Kingworld Medicines dividend yield – Kingworld Medicines Group Ltd Declares 0.0247 Cash Dividend

June 3, 2023

🌥️Dividends Yield

On June 2 2023, Kingworld Medicines ($SEHK:01110) Group Ltd declared a 0.0247 CNY cash dividend for the financial year of 2022. This dividend payment is the same as the previous 3 years, with an average dividend yield of 4.43%. For investors looking for a reliable dividend stock, KINGWORLD MEDICINES is certainly worth considering. The ex-dividend date for this payment is June 1 2023, meaning that shareholders must be on the record as owners of the stock before this date in order to receive the payment.

Furthermore, those who purchase the stock after this date will not be eligible for the dividend. Therefore, if you are looking to take advantage of the dividend payment, now is the time to purchase KINGWORLD MEDICINES shares.

Market Price

The stock opened at HK$0.8, then closed at HK$0.7, a 7.5% drop from its last closing price of HK$0.8. As such, the market reacted negatively to the news, which caused the stock to fall drastically. Investors may be concerned about the company’s ability to keep up with the dividend payments in the future, given its relatively small size and limited financial resources. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kingworld Medicines. More…

| Total Revenues | Net Income | Net Margin |

| 957.7 | 22.74 | 2.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kingworld Medicines. More…

| Operations | Investing | Financing |

| 186.55 | -84.05 | -51.31 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kingworld Medicines. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.26k | 569.15 | 0.99 |

Key Ratios Snapshot

Some of the financial key ratios for Kingworld Medicines are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.7% | 21.4% | 8.3% |

| FCF Margin | ROE | ROA |

| 9.8% | 8.0% | 4.0% |

Analysis

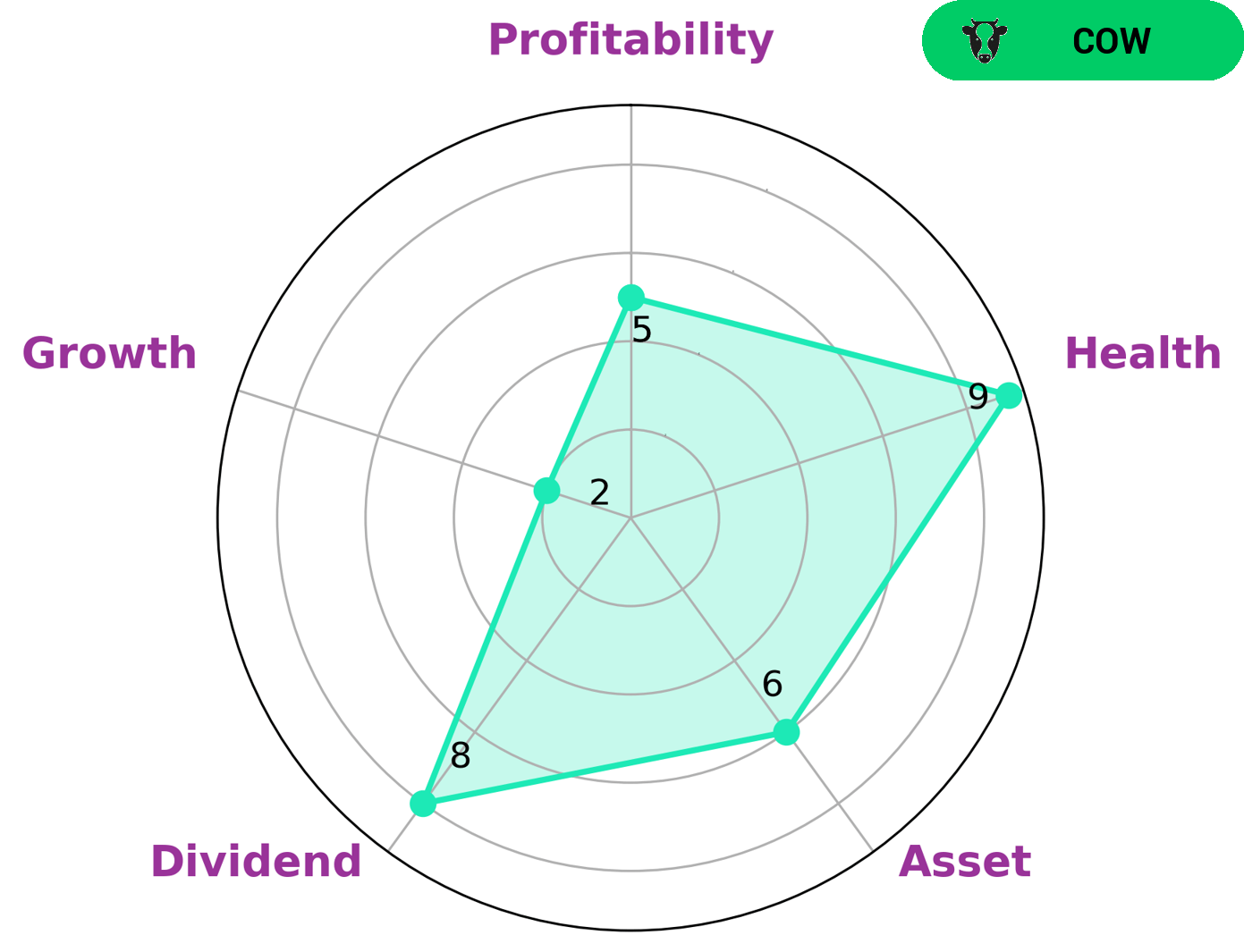

GoodWhale recently conducted an analysis of KINGWORLD MEDICINES‘ wellbeing. The Star Chart showed that KINGWORLD MEDICINES had a very high health score of 9/10 when considering its cashflows and debt, indicating the company is capable of sustaining itself in times of crisis. We have classified KINGWORLD MEDICINES as a ‘cow’, meaning the company has a track record of paying out consistent and sustainable dividends. Given this analysis, we believe that KINGWORLD MEDICINES is an ideal company for dividend-focused investors. The company is strong in dividend, medium in asset, profitability and weak in growth. Investors looking for a reliable source of dividend income may find KINGWORLD MEDICINES to be a good choice. More…

Peers

The competition between Kingworld Medicines Group Ltd and its competitors, Nihon Chouzai Co Ltd, Codupha Central Pharmaceutical JSC, and Honliv Healthcare Management Group Co Ltd, is fierce as each company strives to be the top provider of healthcare products and services. With the stakes being high, each organization is doing their best to provide quality goods and services, while keeping prices as low as possible. In order to do this, each company must stay one step ahead of their competitors in terms of technology, innovation, and customer service.

– Nihon Chouzai Co Ltd ($TSE:3341)

Nihon Chouzai Co Ltd is a leading global provider of medical products, pharmaceuticals, and health-related services. The company has a market capitalization of 33.38B as of 2023, indicating its total worth in the public stock market. Additionally, the Return on Equity (ROE) of 12.92% indicates the company’s ability to generate income with shareholders’ funds. Nihon Chouzai Co Ltd continues to be a leader in its industry through its commitment to research and development, providing customers with the most up-to-date technology and services.

– Codupha Central Pharmaceutical JSC ($HNX:CDP)

Honliv Healthcare Management Group Co. Ltd. is a multi-national healthcare group that provides a range of services across the healthcare industry. With a market cap of 1.32 billion as of 2023, the company is well-positioned to continue to expand its operations in the future. Its strong financial performance and Return on Equity (ROE) of 7.91% demonstrate the company’s commitment to achieving strong returns for its shareholders. The company focuses on providing integrated solutions to improve patient care, including medical devices and equipment, diagnostics and analytics, healthcare information technology, and healthcare services such as telemedicine and medical tourism. It also serves patients in China, the U.S., and other countries around the world.

Summary

KINGWORLD MEDICINES is an attractive investment opportunity for income seekers due to its consistent dividend payout of 0.02 CNY per share for the past three years. This results in an average dividend yield of 4.43%, which is significantly higher than the market average. Investors should consider potential long-term growth opportunities that the company presents, as its business model is likely to be profitable and sustainable. Analysts should evaluate the company’s financial performance and potential future earnings to determine if it is a good fit for their portfolio.

Additionally, investors should consider any risks associated with investing in KINGWORLD MEDICINES, such as fluctuations in the stock price or operational issues. Overall, KINGWORLD MEDICINES is a solid investment opportunity with strong potential for long-term capital appreciation.

Recent Posts