Nippon Thompson dividend – “Nippon Thompson Co Ltd Declares 9.0 Cash Dividend”.

March 18, 2023

Dividends Yield

On March 1 2023, Nippon Thompson ($TSE:6480) Co Ltd declared a 9.0 JPY cash dividend per share. This is the third consecutive year that the company has declared an annual dividend per share, following those of 16.0 and 13.0 JPY in 2021 and 2022 respectively. For investors looking for dividend stocks, NIPPON THOMPSON may be a suitable option, with a dividend yield of 2.91%, 2.11% and 1.97% in 2021, 2022 and 2023 respectively, with an average yield of 2.33%. The ex-dividend date for the current year is March 30 2023.

With a consistently growing dividend yield, NIPPON THOMPSON is an attractive option for investors seeking a reliable income stream. With its steady dividend growth, investors can be assured of a consistent return on invested capital.

Share Price

With the news of this dividend, the company’s stock opened at JP¥586.0 and closed at JP¥596.0, up by 0.8% from previous closing price of 591.0. The ex-dividend date is scheduled for March 16, 2021. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nippon Thompson. More…

| Total Revenues | Net Income | Net Margin |

| 68.23k | 6.28k | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nippon Thompson. More…

| Operations | Investing | Financing |

| 6.47k | -2.1k | -6.44k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nippon Thompson. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 111.36k | 41.8k | 979.2 |

Key Ratios Snapshot

Some of the financial key ratios for Nippon Thompson are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.6% | 56.8% | 14.3% |

| FCF Margin | ROE | ROA |

| 6.7% | 8.8% | 5.5% |

Analysis

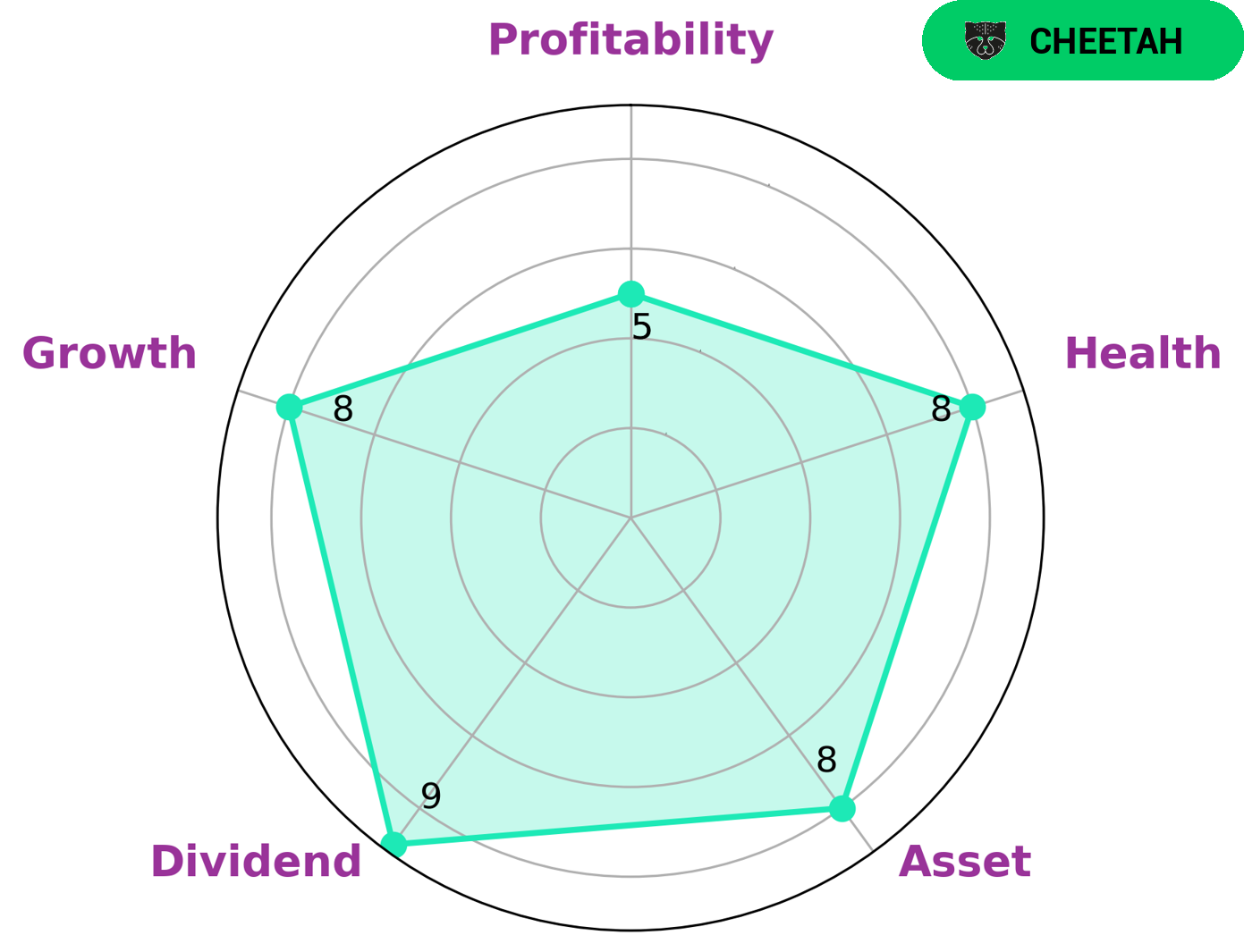

GoodWhale has conducted an analysis of NIPPON THOMPSON‘s fundamentals and found that it is classified as ‘cheetah’. This type of company has a high revenue or earnings growth, but is considered less stable due to lower profitability. We believe this could make it attractive to investors who are looking for high returns with a slightly higher risk profile. The company has a high health score of 8/10, which is a result of its strong cashflows and debt. This gives us confidence that NIPPON THOMPSON is capable of riding out any crisis without the risk of bankruptcy. Additionally, the company is strong in assets, dividend growth, and medium in profitability, all reinforcing its ability to survive in any financial climate. More…

Peers

Nippon Thompson Co Ltd faces stiff competition from a host of other companies in the precision machinery manufacturing industry, including Ningbo Haitian Precision Machinery Co Ltd, Chiu Ting Machinery Co Ltd, and Chumpower Machinery Corp. All of these companies are vying for market share in this space, providing customers with a wide range of products and services.

– Ningbo Haitian Precision Machinery Co Ltd ($SHSE:601882)

Ningbo Haitian Precision Machinery Co Ltd, a Chinese company that specializes in the production of machinery, has a market capitalization of 15.34 billion as of 2023. This market cap indicates that the company has a high level of liquidity and is well-positioned to generate future profits for its shareholders. Moreover, its Return on Equity (ROE) is 19.68%, which is higher than the industry average and indicates the company is able to efficiently generate returns on its investments. All of these factors contribute to making the company an attractive investment opportunity.

– Chiu Ting Machinery Co Ltd ($TWSE:1539)

Chiu Ting Machinery Co Ltd is a Taiwanese company that specializes in manufacturing and distributing machinery parts and equipment. As of 2023, the company had a market cap of 1.93B, making it a mid-size business. Additionally, the company has an impressive Return on Equity of 20.95%, which is higher than the industry average. This demonstrates the company’s sound management and financial health, and its ability to create value for its shareholders.

– Chumpower Machinery Corp ($TPEX:4575)

Chumpower Machinery Corp is a global manufacturer and supplier of mechanical components, primarily for the automotive industry. With a market cap of 1 billion USD as of 2023, the company has experienced steady growth over the years. Chumpower’s Return on Equity (ROE) stands at 5.77%, showing that the company is able to generate a healthy amount of profits from its shareholders’ equity. The company’s focus on cost effective and quality products has enabled it to remain competitive in the industry.

Summary

Nippon Thompson Co. Ltd. is an attractive option for dividend investors who wish to benefit from a consistent income stream. The company has issued a dividend per share for the past three years at 16.0, 13.0, and 8.0 JPY, with dividend yields set at 2.91%, 2.11%, and 1.97% for 2021 to 2023. Moreover, the average dividend yield of 2.33% is higher than the Japanese market average. Analyzing this company’s financials and dividend history can give investors a better idea of how reliable their dividend income will be in the future and whether or not this stock is a suitable option for their investment portfolio.

Recent Posts