MRG.UN stock dividend – MORGUARD NORTH AMERICAN RESIDENTIAL REAL ESTATE INVESTMENT TRUST Declares 0.06 Cash Dividend

February 17, 2023

Dividends Yield

MRG.UN stock dividend – On February 16, 2023, MORGUARD NORTH AMERICAN RESIDENTIAL REAL ESTATE INVESTMENT TRUST ($TSX:MRG.UN) (“MORGUARD REIT”) declared a 0.06 cash dividend per share. This marks the third consecutive year of issuing a dividend of 0.7 CAD per share, providing a yield of 4.04% from 2022 to 2023. For those who are dividend seekers, investing in MORGUARD REIT could be a good choice to reap the rewards of a steady dividend. The ex-dividend date for this dividend is February 27, 2023.

It is advised that shareholders who want to receive the next dividend payment from the company should purchase their shares before the ex-dividend date. They should also ensure their shares are registered in the company’s records no later than two days prior to the ex-dividend date in order to qualify for the dividend payment. MORGUARD REIT has a strong track record of providing solid returns to its investors, and its latest dividend declaration is another indication of its commitment to rewarding shareholders with regular payments. With a yield of 4.04%, investors can expect a steady rate of return while they wait for the stock price to increase in the long term.

Share Price

This dividend is a sign of the trust’s commitment to continuing to reward its shareholders for their investment in the trust. The trust aims to generate consistent cash flows to its shareholders while also providing access to residential real estate investments across the United States and Canada. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MRG.UN. More…

| Total Revenues | Net Income | Net Margin |

| 278.49 | 219.28 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MRG.UN. More…

| Operations | Investing | Financing |

| 75.17 | -11.06 | -78.88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MRG.UN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.86k | 2.08k | 44.83 |

Key Ratios Snapshot

Some of the financial key ratios for MRG.UN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 47.3% |

| FCF Margin | ROE | ROA |

| – | – | – |

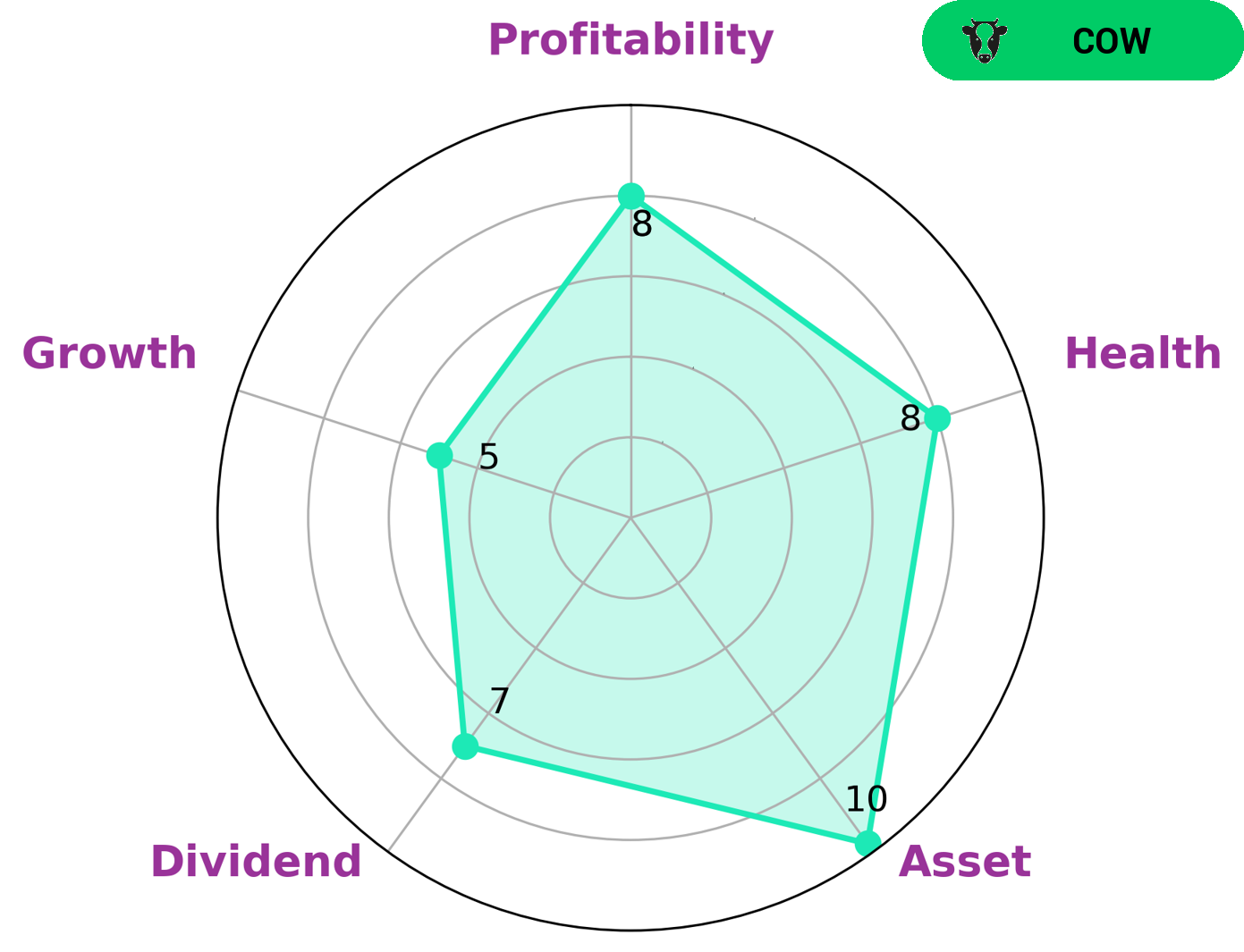

Analysis

Those looking for long-term security through stable dividend payments or those who are seeking a steady income stream could both find this company an appealing option. Ultimately, these fundamentals make the company a great option for many different types of investors. More…

Peers

The company competes with Dream Residential REIT, BSR Real Estate Investment Trust, Independence Realty Trust Inc, and other companies in the real estate investment trust industry.

– Dream Residential REIT ($TSX:DRR.U)

BSR Real Estate Investment Trust is a Canadian real estate investment trust that owns, develops, and manages a portfolio of properties in the United States. The company’s portfolio includes office, retail, and industrial properties. As of 2021, the company’s portfolio consisted of 49 properties totaling 8.1 million square feet of gross leasable area.

– BSR Real Estate Investment Trust ($TSX:HOM.U)

Independence Realty Trust is a self-managed real estate investment trust that owns, operates, and invests in multifamily residential properties. The company’s portfolio consists of approximately 9,600 units in 36 properties, all located in the United States.

Summary

This makes it an attractive investment option for dividend seekers looking to get a steady return on their money. It is worth noting that the company has a robust balance sheet and solid record of capital appreciation, making it a relatively safe investment option. Overall, it is a reliable option for investors looking to diversify their portfolios with a low-risk real estate investment.

Recent Posts