MRT.UN dividend – Morguard Real Estate Investment Trust Announces 0.02 Cash Dividend

May 31, 2023

☀️Dividends Yield

Morguard Real Estate ($TSX:MRT.UN) Investment Trust is pleased to announce that on May 26, 2023, they issued a 0.02 cash dividend. This brings the cumulative dividend yield from 2021 to 2023 to 4.58%, 4.57%, and 4.5% respectively, with an average dividend yield of 4.55%. The ex-dividend date has been set for May 30, 2023. Investors should always consider their own investment objectives and risk tolerances before investing in any stock.

Stock Price

MREIT is a trust that primarily owns and manages commercial real estate investments in Canada, the US, and Europe. It currently has a market capitalization of over $3 billion CAD and has a portfolio with over 4 million square feet of office, industrial, and retail space. With a strong track record of delivering steady returns to investors, MREIT has become a preferred choice for investors looking for stable income from real estate investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MRT.UN. More…

| Total Revenues | Net Income | Net Margin |

| 246.12 | -131.16 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MRT.UN. More…

| Operations | Investing | Financing |

| 76.23 | -38.33 | -39.88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MRT.UN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.37k | 1.33k | 16.22 |

Key Ratios Snapshot

Some of the financial key ratios for MRT.UN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 49.3% |

| FCF Margin | ROE | ROA |

| – | – | – |

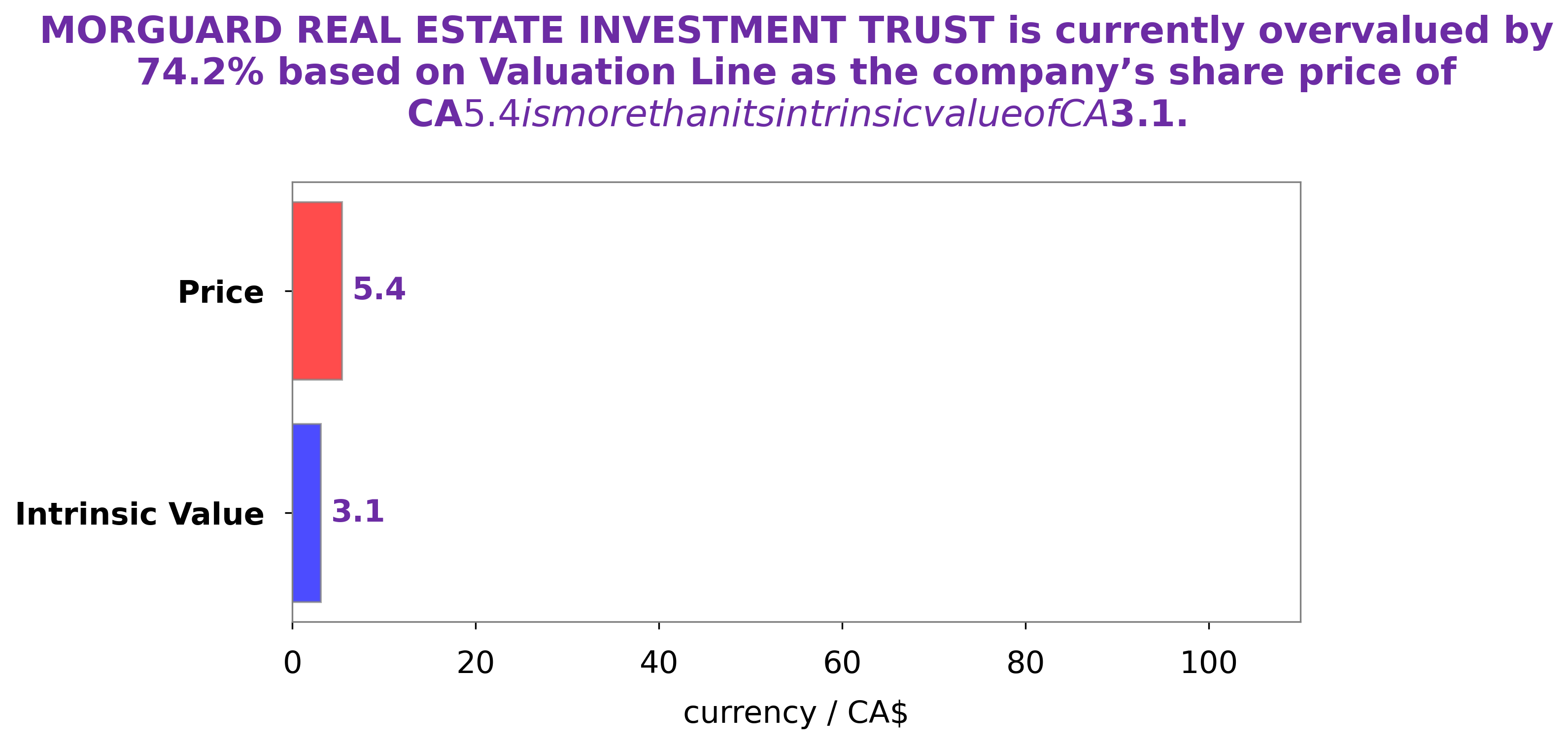

Analysis – MRT.UN Stock Intrinsic Value

At GoodWhale, we have conducted an analysis of MORGUARD REAL ESTATE INVESTMENT TRUST’s fundamentals. Our proprietary Valuation Line has calculated the intrinsic value of MORGUARD REAL ESTATE INVESTMENT TRUST’s share to be around CA$3.1. However, the current market price is much higher, at CA$5.4, meaning the stock is overvalued by 74.4%. More…

Peers

Its competitors include BTB Real Estate Investment Trust, PRO Real Estate Investment Trust, and Melcor Real Estate Investment Trust. While each company has its own strengths and weaknesses, Morguard has proven to be a powerful force in the industry.

– BTB Real Estate Investment Trust ($TSX:BTB.UN)

BTB Real Estate Investment Trust, Canada’s largest real estate investment trust, is a leading provider of commercial real estate solutions across the country. The company owns and operates a diversified portfolio of properties in major urban centres, including office, retail, and industrial properties. BTB’s market cap is $286.39M as of 2022. The company has a strong track record of delivering value to its shareholders, and its diversified portfolio and experienced management team provide a solid foundation for future growth.

– PRO Real Estate Investment Trust ($TSX:PRV.UN)

H&R REIT is a real estate investment trust that owns, operates, and develops a portfolio of office, retail, and industrial properties. The company has a market cap of $349.49 million as of 2022. H&R REIT’s portfolio includes properties in Canada, the United States, and Europe. The company was founded in 1996 and is headquartered in Toronto, Canada.

– Melcor Real Estate Investment Trust ($TSX:MR.UN)

Melcor Real Estate Investment Trust has a market cap of $73.89M as of 2022. The company is a real estate investment trust that invests in, owns, and manages a portfolio of income-producing real estate assets in Canada. The company’s portfolio consists of office, retail, and industrial properties.

Summary

MORGUARD REAL ESTATE INVESTMENT TRUST has a consistent history of offering attractive dividend yields for investors, averaging 4.55 % over the past three years. With a dividend of 0.24 CAD in 2021 and 0.26 CAD in 2023, investors can expect consistent returns on their investments over the next three years. The company’s history of paying dividends, along with its steady growth potential, make it an attractive investment option for investors seeking steady income and capital gains.

Recent Posts