Jungheinrich Ag dividend – Jungheinrich AG Declares 0.68 Cash Dividend

May 27, 2023

Dividends Yield

Jungheinrich ($BER:JUN3) AG declared a 0.68 EUR cash dividend on May 26 2023, giving investors looking for dividend stocks a great opportunity. The company has been consistent with their annual dividend per share over the last three years, at 0.68 EUR, 0.43 EUR, and 0.48 EUR respectively. Furthermore, the dividend yields from 2020 to 2022 were 2.59%, 1.14%, and 2.55%, with an average of 2.09%. Moreover, investors should also consider the ex-dividend date of May 12 2023.

Overall, for investors looking to add dividend stocks to their portfolio, Jungheinrich AG is a great choice. With its consistent dividend per share and yields over the last three years, the company provides investors with a reliable and attractive investment option. Furthermore, considering the ex-dividend date of May 12 2023, now is an ideal time to purchase shares in Jungheinrich AG.

Market Price

When the market opened at €29.7, the stock quickly rose to close at €30.4. The dividend payment is expected to take place on November 30, 2020. This is the third consecutive year that JUNGHEINRICH AG has declared a dividend, demonstrating the company’s commitment to rewarding shareholders for their long-term investment. This dividend payment marks the company’s commitment to returning value to shareholders and sets an example for other companies in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jungheinrich Ag. More…

| Total Revenues | Net Income | Net Margin |

| 4.45k | 248.55 | 5.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jungheinrich Ag. More…

| Operations | Investing | Financing |

| -84.92 | 52.69 | -72.36 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jungheinrich Ag. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6k | 4.07k | 18.91 |

Key Ratios Snapshot

Some of the financial key ratios for Jungheinrich Ag are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.9% | 8.2% | 8.0% |

| FCF Margin | ROE | ROA |

| -4.3% | 11.9% | 3.7% |

Analysis

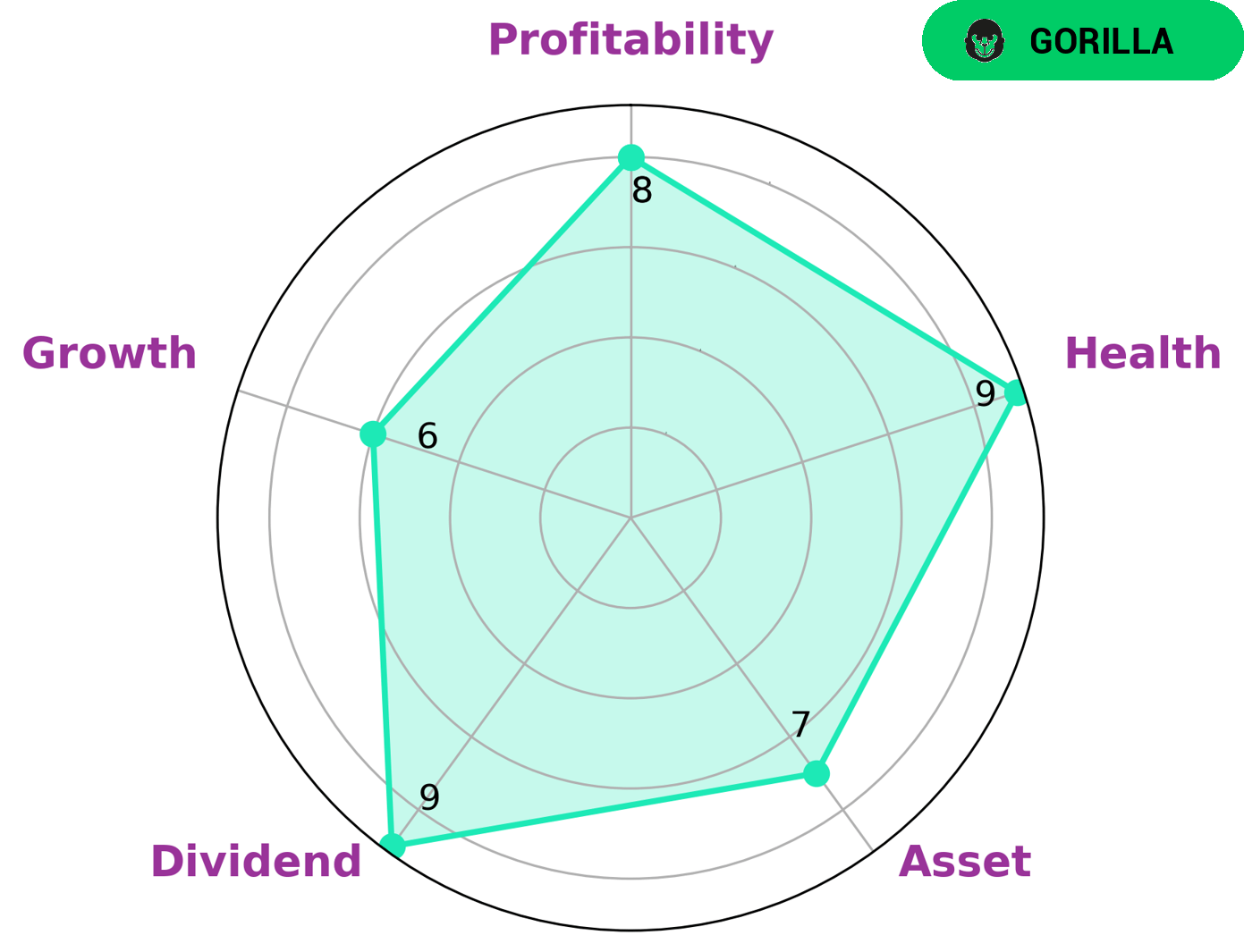

At GoodWhale, we have conducted an extensive analysis of the fundamentals of JUNGHEINRICH AG. After examining the company’s performance over time, we have concluded that they have a strong asset, dividend, and profitability. Furthermore, their growth rate is assessed as medium. Comparing to other companies, JUNGHEINRICH AG is classified as a ‘gorilla’, which is a term we use to describe those that have achieved stable and high revenue or earning growth due to their strong competitive advantage. We believe that investors who are looking for long-term stability and strong fundamentals may be interested in investing in JUNGHEINRICH AG. Additionally, with its high health score of 9/10 considering its cashflows and debt, the company is capable of paying off debt and funding its future operations. More…

Peers

Along with Homag Group AG, SMC Corp, and ITT Inc, Jungheinrich AG is one of the major players in the industry, providing warehouse solutions to a variety of businesses.

– Homag Group AG ($BER:HG1)

Homag Group AG is a leading global woodworking machinery and systems manufacturer. Its products range from single machines to factory-wide systems, and from sawing to the finishing of wood surfaces. The company has a market cap of 618.11 million as of 2023, indicating a strong size and market presence. It also has an impressive return on equity of 48.17%, indicating that the company is utilizing its resources efficiently to generate returns for shareholders.

– SMC Corp ($TSE:6273)

SMC Corporation is an industrial automation and components manufacturer based in Japan. As of 2023, the company has a market capitalization of 4.78T and a Return on Equity of 11.52%. SMC specializes in providing components and systems for air control, fluid power, and electronic sensing applications. The company offers a wide range of products in various fields, from pneumatics to control valves, sensors, and robotic systems. With its strong financials and increasing market share in the industrial automation landscape, SMC has positioned itself as a leader in the industry.

– ITT Inc ($NYSE:ITT)

HITT Inc is a global technology and services company that provides integrated solutions for government and commercial sectors. With a market capitalization of 6.58 billion dollars in 2023, HITT Inc. is one of the largest publicly traded companies in the technology sector. The company’s Return on Equity (ROE) of 13.39% indicates a strong level of profitability and demonstrates the company’s ability to use investor funds to generate a healthy return. HITT Inc offers an array of IT services and products to clients in government, health and education, and defense industries.

Summary

JUNGHEINRICH AG is an attractive dividend stock for investors. Over the past three years, it has consistently paid out a dividend of 0.68 EUR per share in 2020, 0.43 EUR in 2021, and 0.48 EUR in 2022. Its dividend yields for each respective year have been 2.59%, 1.14%, and 2.55%.

On average, its dividend yield has stood at around 2.09%. With a consistent track record of dividend payments and a healthy dividend yield, JUNGHEINRICH AG is worth considering for investors seeking dividend stocks.

Recent Posts