Link Real Estate dividend yield – Link Real Estate Investment Trust Declares 1.188 Cash Dividend

June 3, 2023

☀️Dividends Yield

Link Real Estate ($SEHK:00823) Investment Trust (LINK) is proud to announce their 1.188 Cash Dividend declared June 1 2023. Over the past 3 years, LINK has issued an annual dividend per share of 2.97, 2.99, and 2.79 HKD, with dividend yields of 4.2%, 4.1%, and 4.49%. This yields an average dividend yield of 4.26%, making it an attractive option for investors interested in dividend stocks. The ex-dividend date for the dividend is June 15 2023. In addition to the 1.188 Cash Dividend, LINK has consistently implemented investor-friendly policies to ensure that shareholders are rewarded for their long-term support and commitment.

This includes share repurchases, special dividends, and more. LINK’s dedication to their shareholders is evident in their performance and growth over the years. LINK firmly believes that their dividend policy will continue to be a driving force for growth and success in the future.

Stock Price

The closing price of the stock on the same day was HK$45.8, up by 0.7% from the previous day’s close of HK$45.5. This dividend comes as a welcome announcement for shareholders of the REIT as it will add to their returns. REITs provide investors with an opportunity to invest in real estate without having to purchase physical properties. They offer investors a diversified portfolio that is managed professionally and offers regular income in the form of dividends. LINK REAL ESTATE INVESTMENT TRUST is one such REIT that provides investors with exposure to Hong Kong’s commercial property market.

The trust is well-diversified and offers exposure to a wide range of asset types, including offices, retail, residential, and hotels. The trust’s dividend announcement is likely to be well-received by the REIT’s investors and could serve as an incentive for those looking to invest in REITs. It demonstrates the REIT’s commitment to delivering returns to its investors and is likely to boost investor confidence in the trust. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Link Real Estate. More…

| Total Revenues | Net Income | Net Margin |

| 11.87k | 14.6k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Link Real Estate. More…

| Operations | Investing | Financing |

| 7.37k | -14.5k | 7.3k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Link Real Estate. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 238.69k | 67.83k | 78.58 |

Key Ratios Snapshot

Some of the financial key ratios for Link Real Estate are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 70.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – Link Real Estate Intrinsic Value Calculation

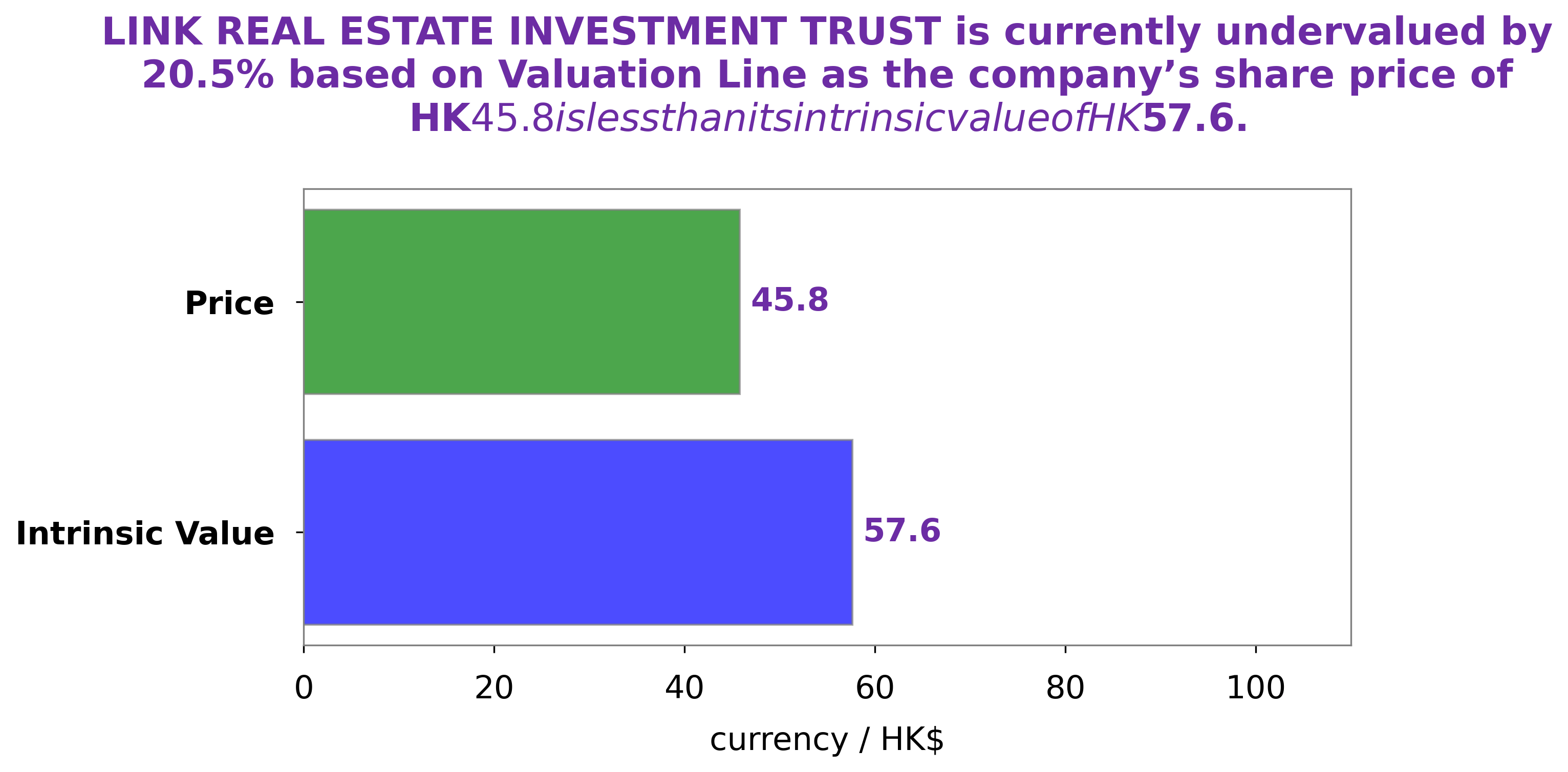

At GoodWhale, we have conducted an in-depth analysis of the fundamentals of LINK REAL ESTATE INVESTMENT TRUST to provide investors with an informed view of the stock. Our proprietary Valuation Line has calculated a fair value of around HK$57.6 for the stock. This means that the current market price of LINK REAL ESTATE INVESTMENT TRUST, at HK$45.8, is undervalued by 20.5%. This could be a good buying opportunity for investors looking to capitalise on a potentially mispriced asset. More…

Peers

Link Real Estate Investment Trust (Link REIT) is the largest publicly listed REIT in Asia and the first REIT listed in Hong Kong. Link REIT is the largest in terms of market capitalization amongst its competitors, Champion Real Estate Investment Trust, Sunlight Real Estate Investment Trust, and Mapletree Pan Asia Commercial Trust. It is engaged in the ownership and management of a diversified portfolio of retail and office properties in Hong Kong.

– Champion Real Estate Investment Trust ($SEHK:02778)

Champion Real Estate Investment Trust is a Hong Kong-based real estate investment trust, with a market cap of 17.26B as of 2022. The company primarily engages in the acquisition, development and leasing of commercial and residential properties in Hong Kong and other cities in the Greater China region. The company’s portfolio consists of office buildings, shopping malls, serviced apartments and residential properties. Champion Real Estate Investment Trust also provides asset management and property management services, as well as operates a real estate investment fund. The company’s focus is on providing long-term returns to its investors from its diversified portfolio of income producing properties.

– Sunlight Real Estate Investment Trust ($SEHK:00435)

Sunlight Real Estate Investment Trust is a publicly traded real estate investment trust (REIT) with a market cap of 5.59 billion as of 2022. The company invests in a diversified portfolio of commercial real estate properties, including office, retail, industrial, hotel and residential properties in the United States. Sunlight Real Estate Investment Trust is one of the leading REITs in the United States, with a market capitalization that is among the highest of all publicly traded REITs. The company’s portfolio consists of over 200 properties located in major metropolitan areas across the United States. Sunlight Real Estate Investment Trust is a publicly traded company listed on the New York Stock Exchange.

– Mapletree Pan Asia Commercial Trust ($SGX:N2IU)

Mapletree Pan Asia Commercial Trust is a Singapore-based real estate investment trust (REIT) that invests in office and retail properties across the Asia-Pacific region. As of 2022, the company has a market capitalization of 8.74 billion Singapore dollars, making it one of the largest REITs in Singapore. The trust’s portfolio includes prime office and retail assets located in major cities such as Singapore, Tokyo, Sydney, Manila, and Bangalore. It has also invested in other commercial assets such as hotels and data centres. Through its strategic investments, Mapletree Pan Asia Commercial Trust aims to offer investors a stable stream of income and potential capital appreciation.

Summary

LINK Real Estate Investment Trust (REIT) offers an attractive dividend yield for investors. The REIT has a track record of consistent dividend payments and has the potential for capital appreciation. Its portfolio of investment properties are mainly located in Hong Kong, with a focus on retail and office properties. LINK REIT offers a stable income stream, with low risk and low volatility.

As the Hong Kong property market continues to strengthen, LINK REIT’s portfolio and dividend payments are expected to benefit from this growth. Investors should therefore consider LINK REIT as a reliable and attractive long-term investment option.

Recent Posts