Nisource Inc dividend calculator – NiSource Inc Declares 0.25 Cash Dividend

April 7, 2023

Dividends Yield

On April 1 2023, NiSource Inc announced that it would be declaring a 0.25 cash dividend for its investors. This dividend follows the three-year streak of consistent dividend per share of 0.94 USD each year, with an average dividend yield of 3.17%. This news is of particular interest for those who invest in dividend stocks. The upcoming ex-dividend date of April 27 2023 is something investors should consider when making their stock purchases.

This dividend payout is great news for both current investors and potential investors alike as it provides an extra stream of income. NISOURCE INC ($NYSE:NI) is a great choice for those looking to invest in a reliable dividend stock and the upcoming payment provides yet another opportunity to take advantage of the dividend yield.

Stock Price

This announcement came as the company’s stock opened at $27.9 and closed at $27.8, a decrease of 0.7% from its last closing price of $28.0. This dividend announcement follows the company’s strategic growth initiatives which have been designed to increase shareholder value. Furthermore, the board of directors has expressed confidence in the company’s continued success and strong financial performance, despite the challenges of the current economic climate. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nisource Inc. More…

| Total Revenues | Net Income | Net Margin |

| 5.85k | 749 | 12.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nisource Inc. More…

| Operations | Investing | Financing |

| 1.41k | -2.57k | 1.14k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nisource Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 26.74k | 18.83k | 18.38 |

Key Ratios Snapshot

Some of the financial key ratios for Nisource Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.9% | -3.8% | 22.5% |

| FCF Margin | ROE | ROA |

| -13.6% | 11.1% | 3.1% |

Analysis

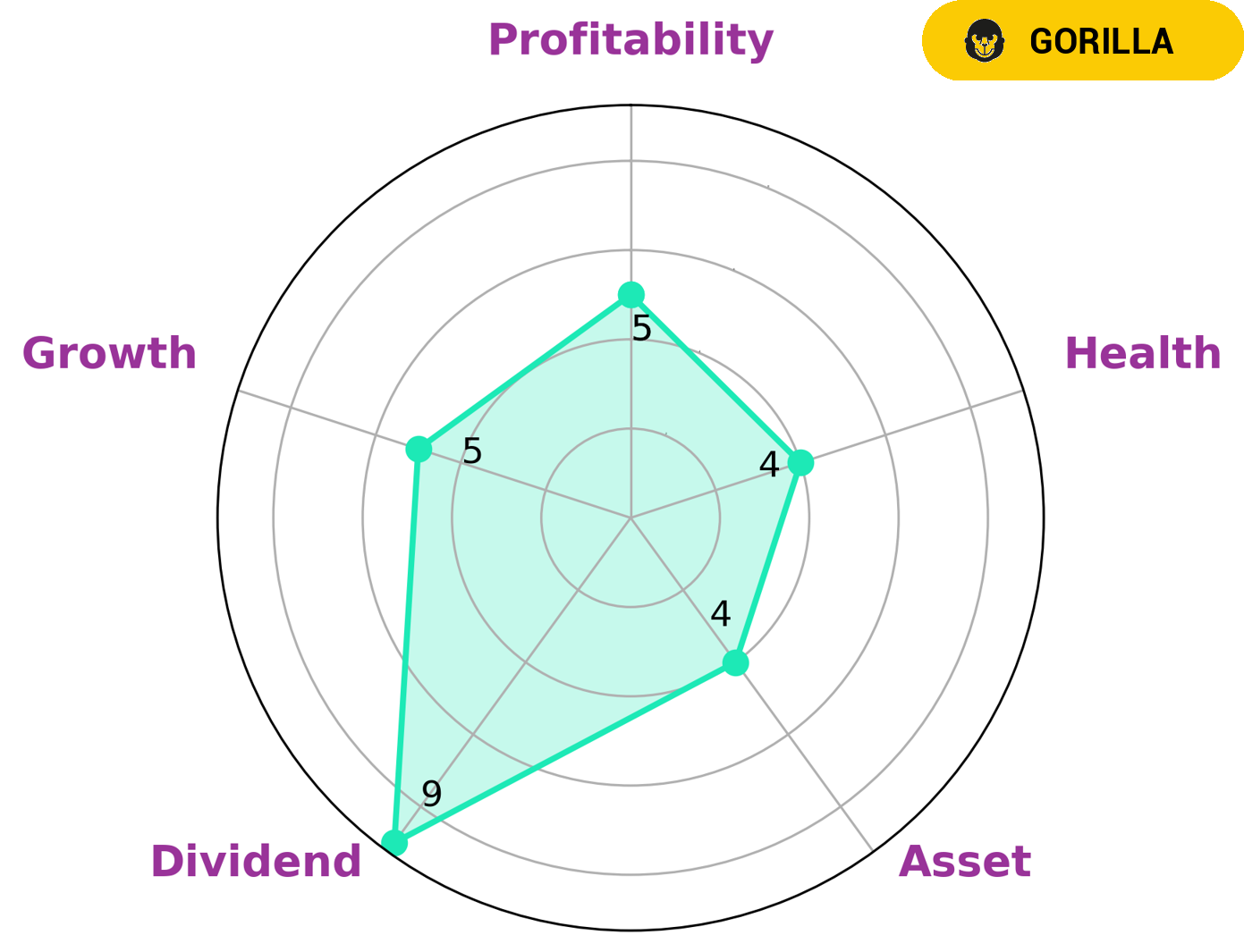

GoodWhale has conducted an analysis of NISOURCE INC‘s fundamentals and have classified the company as ‘gorilla’, a type of company which has achieved stable and high revenue or earnings growth due to its strong competitive advantage. We believe that this company may be of interest to value, dividend and growth investors. The company has a strong dividend score, medium asset and growth scores, and intermediate health score of 4/10 considering its cashflows and debt. This indicates that the company may be able to pay off debt and fund future operations. Ultimately, this could help the company to continue to generate stable and high revenues or earnings growth in the long term. More…

Peers

NiSource Inc is an energy holding company that operates regulated natural gas and electric utilities. The company’s subsidiaries include Columbia Gas of Massachusetts, Inc., Columbia Gas of Ohio, Inc., NIPSCO Industries, Inc., and Northern Indiana Public Service Company. NiSource’s competitors include ALLETE Inc, Ameren Corp, Dominion Energy Inc.

– ALLETE Inc ($NYSE:ALE)

ALLETE Inc. is a diversified energy company with two electric utilities serving more than 750,000 customers in Minnesota and Wisconsin, and a non-regulated business that generates, transmits, stores and distributes electricity. The company has a market cap of 2.89B as of 2022 and a Return on Equity of 4.57%.

– Ameren Corp ($NYSE:AEE)

Ameren Corporation is a utility holding company engaged in the generation, transmission, and distribution of electricity and the distribution of natural gas. The company operates through four segments: electric generation, electric transmission, natural gas transmission, and natural gas distribution.

As of 2022, Ameren’s market capitalization is $19.8 billion and its return on equity is 10.16%. The company is headquartered in St. Louis, Missouri, and serves more than 2.4 million electric and natural gas customers in Missouri and Illinois.

– Dominion Energy Inc ($NYSE:D)

Dominion Energy is an energy company that operates primarily in the United States. The company is involved in the production and distribution of electricity and natural gas. Dominion Energy has a market cap of 53.62B as of 2022 and a Return on Equity of 7.47%. The company is a leading provider of electricity and natural gas in the United States. Dominion Energy has a diversified portfolio of assets and is one of the largest producers and transporters of energy in the United States.

Summary

Investing in NiSource Inc. is an attractive option due to its consistent dividend payments over the past three years. With a dividend yield of 3.17%, investors can expect a steady return on their investment. The company also has a strong financial position, as evidenced by its credit ratings and share price performance. NiSource has demonstrated a commitment to shareholders by returning profits through dividends, buybacks, and debt repayment.

Additionally, its diversified portfolio of energy infrastructure assets provides significant stability and a balanced approach to growth. Finally, NiSource is well-positioned to capitalize on industry trends and benefit from the growing driving demand for natural gas and renewable energy sources. All in all, NiSource is a solid choice for long-term investors looking for reliable and consistent returns.

Recent Posts