K&o Energy stock dividend – K&O Energy Group Declares 17.0 Cash Dividend

June 3, 2023

☀️Dividends Yield

K&O Energy Group Inc. has declared a 17.0 JPY cash dividend to be paid on June 1st 2023. This marks the fourth consecutive year that the company has paid out a dividend. Over the past three years, K&O ENERGY ($TSE:1663) has paid an annual dividend per share of 32.0, 32.0, and 30.0 JPY, respectively. This steady dividend payment makes it attractive to those interested in dividend stocks. In particular, its average dividend yield from 2021 to 2023 was 2.06%.

Additionally, the dividends for 2021 and 2023 were 2.07% and 2.04%, respectively. The ex-dividend date for the 2023 dividend is June 29th, so investors must own the shares by that date in order to receive the dividend payment. Those who are interested can start planning now in order to ensure they are eligible for the dividend payment come June.

Stock Price

Despite the announcement, the stock opened at JP¥2155.0 and closed at JP¥2140.0, a decrease of 1.2% from the previous day’s closing price of JP¥2166.0. The company’s management said they remain confident in their prospects and expect their dividend to be well received by investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for K&o Energy. More…

| Total Revenues | Net Income | Net Margin |

| 107.31k | 5.12k | 4.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for K&o Energy. More…

| Operations | Investing | Financing |

| 12.17k | -9.67k | -1.87k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for K&o Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 106.07k | 18.45k | 3.21k |

Key Ratios Snapshot

Some of the financial key ratios for K&o Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.0% | 36.1% | 7.9% |

| FCF Margin | ROE | ROA |

| 5.8% | 6.2% | 5.0% |

Analysis

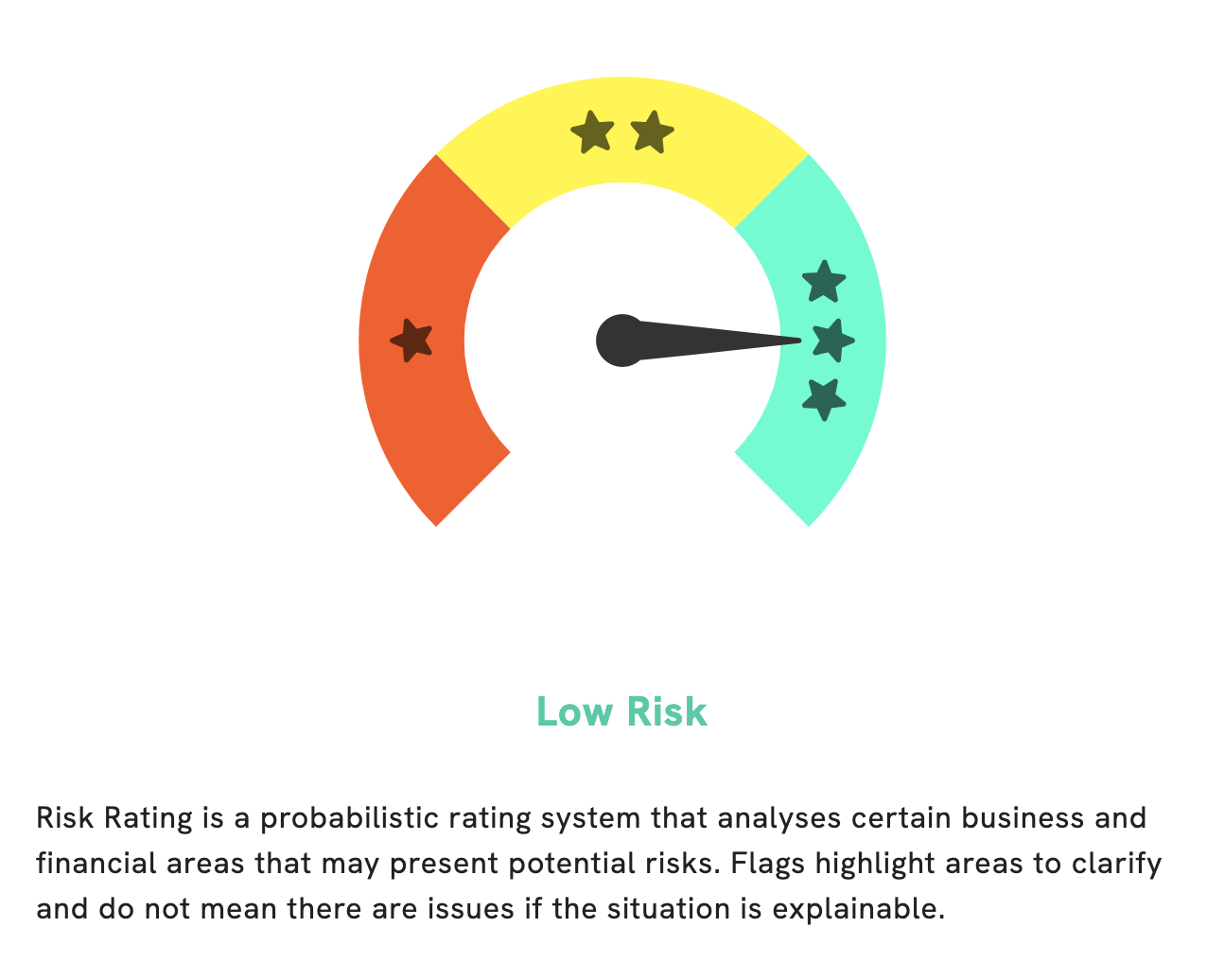

At GoodWhale, we recently conducted an analysis of K&O ENERGY‘s fundamentals. According to our Risk Rating, K&O ENERGY is a low risk investment in terms of financial and business aspects. However, upon closer examination, we detected two risk warnings in the income sheet and balance sheet. If you would like to find out more about these warnings, be sure to register on our website goodwhale.com. More…

Peers

The company competes with Delong Composite Energy Group Co Ltd, Osaka Gas Co Ltd, and Daesung Energy Co Ltd to provide the best and most reliable energy solutions to their respective customers. All four companies are at the top of their game, striving to remain ahead of the competition with innovative solutions and industry leading practices.

– Delong Composite Energy Group Co Ltd ($SZSE:000593)

DeLong Composite Energy Group Co Ltd is a Chinese energy company that provides energy and related services, such as natural gas and electricity generation, transmission, and distribution. The company has a market capitalization of 2.37 billion dollars, which makes it one of the foremost players in the energy sector. Additionally, the company boasts an impressive Return on Equity (ROE) of 5.52%, indicating that the company is taking full advantage of its assets and generating reliable returns for its shareholders.

– Osaka Gas Co Ltd ($TSE:9532)

Osaka Gas Co Ltd is one of the largest gas utilities and energy companies in Japan. It is a multi-specialty company that provides natural gas, electricity, and other energy-related products and services to their customers. The company has a market cap of 917.33 billion as of 2023, and demonstrates a Return on Equity of 2.61%. This high market cap indicates that Osaka Gas Co Ltd has a strong market presence and is well regarded by investors. It also indicates a strong financial performance, as the Return on Equity ratio is well above average.

– Daesung Energy Co Ltd ($KOSE:117580)

Daesung Energy Co Ltd, is a South Korean energy company specializing in the production and sale of electricity, natural gas, and other energy sources. With a market cap of 233.33B as of 2023, the company has experienced steady growth and is considered a major player in the energy sector. Daesung Energy Co Ltd also has a Return on Equity of 6.8%, indicating that it has been able to efficiently and effectively utilize its assets to generate profits. The company is well-positioned to capitalize on future growth opportunities and continue to be a leader in the energy industry.

Summary

K&O ENERGY is a great option for dividend-seeking investors. Over the past three years, the company has paid an annual dividend per share of 32.0 JPY, 32.0 JPY, and 30.0 JPY, respectively. This provides an average dividend yield of 2.06% from 2021 to 2023, and a yield of 2.07% in 2021 and 2.04% in 2023.

Recent Posts