Nittoseiko dividend calculator – Nittoseiko Co Ltd Declares 9.0 Cash Dividend

June 8, 2023

🌥️Dividends Yield

Nittoseiko ($TSE:5957) Co Ltd has recently announced a cash dividend of 9.0 JPY on June 1 2023. This is an increase from the 16.0 JPY dividend per share that the company has been issuing annually for the past 3 years, yielding an average of 2.97%. For investors looking for stocks that could offer them a reliable dividend income, NITTOSEIKO could be a good choice. The ex-dividend date for the 9.0 JPY dividend is June 29 2023. This date is important to keep in mind for investors looking to benefit from this dividend payment.

Those who purchase the stock before this date will be eligible to receive the dividend, while those who purchase it after this date will not be eligible. Therefore, it is important to take this into consideration when making investment decisions. Overall, NITTOSEIKO’s dividend payment of 9.0 JPY is a great opportunity for investors looking to create a steady and reliable income stream from their investments. It’s worth taking the time to research the company and understand its fundamentals before making any decisions.

Market Price

This announcement was made at the Tokyo Stock Exchange, where the stock opened at JP¥571.0 and closed at JP¥573.0, a 0.9% decrease from its prior closing price of JP¥578.0. This dividend is expected to be paid out to shareholders in the near future, subject to approval from the company’s board of directors. Nittoseiko_Co_Ltd_Declares_9.0_Cash_Dividend”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nittoseiko. More…

| Total Revenues | Net Income | Net Margin |

| 44.02k | 1.83k | 4.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nittoseiko. More…

| Operations | Investing | Financing |

| 999.18 | -1.99k | -1.3k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nittoseiko. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 53.41k | 18.91k | 832.39 |

Key Ratios Snapshot

Some of the financial key ratios for Nittoseiko are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.1% | 4.1% | 7.3% |

| FCF Margin | ROE | ROA |

| -0.1% | 6.6% | 3.8% |

Analysis

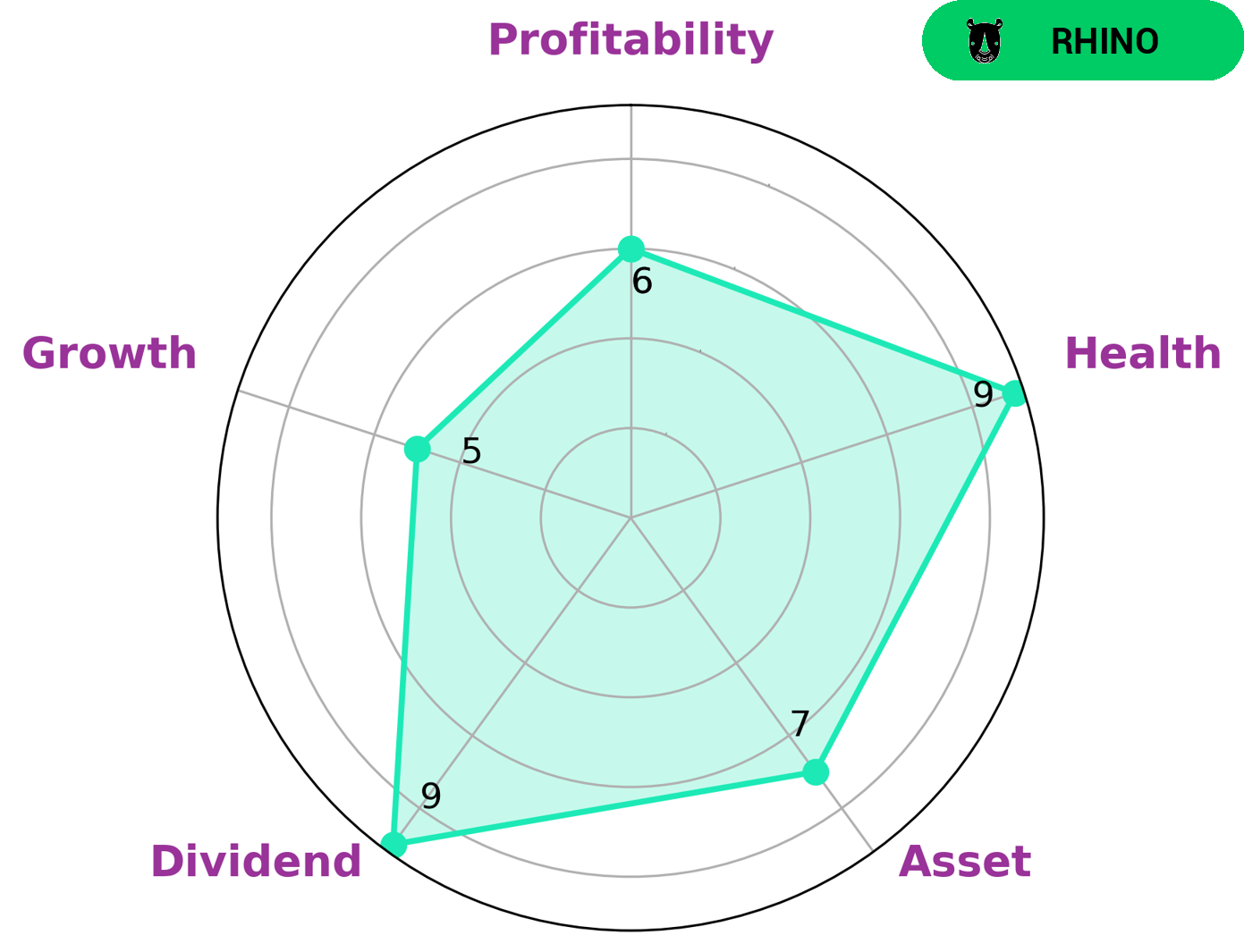

GoodWhale has conducted a thorough analysis of NITTOSEIKO‘s financials. Our Star Chart analysis shows that NITTOSEIKO is strong in terms of asset and dividend, and medium in terms of growth and profitability. Moreover, our health score is 9 out of 10, indicating that the company is able to safely ride out any crisis without the risk of bankruptcy, due to its healthy cashflows and debt. We have classified NITTOSEIKO as a ‘rhino’ type of company, one that has achieved moderate revenue or earnings growth. In light of this analysis, we believe that investors who are looking for a stable investment option with moderate potential for returns would be interested in NITTOSEIKO. More…

Peers

It is one of the top suppliers in the industry, with competitive rivals such as Chicago Rivet & Machine Co, Waida Mfg Co Ltd, and Yindu Kitchen Equipment Co Ltd. All four companies strive to produce top quality products that meet customer demands for quality, cost-efficiency and innovation.

– Chicago Rivet & Machine Co ($NYSEAM:CVR)

Chicago Rivet & Machine Co is a leading manufacturer of rivets, fasteners, and precision machined parts in the United States. As of 2023, the company has a market cap of 28.26M and a Return on Equity of 1.44%. The company’s market cap is an indication of the market value of its outstanding shares, while its Return on Equity measures how efficiently the company is using its equity to generate profits. This suggests that the company has been successful in increasing its profitability through the efficient use of its equity.

– Waida Mfg Co Ltd ($TSE:6158)

Waida Mfg Co Ltd is a global leader in precision machining and manufacturing. The company specializes in cutting tools, grinding machines, and other related material processing tools. With a market cap of 6.48B as of 2023, the company is well-positioned to continue to grow and expand its business. Waida Mfg Co Ltd’s Return on Equity stands at 8.49%, which is indicative of the company’s strong financial performance and ability to generate profits from its operations.

– Yindu Kitchen Equipment Co Ltd ($SHSE:603277)

Yindu Kitchen Equipment Co Ltd is a leading manufacturer and supplier of kitchen equipment and appliances. With a market cap of 6.94B as of 2023, it is considered one of the top companies in its sector. Its Return on Equity (ROE) of 14.13% is an indication of their strong financial performance and profitability over the past year. Yindu Kitchen Equipment Co Ltd has established itself as a leader in the industry and is well-positioned to remain competitive in the years to come.

Summary

NITTOSEIKO is an attractive stock for investors seeking dividend income. Over the past three years, the company has paid out an average dividend of 16.0 JPY per share, giving a yield of 2.97%. This is a reliable and consistent source of income, making NITTOSEIKO an attractive option among dividend-paying stocks. With its steady and reliable dividend payments, NITTOSEIKO is an ideal choice for investors looking to diversify their portfolio by investing in an established, dividend-paying company.

Recent Posts