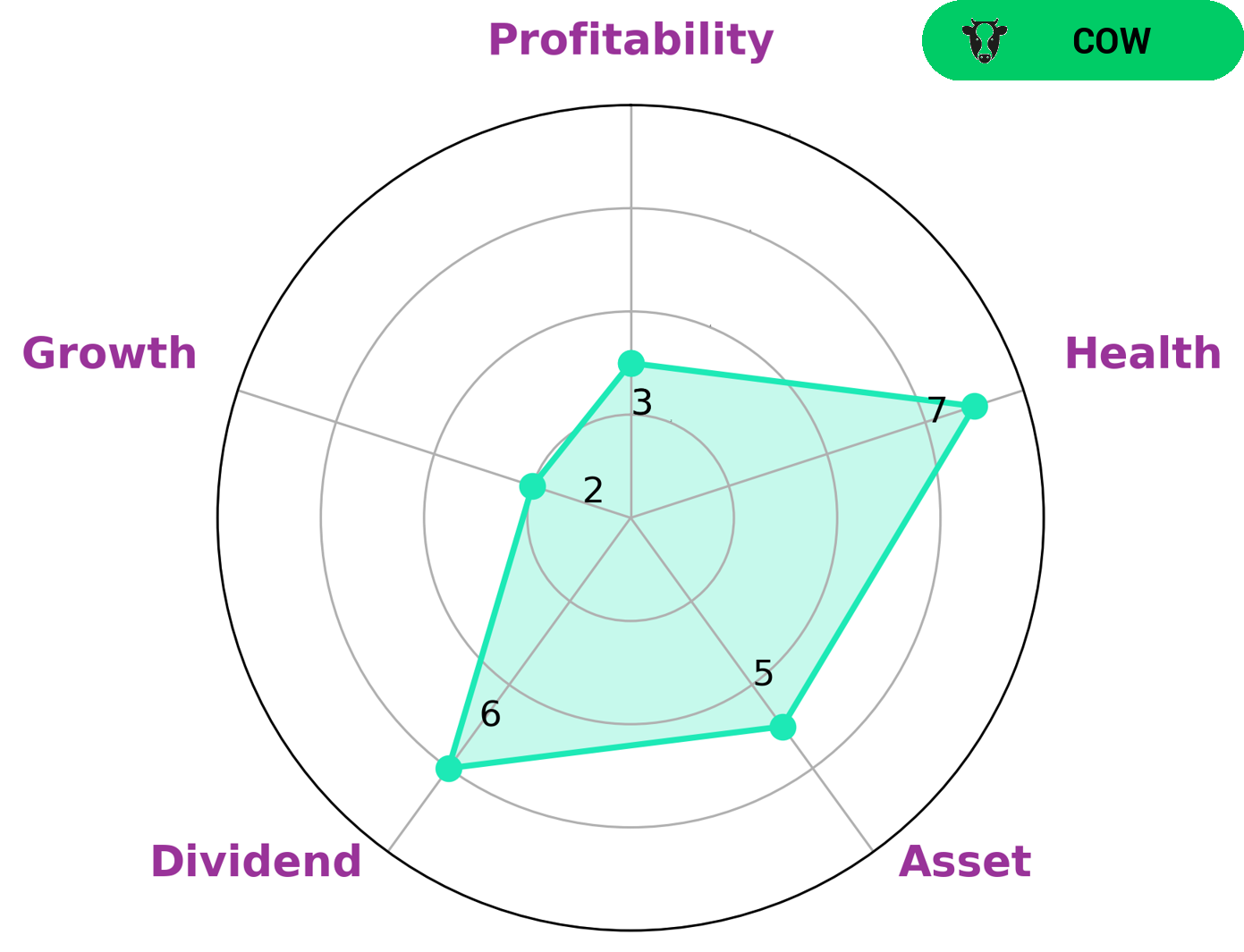

At GoodWhale, we have conducted an analysis of ANNALY CAPITAL MANAGEMENT’s wellbeing. The Star Chart shows that ANNALY CAPITAL MANAGEMENT is strong in dividends, medium in asset and weak in growth and profitability. We classify ANNALY CAPITAL MANAGEMENT as a ‘cow’, meaning a company with a track record of paying out consistent and sustainable dividends. This type of company will likely be attractive to investors looking for a reliable income stream. We give ANNALY CAPITAL MANAGEMENT a health score of 7/10 with regards to cashflows and debt, indicating that it is well positioned to sustain future operations even in times of crisis. More…

Peers

Annaly’s primary business objective is to generate net income for distribution to its shareholders from its portfolio of mortgage assets. Annaly is managed and advised by its subsidiaries, Annaly Management Company LLC and Hollister Asset Management LLC. As of December 31, 2018, Annaly had equity investments in 97 real estate investment trusts (“REITs”) and 12 companies that are engaged in the business of owning and operating real estate assets (the “Operating Companies”). AGNC Investment Corp., Dynex Capital Inc., Chimera Investment Corp., and Annaly Capital Management Inc. are all companies that invest in mortgage assets in the United States. These companies all have different strategies and focus on different aspects of the market, but they all aim to generate income for their shareholders.

– AGNC Investment Corp ($NASDAQ:AGNC)

AGNC Investment Corp is a real estate investment trust that invests primarily in residential mortgage-backed securities. The company has a market cap of 4.37B as of 2022.

– Dynex Capital Inc ($NYSE:DX)

Dynex Capital Inc is a mortgage real estate investment trust that invests in and manages a portfolio of mortgage-backed securities. As of December 31, 2020, the company’s investment portfolio totaled $9.6 billion. The company has a market cap of $511.5 million as of March 2021. Dynex Capital Inc is headquartered in New York, New York.

– Chimera Investment Corp ($NYSE:CIM)

Chimera Investment Corporation is a real estate investment trust that focuses on investing in and managing a portfolio of residential mortgage assets, including agency residential mortgage-backed securities, non-agency residential mortgage-backed securities, and other mortgage-related investments. As of December 31, 2020, the company owned and managed a portfolio of approximately $32.6 billion in residential mortgage assets.

Summary

Annaly Capital Management has been a reliable dividend stock for investors, providing a consistent dividend yield of 13.68% over the past three years. It has consistently paid an annual dividend per share of 3.52 USD. This dividend yield is attractive and could make Annaly an appealing option for dividend investors.

Additionally, this company offers an opportunity to capitalize on long-term growth potential and stability. Investors should research the company in more detail to make an informed decision before investing.

Recent Posts