Lamar Advertising dividend – Lamar Advertising Co Announces 1.25 Cash Dividend

June 12, 2023

🌥️Dividends Yield

Lamar Advertising ($BER:6LA) Co announced on June 2 2023 that they are issuing a 1.25 cash dividend. If you’re an investor looking for stocks with dividend yields, LAMAR ADVERTISING is a great option for you. With annual dividends per share of 4.85 USD, 4.7 USD, and 3.5 USD in the past three years, it offers respective dividend yields of 5.04%, 4.9%, and 3.38% in 2021, 2022, and 2023. This yields an average dividend yield of 4.44%.

The ex-dividend date for this dividend is June 15 2023. With such great yields, LAMAR ADVERTISING is a great choice for investors who are looking for dividend-paying stocks.

Stock Price

Lamar Advertising Co. announced on Friday that it will be paying out a cash dividend of 1.25. This news sent the stock price of LAMAR ADVERTISING higher, as it opened the day at €85.0 and ended the day at the same price, up by 1.2% from its closing price of €84.0 the day before. The announcement marks a positive outlook for the company’s future, as it allows investors to benefit from the company’s earnings and have a share in its success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lamar Advertising. More…

| Total Revenues | Net Income | Net Margin |

| 2.05k | 422.17 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lamar Advertising. More…

| Operations | Investing | Financing |

| 788.29 | -588.39 | -281.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lamar Advertising. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.44k | 5.28k | 11.39 |

Key Ratios Snapshot

Some of the financial key ratios for Lamar Advertising are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 27.2% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

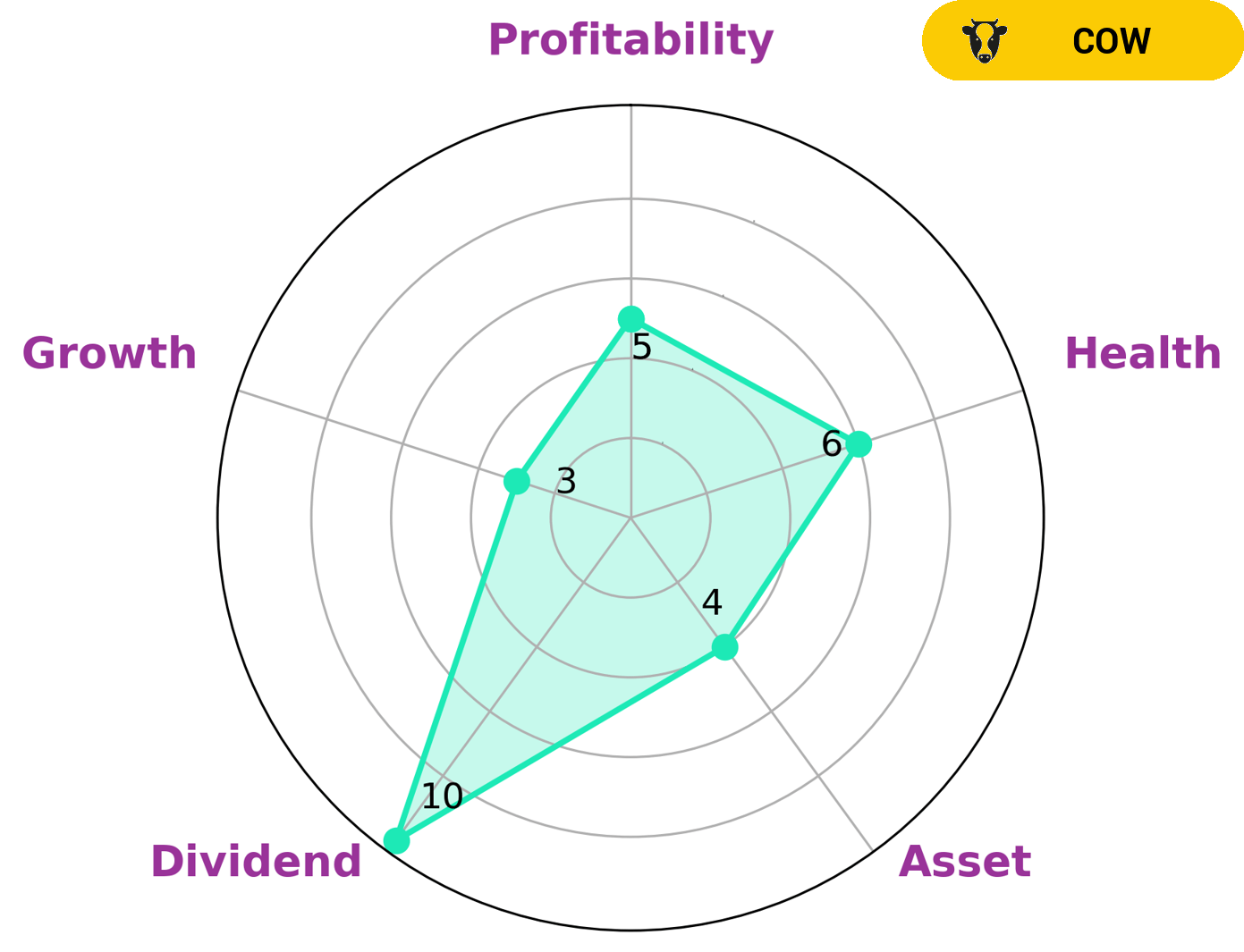

GoodWhale has conducted an analysis of the financials of LAMAR ADVERTISING. Based on our star chart, the company is strong in dividend, with a medium rating in asset, profitability, and weak in growth. Moreover, it has an intermediate health score of 6/10 reflecting its cashflows and debt. We believe that LAMAR ADVERTISING is likely to safely ride out any crisis without the risk of bankruptcy. We have classified LAMAR ADVERTISING as a ‘cow’, meaning that it has the track record of paying out consistent and sustainable dividends. We believe that this type of company may be of interest to investors looking for steady income and capital appreciation. More…

Summary

Lamar Advertising is a promising stock for dividend investors, offering an average dividend yield of 4.44% over the past three years. It has paid out dividends of 4.85 USD, 4.7 USD, and 3.5 USD in 2021, 2022, and 2023, respectively. The company is also known for its stability and strong balance sheet, with ample liquidity to fund future dividend payments. Investors looking for steady income in the long-term can consider investing in Lamar Advertising for its consistent dividend yields and financial strength.

Recent Posts