Movado Group dividend calculator – Movado Group Declares Cash Dividend of 0.35

June 9, 2023

🌥️Dividends Yield

Movado Group ($NYSE:MOV) Inc. has recently declared a cash dividend of 0.35 USD per share on June 1 2023. If you are looking to invest in stocks with dividends, MOVADO GROUP may be an option worth considering. The company has issued an annual dividend of 1.4 USD per share for the past three years. This has resulted in a dividend yield of 4.28%, 4.28%, and 3.08% respectively for the years 2022 to 2024, with an overall dividend yield of 3.88%.

The ex-dividend date for MOVADO GROUP is June 6 2023. Therefore, if you are interested in taking advantage of this dividend payment, make sure to buy the stock before the ex-dividend date.

Price History

On Thursday, the stock opened at $25.6 and closed at $25.2, down by 1.2% from the previous closing price of 25.4. This cash dividend of 0.35 per share is an attractive payout for investors, especially considering the current market volatility and uncertain economic outlook. The dividend represents an annualized yield of 1.4%. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Movado Group. More…

| Total Revenues | Net Income | Net Margin |

| 733.38 | 85.14 | 11.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Movado Group. More…

| Operations | Investing | Financing |

| 53.6 | -10.18 | -72.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Movado Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 741.5 | 246.58 | 22.22 |

Key Ratios Snapshot

Some of the financial key ratios for Movado Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.5% | 108.0% | 14.9% |

| FCF Margin | ROE | ROA |

| 6.2% | 13.6% | 9.2% |

Analysis

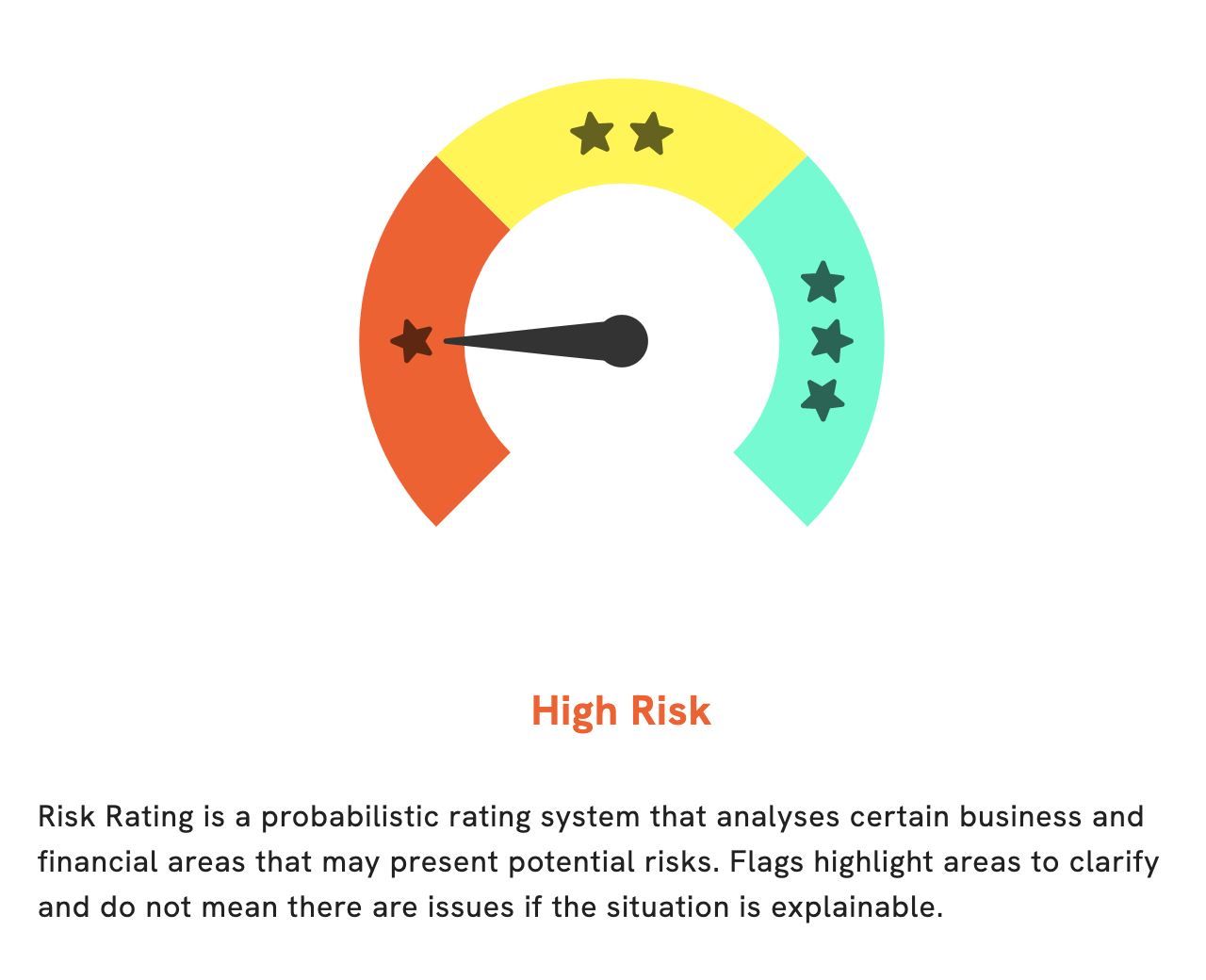

GoodWhale is here to provide you with a comprehensive analysis of MOVADO GROUP‘s financials. Through our Risk Rating system, we have determined that MOVADO GROUP is a high risk investment. This means that there are some areas of MOVADO GROUP’s finances that may be of concern. To give you a better understanding of these risks, GoodWhale has detected two risk warnings in MOVADO GROUP’s income statement and balance sheet. To get a better look into the financials of MOVADO GROUP, register with us and see our full report. With GoodWhale, you can get a detailed analysis of MOVADO GROUP’s financials and see which areas need attention. Don’t worry about making an informed decision; let GoodWhale take the guesswork out of investing in MOVADO GROUP. More…

Peers

The company competes in the global market with other leading companies such as Lands’ End Inc, Bergio International Inc, and Vaibhav Global Ltd. Movado Group has a strong portfolio of brands that cater to different segments of the market. The company’s products are known for their unique design and superior quality. Movado Group has a wide distribution network and a strong marketing and advertising capability. The company’s focus on innovation and customer satisfaction has helped it to maintain its leading position in the market.

– Lands’ End Inc ($NASDAQ:LE)

Lands’ End is a retail company that sells clothing, luggage, and home furnishings. The company was founded in 1963 and is headquartered in Dodgeville, Wisconsin. Lands’ End operates through two segments: Direct and Retail. The Direct segment offers products through catalogs, website, and corporate sales. The Retail segment operates Lands’ End Shops at Sears locations and standalone Lands’ End Inlet stores. As of 2022, Lands’ End had a market cap of 314.92 million and a return on equity of 7.35%.

– Bergio International Inc ($OTCPK:BRGO)

Bergio International Inc is a publicly traded company that designs, manufactures, and markets fine jewelry. The company was founded in 1984 and is headquartered in New York, New York. As of 2022, Bergio International Inc had a market capitalization of $675,620.00 and a return on equity of -4.34%. The company’s products are sold through its own website and through independent retailers.

– Vaibhav Global Ltd ($BSE:532156)

As of 2022, Vaibhav Global Ltd has a market cap of 57.39B and a ROE of 10.1%. The company is engaged in the design, manufacture and export of fashion jewelry, watches and accessories. It has a strong presence in the US, Europe and Asia Pacific markets. The company has a wide range of products that are affordable and stylish.

Summary

MOVADO GROUP is an attractive option for investors looking to invest in stocks with dividends. For the past three years, it has issued dividends per share of 1.4 USD, 1.4 USD and 0.85 USD respectively. The dividend yields for 2022 to 2024 are estimated to be 4.28%, 4.28% and 3.08% on average, with an overall yield of 3.88%. This implies potential returns for investors over the medium term.

However, it is important to conduct thorough due diligence to properly assess the company’s current and future prospects before investing in the stock.

Recent Posts