Mativ Holdings dividend – Mativ Holdings Inc Declares 0.4 Cash Dividend

May 28, 2023

Dividends Yield

On May 25 2023, Mativ Holdings ($BER:MH2) Inc announced that they will be issuing a cash dividend of 0.4 USD per share. This is the fourth consecutive year that MATIV HOLDINGS has been consistently issuing annual dividends per share, with the 2021 to 2023 yields at 1.64, 1.68, and 1.76 USD and 6.94%, 6.98%, and 4.28% respectively. The overall average dividend yield for the period is 6.07%. If you are looking for a viable dividend stock, MATIV HOLDINGS may be a good option for you with the upcoming ex-dividend date of May 25 2023.

This indicates that shareholders of record as of May 25 2023 will be eligible for the dividend payout. Therefore, if you are seeking for stable dividend payouts, MATIV HOLDINGS is certainly worth a try!

Share Price

Following the announcement, shareholders responded positively as the stock opened at €15.1 and closed at €15.1, down by 4.4% from the prior closing price of 15.8. This marks the first dividend announced by the company this year. The dividend announcement is seen as a sign that MATIV HOLDINGS Inc is financially stable and confident in its future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mativ Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.44k | -16.7 | -0.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mativ Holdings. More…

| Operations | Investing | Financing |

| 176.5 | -491.1 | 356.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mativ Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.67k | 2.52k | 21.11 |

Key Ratios Snapshot

Some of the financial key ratios for Mativ Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 33.5% | -26.1% | 2.5% |

| FCF Margin | ROE | ROA |

| 4.4% | 3.3% | 1.1% |

Analysis

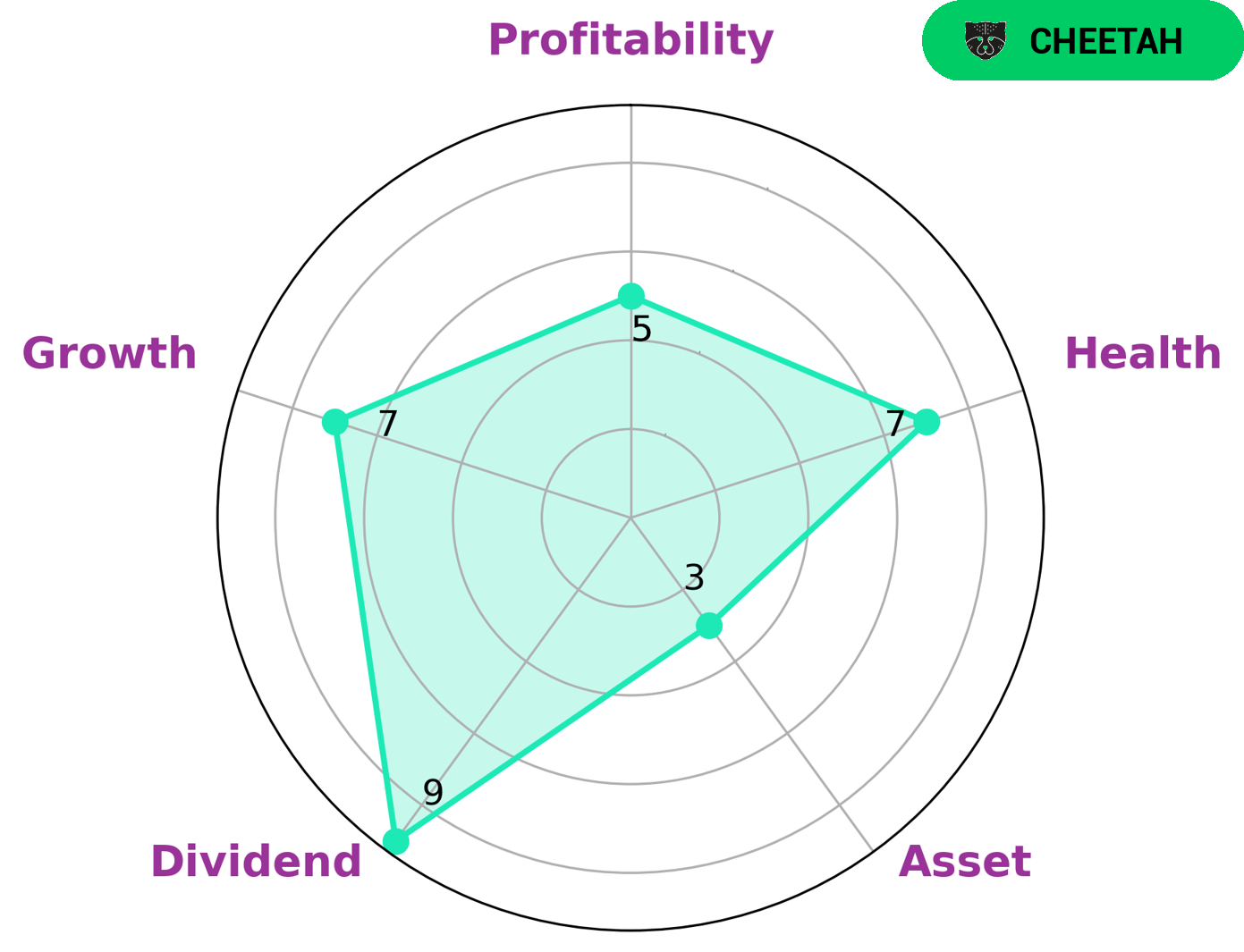

At GoodWhale, we have analyzed MATIV HOLDINGS‘s financials and classified them according to the Star Chart. We concluded that MATIV HOLDINGS is a ‘cheetah’ type of company, one that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This makes MATIV HOLDINGS an attractive option for investors who are looking for capital appreciation and growth opportunities, but are wary of the associated risks. Notably, MATIV HOLDINGS is strong in dividend and growth, medium in profitability and weak in asset. It’s also worthy of mention that MATIV HOLDINGS has a high health score of 7/10 considering its cashflows and debt – indicating that it is capable to sustain future operations in times of crisis. We believe that this company is well-positioned to continue its growth trajectory and provide attractive returns in the long-term. More…

Summary

Investing in MATIV HOLDINGS has been a profitable venture over the past three years, with the company consistently offering annual dividends per share of 1.64, 1.68, and 1.76 USD yielding 6.94%, 6.98%, and 4.28% respectively from 2021 to 2023. The average dividend yield for this period comes in at 6.07%, which is quite attractive for investors looking for a steady income stream. Additionally, the company appears to have a stable cash flow and is able to provide steady returns over the long term, making it a good choice for investors seeking a reliable dividend investment.

Recent Posts