Microchip Technology dividend calculator – Microchip Technology Increases Quarterly Dividend by 9.1%, Payable March 7 with a Forward Yield of 1.69%.

February 3, 2023

Trending News 🌥️

Microchip Technology dividend calculator – Microchip Technology ($NASDAQ:MCHP) Inc. is a leading American semiconductor company and one of the largest manufacturers of microcontrollers and analog semiconductors in the world. They provide a wide range of products and services for a variety of electronic systems including automotive, communications, industrial and embedded systems. The company has recently announced a quarterly dividend of $0.358 per share, representing a 9.1% increase from the prior dividend of $0.328. This increase in dividend will be payable on March 7 to shareholders of record as of February 21. The ex-dividend date for this dividend is February 17. The forward yield for this dividend is 1.69%. This dividend increase is in line with the company’s long-term goal of increasing shareholder value by paying out a sustainable dividend.

The company also has a long history of increasing its dividend on an annual basis, which has resulted in a five-year dividend growth rate of 8%. The recent dividend increase is a reflection of the company’s strong financial performance and outlook. In addition to its strong financial performance, the company has also been focused on expanding its product portfolio and entering new markets. This strategy has resulted in increased sales and profits, which have helped to support the dividend increase. The company’s strong financial performance and strategy for growth have made it an attractive investment for those seeking income and capital appreciation. For more information about the Microchip Technology Dividend Scorecard, Yield Chart, and Dividend Growth, please refer to the company’s website.

Dividends – Microchip Technology dividend calculator

This is the third consecutive year that the company has issued an annual dividend per share of 1.06 USD, 0.91 USD and 0.75 USD respectively. The dividend yields of 2021, 2022, and 2023 are estimated to be 1.46%, 1.21% and 1.31% respectively with an average dividend yield of 1.33%. This is a great opportunity for the investors to get higher returns on their investments. The company’s management has expressed confidence in the sustainability of the increased dividend and its ability to generate cash flows for the benefit of shareholders in the future. The board is confident that it can continue to increase its dividends and reward shareholders with higher returns as the company continues to grow and innovate.

The company is well-positioned to capitalize on the growing demand for its products and services, which should propel growth in the next few years. Overall, this is a great move by Microchip Technology, as it shows that the company is financially sound and is confident in its ability to sustain increased dividend payments. This will be beneficial to both current and future investors as they will be able to reap higher returns on their investments.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Microchip Technology. More…

| Total Revenues | Net Income | Net Margin |

| 7.64k | 1.84k | 24.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Microchip Technology. More…

| Operations | Investing | Financing |

| 3.23k | -553.6 | -2.63k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Microchip Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.14k | 10.04k | 11.1 |

Key Ratios Snapshot

Some of the financial key ratios for Microchip Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.5% | 45.2% | 32.5% |

| FCF Margin | ROE | ROA |

| 36.6% | 25.7% | 9.6% |

Stock Price

This news has been welcomed by investors as the stock opened at $82.0 on Thursday and closed at $84.5, up by 4.2% from the prior closing price of 81.2. The company has a history of delivering advanced technology solutions and creating innovative products for the consumer and industrial markets. Microchip Technology’s products are used in a variety of applications, including automotive, consumer electronics, communications, networking and industrial automation. The company’s commitment to innovation and product quality has enabled them to become one of the most successful semiconductor companies in the world. With an impressive portfolio of products and comprehensive development tools, Microchip Technology continues to be a leader in the semiconductor industry. The increase in the quarterly dividend is a testament to the success of the company and its commitment to providing superior products and services to its customers.

The high dividend yield is also indicative of the company’s financial strength and stability, providing investors with greater confidence in their investments. Overall, the increase in the quarterly dividend is a positive move for Microchip Technology and demonstrates their commitment to increasing shareholder value. With a forward yield of 1.69%, investors are sure to benefit from this announcement for years to come. Live Quote…

Analysis

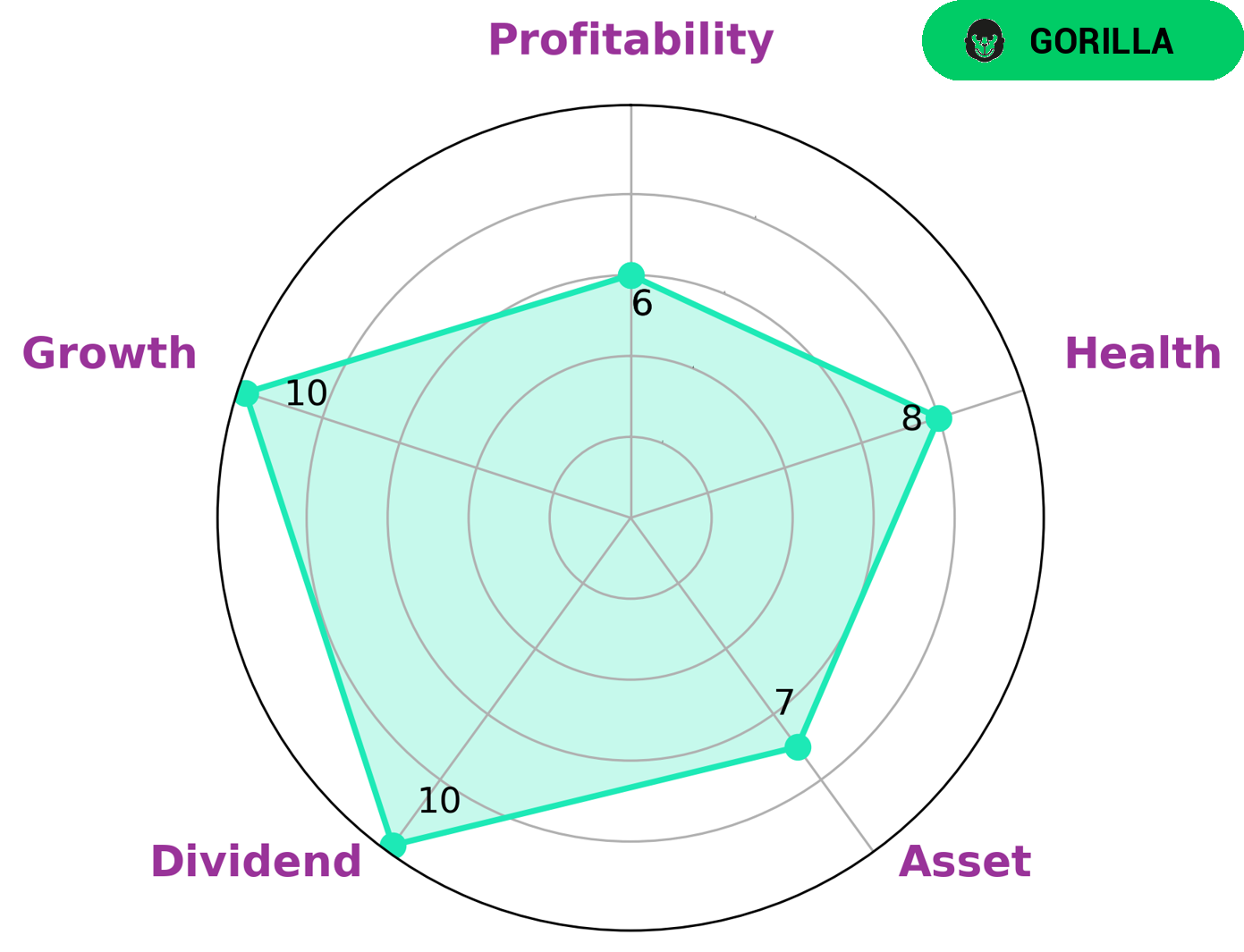

GoodWhale has conducted an analysis on the wellbeing of MICROCHIP TECHNOLOGY and according to their Star Chart, this company has a high health score of 8/10 with respect to its cashflows and debt. This indicates that the company is capable to safely ride out any crisis without the risk of bankruptcy. The analysis also revealed that MICROCHIP TECHNOLOGY is strong in asset, dividend, and growth, and medium in profitability. It is classified as ‘gorilla’, a type of company that achieved steady and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for a stable and profitable long-term investment may be interested in MICROCHIP TECHNOLOGY. Investing in such a company can bring benefits such as strong dividends and growth potential, as well as the assurance that the company is capable to survive and manage any financial crisis. Furthermore, the company’s competitive advantage could potentially bring additional profits to investors in the form of higher-than-average returns. In short, MICROCHIP TECHNOLOGY is an attractive investment for those who are looking for a safe and dependable investment with strong potential for growth. Its strong financials and competitive advantage make it a worthwhile consideration for investors with long-term goals. More…

Peers

Microchip Technology Inc is a publicly traded company that designs, develops, and manufactures semiconductor products for a variety of embedded control applications. The company offers microcontrollers, development tools, analog and interface products, wireless and wired connectivity products, memory products, and digital power products. It serves customers in the automotive, communications, computing, consumer, and industrial markets. The company was founded in 1987 and is headquartered in Chandler, Arizona.

Globetronics Technology Bhd is a Malaysia-based company that provides semiconductor assembly and test services. It offers a range of services, including wafer fabrication, wafer probing, final test, packaging, and others. The company serves customers in the automotive, communications, computing, consumer, and industrial markets.

Wafer Works Corp is a Taiwan-based company that provides wafer foundry services. It offers a range of services, including wafer fabrication, final test, and packaging. The company serves customers in the automotive, communications, computing, consumer, and industrial markets.

Skyworks Solutions Inc is a publicly traded company that designs, develops, and manufactures semiconductor products for a variety of radio frequency (RF) and microwave applications. The company offers a range of products, including amplifiers, attenuators, circulators, detectors, diodes, directional couplers, mixers, modulators, oscillators, phase shifters, power dividers/combiners, receivers, switches, and transmitters. It serves customers in the automotive, communications, computing, consumer, industrial, medical, military, and aerospace markets.

– Globetronics Technology Bhd ($KLSE:7022)

Globetronics Technology Bhd is a Malaysian-based company that designs, manufactures and supplies precision sensors, optical and electronic products. The company has a market cap of 696.22M as of 2022 and a Return on Equity of 11.73%. Globetronics Technology Bhd’s products are used in a variety of industries including automotive, healthcare, consumer electronics and industrial.

– Wafer Works Corp ($TPEX:6182)

Wafer Works Corp is a leading provider of semiconductor wafers with a market cap of 21.1B as of 2022. The company has a return on equity of 16.27%. Wafer Works Corp is a leading provider of semiconductor wafers used in the manufacture of integrated circuits. The company’s wafers are used in a variety of electronic devices, including computers, cell phones, and other electronic devices.

– Skyworks Solutions Inc ($NASDAQ:SWKS)

Skyworks Solutions Inc is a company that manufactures radio frequency and microwave semiconductor products. The company has a market cap of 13.11B as of 2022 and a ROE of 25.56%. The company’s products are used in a wide variety of wireless communication applications, including smartphones, tablets, laptops, and other mobile devices.

Summary

Investing in Microchip Technology has proven to be a profitable option for investors. The company recently announced an increase of 9.1% in its quarterly dividend, making it one of the higher yielding stocks in its sector. The dividend is payable on March 7th, giving investors an attractive 1.69% yield.

On the day of the announcement, the stock price rose, indicating that investors are confident in the stock’s performance going forward. It appears that Microchip Technology is a good long-term investment, and investors should consider adding it to their portfolios.

Recent Posts