MPW dividend yield – Medical Properties Trust Inc Announces 0.29 Cash Dividend

June 12, 2023

☀️Dividends Yield

Medical Properties Trust ($NYSE:MPW) Inc announced on June 8 2023, a cash dividend of 0.29 per share. For those looking to invest in a dividend stock, Medical Properties Trust is a great option. Over the past three years, they have issued an annual dividend per share of 1.16 USD, 1.16 USD, and 1.12 USD respectively.

This results in an estimated dividend yields for 2021, 2022, and 2023 of 7.8%, 6.91%, and 5.32% respectively, with an average dividend yield of 6.68%. It is important to note that the ex-dividend date is June 14 2023.

Share Price

The announcement sparked a modestly positive response from investors, as the stock opened at $9.3 and closed at $9.4, up by 0.5% from the previous day’s closing price of $9.3. This is the fourth consecutive quarterly dividend payment from MPT, and marks the company’s commitment to providing value to its investors. MPT has an impressive track record of creating and maintaining strong, steady cash flows, which has enabled it to consistently pay dividends to their shareholders. This latest dividend is expected to increase investor confidence in the stock, and should contribute to its continued success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MPW. More…

| Total Revenues | Net Income | Net Margin |

| 1.48k | 304.11 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MPW. More…

| Operations | Investing | Financing |

| 739.01 | 396.06 | -1.34k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MPW. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.65k | 11.21k | 14.38 |

Key Ratios Snapshot

Some of the financial key ratios for MPW are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 63.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

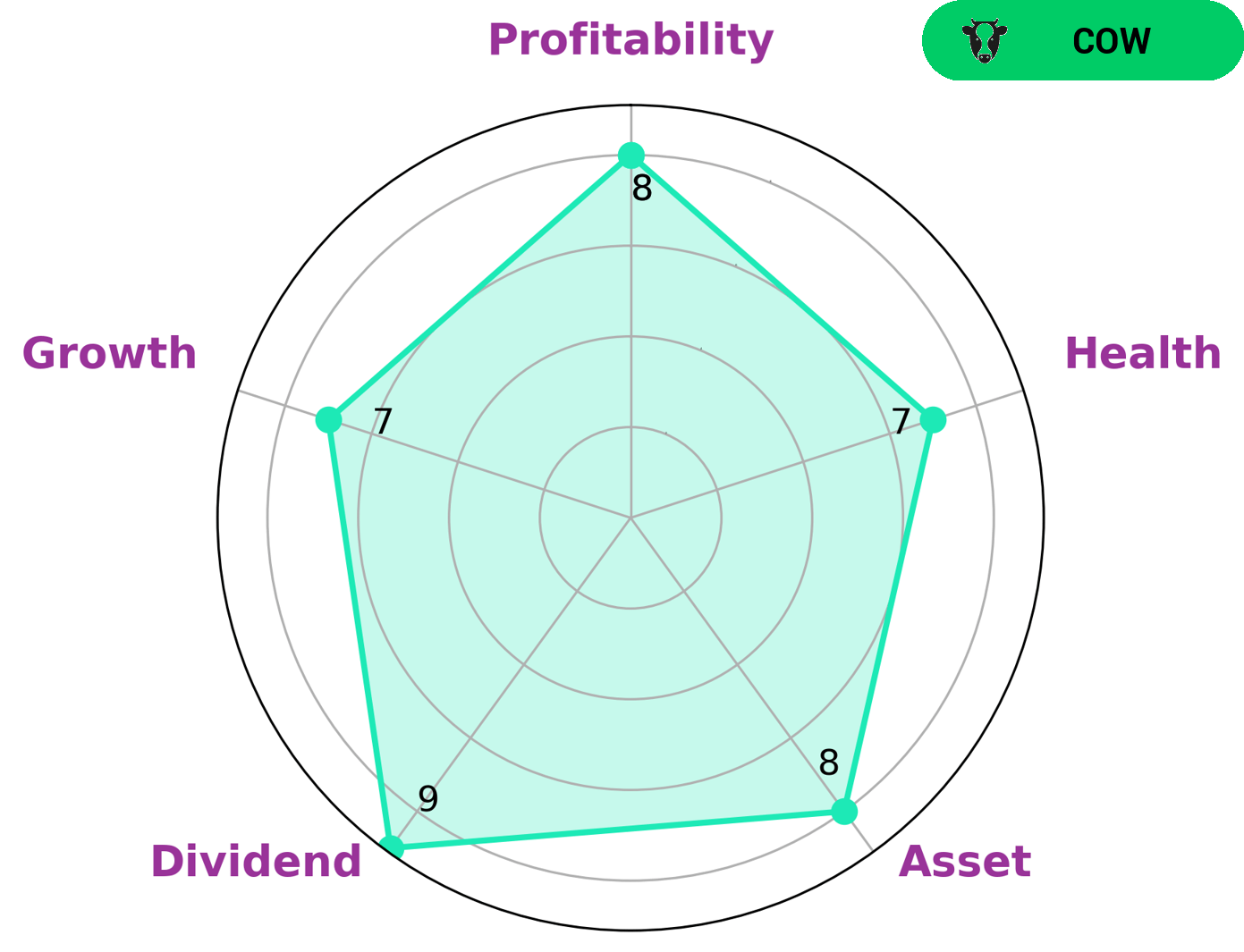

GoodWhale is excited to analyze MEDICAL PROPERTIES TRUST’s financials. Through our Star Chart analysis we can determine that MEDICAL PROPERTIES TRUST is classified as a ‘cow’, meaning it has a track record of paying out consistent and sustainable dividends. As a result, this type of company could be of interest to income-seeking investors who prioritize regular income over potential capital gains. Furthermore, GoodWhale’s financial analysis reveals that MEDICAL PROPERTIES TRUST is strong in asset, dividend, growth, and profitability. Additionally, the company has a high health score of 7/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. Thus, MEDICAL PROPERTIES TRUST could be an attractive option for investors seeking a reliable and dependable dividend-paying company. More…

Peers

The company operates in the United States, Germany, and the United Kingdom. The company was founded in 2003 and is headquartered in Birmingham, Alabama. Healthcare Trust of America, Inc. is a real estate investment trust that invests in healthcare-related real estate assets. The company owns and operates healthcare facilities across the United States. The company was founded in 2006 and is headquartered in Nashville, Tennessee. Vital Healthcare Property Trust is a real estate investment trust that invests in hospitals and other healthcare-related properties in New Zealand and Australia. The company was founded in 2002 and is headquartered in Auckland, New Zealand. Healthcare Trust Inc is a real estate investment trust that focuses on healthcare-related properties. The company operates in the United States and Canada. The company was founded in 2010 and is headquartered in Boston, Massachusetts.

– Healthcare Trust of America Inc ($NZSE:VHP)

Vital Healthcare Property Trust is a real estate investment trust that owns and operates healthcare facilities in New Zealand and Australia. The company has a market cap of 1.52 billion as of 2022. Vital Healthcare Property Trust’s portfolio consists of hospitals, medical centers, and aged care facilities.

– Vital Healthcare Property Trust ($OTCPK:HLTC)

As of 2022, Healthcare Trust Inc has a market cap of 694.19M. The company is a real estate investment trust that invests in healthcare properties, including hospitals, nursing homes, and medical office buildings.

Summary

Investing in Medical Properties Trust can be a good option for dividend-seekers. Over the past three years, the company has issued an annual dividend per share of 1.16 USD, 1.16 USD, and 1.12 USD respectively. The dividend yield for 2021 is estimated to be 7.8%, followed by 6.91% in 2022 and 5.32% in 2023, with an average yield of 6.68%. The company’s past performance coupled with its high dividend yields make it an attractive option for investors looking for consistent returns.

Recent Posts