LEG stock dividend – Leggett & Platt Announces 0.46 Cash Dividend

June 11, 2023

🌥️Dividends Yield

On June 8 2023, Leggett & Platt ($NYSE:LEG) Inc. announced a 0.46 cash dividend, continuing its streak of issuing annual dividend per share for the past three years. The dividend yield is estimated to be 4.78%, 4.67%, and 3.54% from 2021 to 2023 respectively with an average yield of 4.33%. Ex-dividend date for the dividend is set to be June 14 2023. With a solid track record of issuing dividends and an attractive yield, LEGGETT & PLATT could be a good addition to your portfolio.

Stock Price

The stock opened at $32.7 and closed at $32.2, down 1.6% from the previous closing price of 32.7. This dividend is part of Leggett & Platt’s long-term strategy to reward shareholders and further diversify their investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for LEG. More…

| Total Revenues | Net Income | Net Margin |

| 5.04k | 272.9 | 5.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for LEG. More…

| Operations | Investing | Financing |

| 499.1 | -202.1 | -264.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for LEG. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.27k | 3.6k | 12.33 |

Key Ratios Snapshot

Some of the financial key ratios for LEG are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.8% | -5.3% | 8.7% |

| FCF Margin | ROE | ROA |

| 7.5% | 16.7% | 5.2% |

Analysis

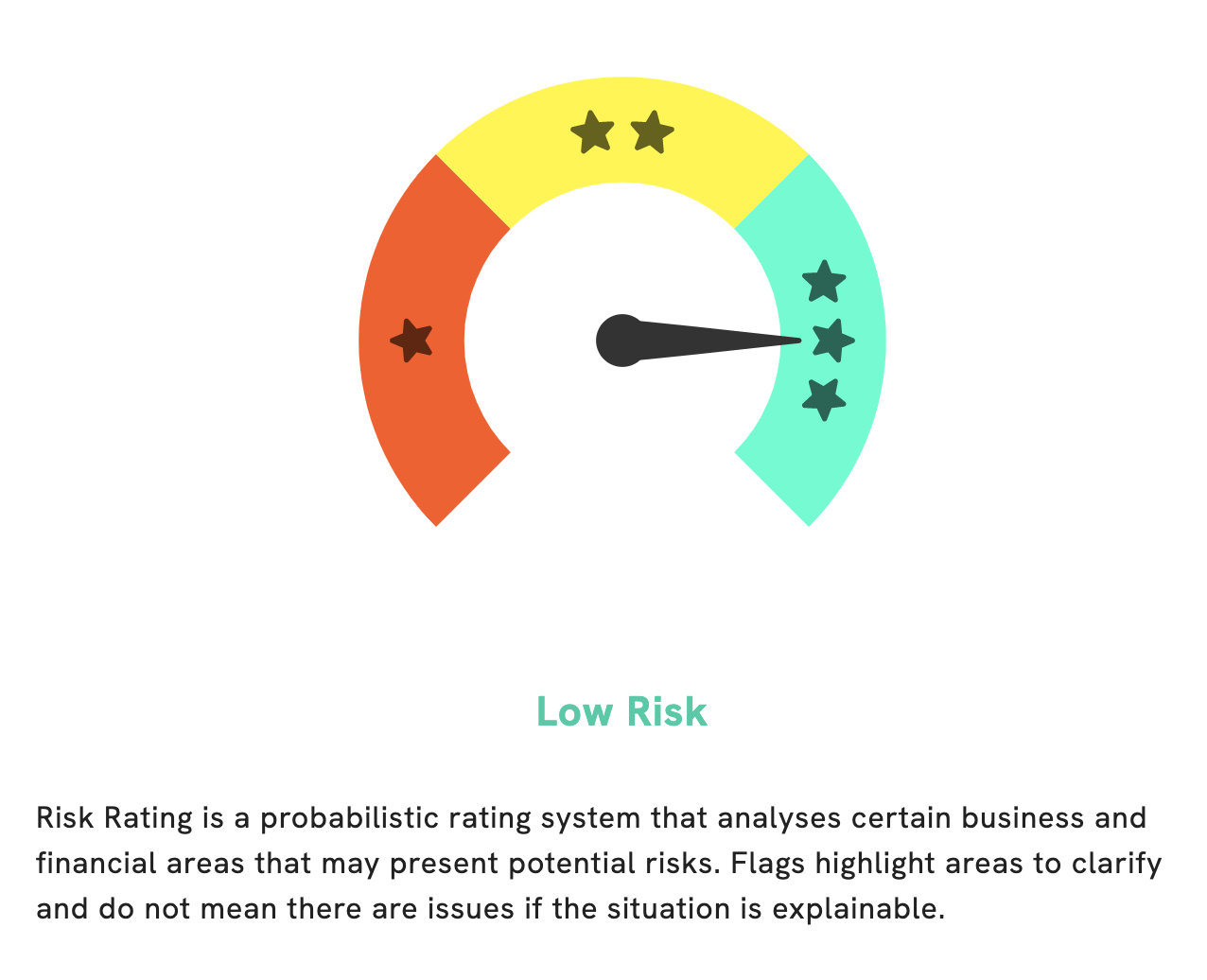

At GoodWhale, we’ve performed an analysis of Leggett & Platt’s fundamentals and have determined that it is a low risk investment across both financial and business aspects. When evaluating these factors, we found that Leggett & Platt has a strong balance sheet, a healthy free cash flow, and low debt-to-assets ratios. The positive metrics that our team found when evaluating Leggett & Platt indicate that the company has strong fundamentals and a solid history of fiscal responsibility. We recommend Leggett & Platt to those looking for a low risk investment. Those interested can become registered users on our platform to check out the specific business and financial areas where Leggett & Platt may have potential risks. More…

Peers

The company operates in 19 countries and sells its products to customers in more than 130 countries. Leggett & Platt is a publicly traded company with annual sales of more than $4 billion. The company has more than 30,000 employees. Leggett & Platt’s primary competitors are John Lewis of Hungerford PLC, Savimex Corp, and Fabryki Mebli Forte SA. Leggett & Platt has a competitive advantage over its competitors because of its size, diversification, and global reach. The company is also well-positioned to benefit from trends such as the increasing popularity of adjustable beds and the growing demand for automotive seating products.

– John Lewis of Hungerford PLC ($LSE:JLH)

Lewis of Hungerford PLC is a company that manufactures and sells kitchen furnishings. As of 2022, it has a market capitalization of 2.61 million GBP and a return on equity of 35.66%. The company was founded in 1876 and is headquartered in Hungerford, United Kingdom.

– Savimex Corp ($HOSE:SAV)

Fabryki Mebli Forte SA is a Polish furniture manufacturer that produces a wide variety of furniture for both home and office settings. The company has a market capitalization of 445.11M as of 2022 and a return on equity of 10.25%. Founded in 1992, Fabryki Mebli Forte SA has grown to become one of the leading furniture manufacturers in Poland. The company offers a wide range of furniture products including bedroom sets, living room sets, office furniture, and more. Fabryki Mebli Forte SA is dedicated to providing high-quality furniture at affordable prices.

Summary

Investors interested in LEggett & Platt Incorporated may be pleased to know that the company has consistently paid dividends over the past 3 years. For 2021, 2022, and 2023, the dividend yield is estimated to be 4.78%, 4.67%, and 3.54% respectively. The average yield is 4.33% and the ex-dividend date is June 14, 2023. While investing in this company may offer a steady income stream, investors should carefully consider the current market conditions and their individual risk profile before making an investment decision.

Recent Posts