Ksb Se stock dividend – KSB SE and Co KGaA Declares 19.76 Cash Dividend

June 1, 2023

🌥️Dividends Yield

KSB SE ($LTS:0BQE) and Co KGaA recently declared a 19.76 cash dividend on May 25, 2023. Over the past three years, KSB SE has issued an annual dividend per share of 12.26 EUR, with a dividend yield of 4.64% for the period from 2022 to 2023. This average yield remains consistent at 4.64%. If you are looking for a dividend stock, then KSB SE may be an option for you to consider.

The ex-dividend date for this year is May 5, 2023. This provides investors a relatively generous return for those looking to invest in KSB SE.

Share Price

The stock price of KSB SE opened at €245.2 and closed at the same price, indicating that the dividend declaration had no impact on the stock price. This dividend declaration further demonstrates the company’s commitment to reward its shareholders with a return on their investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ksb Se. More…

| Total Revenues | Net Income | Net Margin |

| 2.57k | 103.42 | 4.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ksb Se. More…

| Operations | Investing | Financing |

| 2.11 | -89.04 | -75.84 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ksb Se. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.48k | 1.35k | 493.63 |

Key Ratios Snapshot

Some of the financial key ratios for Ksb Se are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.6% | 18.4% | 6.7% |

| FCF Margin | ROE | ROA |

| -3.9% | 12.2% | 4.4% |

Analysis

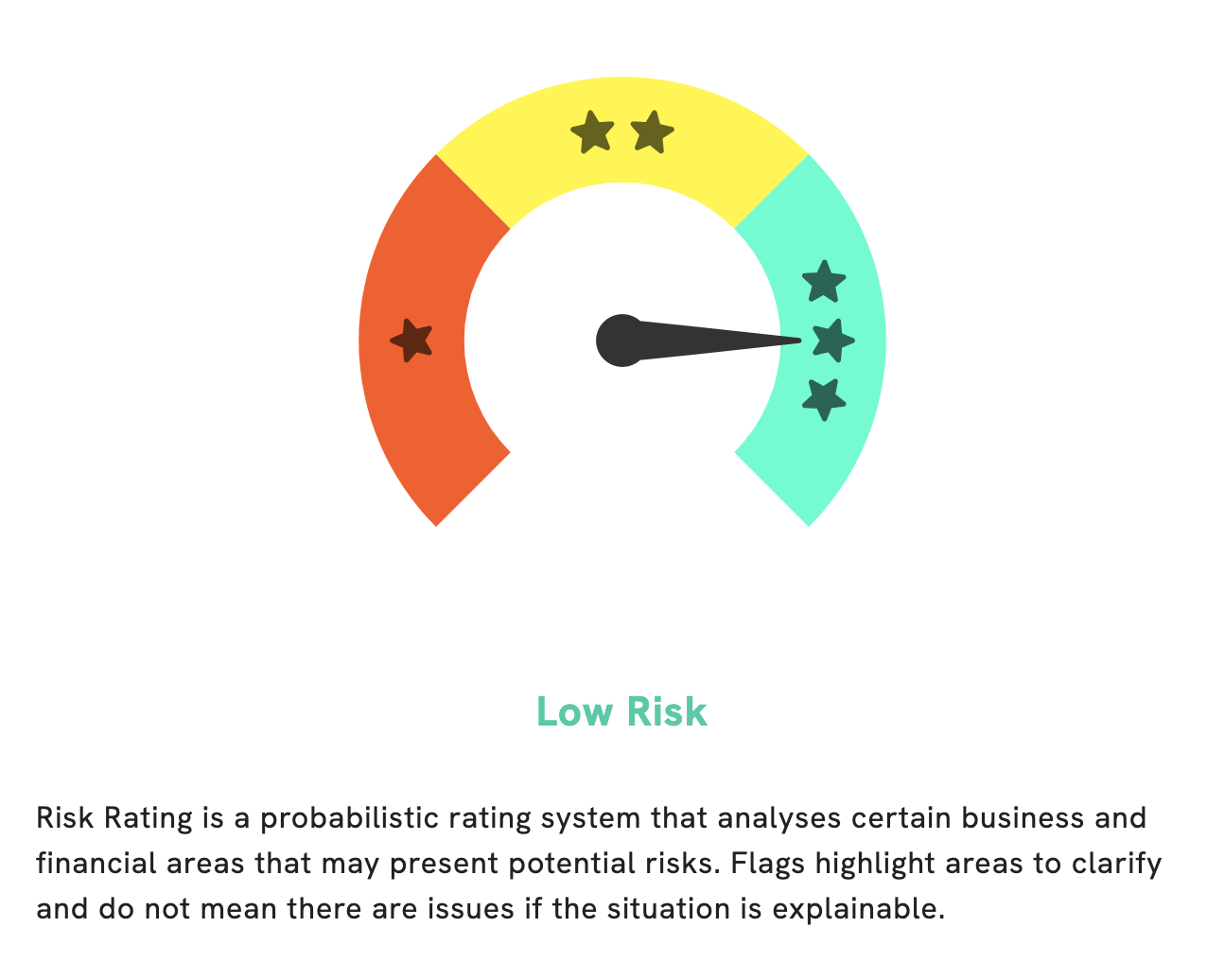

GoodWhale has conducted a thorough analysis of KSB SE‘s financials and our Risk Rating indicates that this is a low risk investment in terms of its financial and business aspects. We’ve identified one risk warning in the income statement, so we recommend that potential investors should register on goodwhale.com for further details. We believe that KSB SE is a reliable and secure investment, with strong financial statements and a solid business model. Our analysis of the company’s finances have revealed no major issues of concern, making it an attractive prospect for those looking for a safe and reliable investment. At GoodWhale, we are committed to providing you with the best possible information to help you make an informed investment decision. We have a comprehensive database which provides detailed and up-to-date information on the financials of KSB SE, allowing you to make an informed decision. We also offer access to our proprietary Risk Rating system, which evaluates the financial and business aspects of the company and gives an indication of the risk associated with investing in it. Our analysis of KSB SE has revealed a low risk rating, indicating that this is a safe and secure investment. We encourage you to register on goodwhale.com and take advantage of our comprehensive analysis of KSB SE, as well as our Risk Rating system. Doing so will give you a better understanding of the financials and allow you to make an informed decision about investing in KSB SE. More…

Summary

KSB SE is a dividend stock that has issued an annual dividend per share of 12.26 EUR for the last three years. The dividend yield for this period is 4.64%, which is the average yield for such stocks in the same period. Investing in KSB SE may be profitable as it offers a steady return on investment with a predictable and consistent payout. Additionally, the company is financially sound and has a strong track record of returns.

Recent Posts