LXP dividend yield calculator – LXP INDUSTRIAL TRUST Declares Dividend of $0.125 Per Share

June 11, 2023

☀️Trending News

Lexington Realty Trust, one of the leading real estate investment trusts (REITs) in the United States, has announced that it is paying a dividend of $0.125 per share on its outstanding common shares. LXP ($NYSE:LXP) Industrial Trust is a publicly traded REIT that specializes in industrial real estate investments. The company primarily invests in industrial properties such as warehouse and distribution centers located throughout the United States. It also has investments in net leased industrial properties, land leases, and development projects. LXP Industrial Trust is committed to delivering superior returns to its shareholders through prudent investments and active asset management.

Dividends – LXP dividend yield calculator

LXP INDUSTRIAL TRUST has just declared an annual dividend of $0.125 per share, making it the third year in a row that the company has issued dividends. The dividend yields for 2021 to 2023 are 4.87%, 4.25%, and 3.36%, respectively, with an average dividend yield of 4.16%. This is significantly higher than the yields of previous years when the dividend per share was set at 0.49, 0.48, and 0.44 USD.

If you are keen on dividend stocks, LXP INDUSTRIAL TRUST might be worth considering. With its relatively high dividend yields and reliable dividend history, it may be a suitable investment for those looking to benefit from dividend income.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for LXP. More…

| Total Revenues | Net Income | Net Margin |

| 326.04 | 107.84 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for LXP. More…

| Operations | Investing | Financing |

| 189.72 | -89.92 | -105.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for LXP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.01k | 1.64k | 7.62 |

Key Ratios Snapshot

Some of the financial key ratios for LXP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 15.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Market Price

On Friday, LXP INDUSTRIAL TRUST declared a dividend of $0.125 per share. The stock opened at $10.5 and closed at $10.2, a 3.0% decrease from the previous closing price of 10.5. This dividend provides investors with a regular income stream and should be an attractive option to those looking for long-term yields.

With the market size of LXP INDUSTRIAL TRUST, this dividend is expected to add considerable value for shareholders, as well as providing a steady return on their investment. This dividend is just one element of the company’s overall investment strategy, which seeks to provide holders with steady returns that can be reinvested to further increase their value. Live Quote…

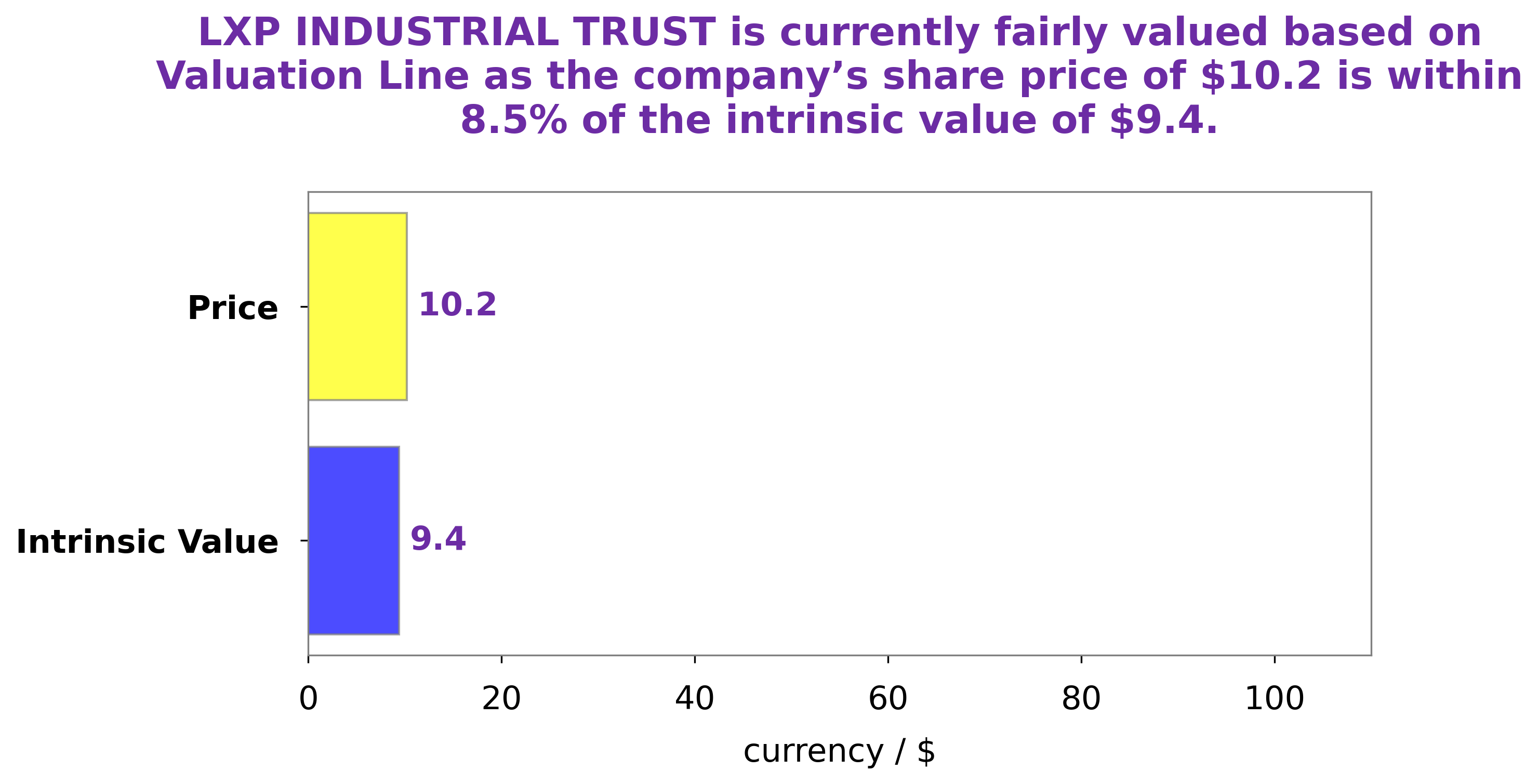

Analysis – LXP Intrinsic Value Calculation

At GoodWhale, we have conducted an analysis on the fundamentals of LXP INDUSTRIAL TRUST. Through our proprietary Valuation Line, we have calculated the fair value of LXP INDUSTRIAL TRUST at around $9.4. We have noticed that the stock is currently being traded at $10.2, which is overvalued by 8.7%. More…

Peers

LXP Industrial Trust’s competitors include H&R Real Estate Investment Trust, Cousins Properties Inc, First Industrial Realty Trust Inc.

– H&R Real Estate Investment Trust ($TSX:HR.UN)

H&R Real Estate Investment Trust has a market cap of $2.91 billion as of 2022. The company is a real estate investment trust that owns, operates, and develops office, retail, and residential properties. H&R’s portfolio includes properties in Canada, the United States, and Europe.

– Cousins Properties Inc ($NYSE:CUZ)

Cousins Properties is a real estate investment trust (REIT) that is engaged in the development, acquisition, and management of commercial real estate properties. The company’s portfolio includes office, retail, and mixed-use properties. As of December 31, 2020, Cousins Properties owned and operated 58 properties with a total of 18.3 million square feet of leasable space.

– First Industrial Realty Trust Inc ($NYSE:FR)

First Industrial Realty Trust, Inc. is a real estate investment trust (REIT) that owns, acquires, develops, and operates industrial properties. The company’s portfolio includes distribution warehouses, light manufacturing facilities, and other types of industrial property. As of December 31, 2020, First Industrial owned 579 properties totaling approximately 86.7 million square feet of space.

Summary

LXP Industrial Trust is a real estate investment trust (REIT) focused on acquiring, owning and operating industrial properties, such as distribution warehouses and light manufacturing facilities. This may have caused the stock to move down slightly on the day of the announcement. Overall, LXP Industrial Trust offers investors an attractive option for an income stream backed by a diversified portfolio of industrial properties. The company has a strong balance sheet and a track record of steady performance, making it an attractive long-term investment.

Recent Posts