Joyful Honda dividend yield – Joyful Honda Co Ltd Announces 23.0 Cash Dividend

June 12, 2023

☀️Dividends Yield

Joyful Honda ($TSE:3191) Co Ltd has announced an impressive 23.0 Cash Dividend on June 1, 2023. This dividend marks the fourth consecutive year that JOYFUL HONDA has issued an annual dividend per share, with previous years’ amounts being 44.0 JPY, 42.0 JPY and 33.5 JPY. The dividend yields for 2021 to 2023 are 2.97%, 2.99% and 2.09%, with an average yield of 2.68%. Investors searching for dividend stocks may want to look into JOYFUL HONDA as a viable option to add to their portfolio.

Its ex-dividend date is June 19th, 2023, giving investors who wish to buy the stock enough time to gain eligibility for the dividend payment. With its steady payout over the last three years and an impressive average yield, JOYFUL HONDA could prove to be a reliable source of income for investors.

Price History

This announcement came shortly after trading began, and the JOYFUL HONDA stock opened at JP¥1708.0 and closed at JP¥1695.0, indicating a 1.2% decrease from the previous closing price of JP¥1716.0. This cash dividend will be paid to shareholders of record as of September 30th, 2021. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Joyful Honda. More…

| Total Revenues | Net Income | Net Margin |

| 128.95k | 11.02k | 8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Joyful Honda. More…

| Operations | Investing | Financing |

| 11.1k | 1.37k | -12.22k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Joyful Honda. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 160.74k | 43.53k | 1.8k |

Key Ratios Snapshot

Some of the financial key ratios for Joyful Honda are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.9% | 6.2% | 10.8% |

| FCF Margin | ROE | ROA |

| 2.6% | 7.4% | 5.4% |

Analysis

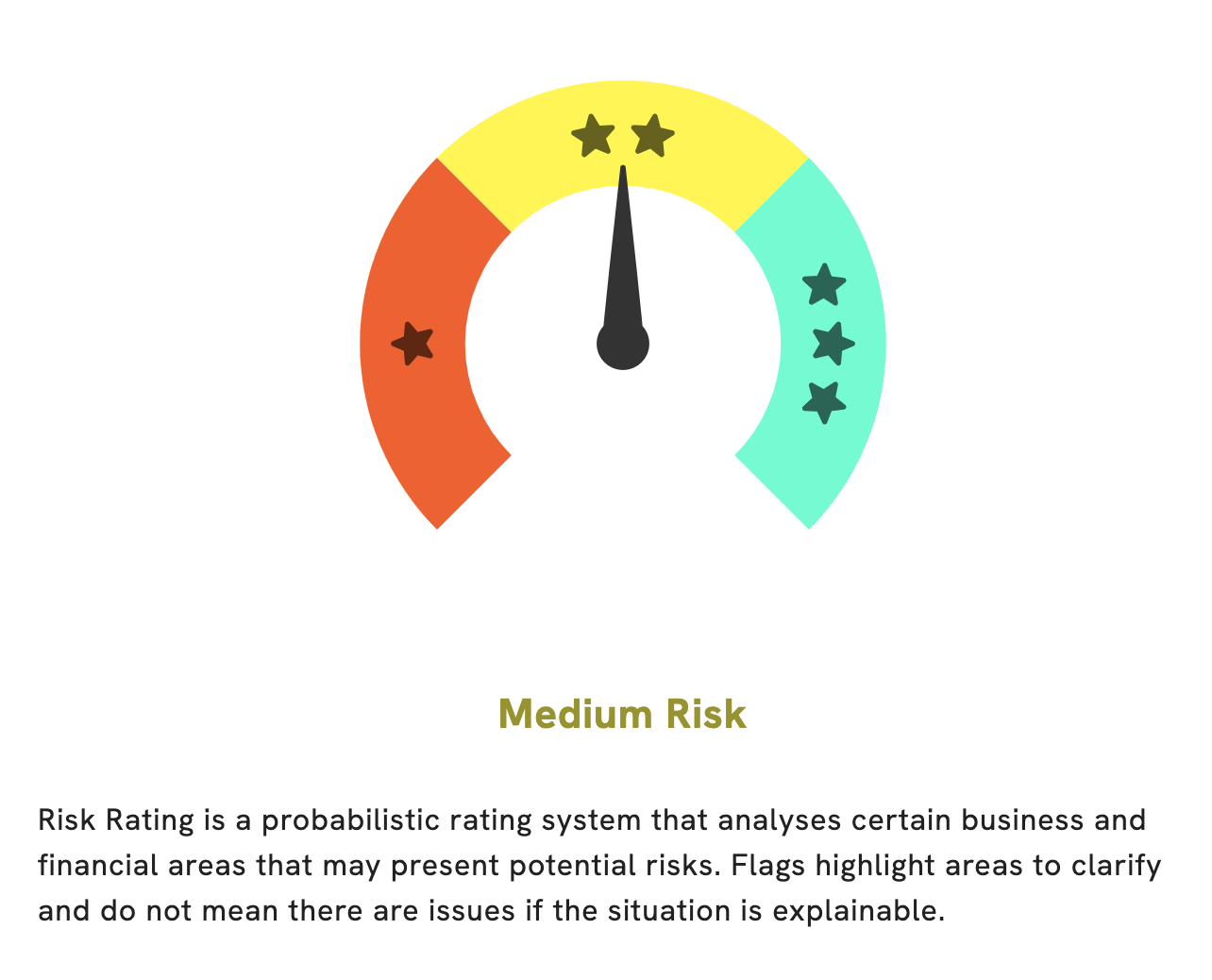

At GoodWhale, we have conducted an analysis of JOYFUL HONDA‘s fundamentals. Based on our Risk Rating, JOYFUL HONDA is a medium risk investment from both financial and business aspects. In particular, we have identified three risk warnings in its income statement, balance sheet, and cashflow statement. To get more detailed information on these risks, become a registered user of GoodWhale. With our comprehensive data and insights, you can make more informed decisions about your investments. More…

Peers

Joyful Honda Co Ltd is an automotive company that faces a lot of competition in the market. Its main competitors include Kohnan Shoji Co Ltd, Wilcon Depot Inc, and Komeri Co Ltd, all of which are competing for market share and customers. All of these companies are striving to provide quality products at competitive prices in order to gain a larger share of the market.

– Kohnan Shoji Co Ltd ($TSE:7516)

Kohnan Shoji Co Ltd is a retail company based in Japan, specializing in building materials and home improvement products. It has a market capitalization of 101.07B as of 2023, which indicates that it is a large and successful company. It also has a Return on Equity of 9.73%, which is a measure of the company’s profitability. This suggests that Kohnan Shoji Co Ltd is able to make good use of its investments and generate healthy returns.

– Wilcon Depot Inc ($PSE:WLCON)

Wilcon Depot Inc is a leading Philippine-based home improvement and construction supplies retailer. The company has a market capitalization of 133.86 billion as of 2023, indicating its strong financial performance and potential for growth. Additionally, Wilcon Depot Inc has a Return on Equity (ROE) of 17.66%, which is indicative of the company’s success in generating income from its shareholders’ equity. This indicates that the company is able to generate a relatively high return on its invested capital, which is an important indicator of the company’s financial health and future growth prospects.

– Komeri Co Ltd ($TSE:8218)

Komeri Co Ltd is a Japanese electronics and home appliance retailer. The company has a market cap of 126.75B as of 2023, indicating its strong presence in the market. Its Return on Equity (ROE) stands at 7.18%, which suggests that the company is generating profits efficiently and providing a good return on shareholder’s investments. Komeri Co Ltd is dedicated to providing quality products and services to customers, believing that customer satisfaction is the foundation of their success.

Summary

Investing in JOYFUL HONDA is a relatively safe bet given its consistent dividend payouts over the last few years. Since 2021, the company has paid out an annual dividend of 44.0 JPY, 42.0 JPY and 33.5 JPY per share, respectively. This translates to a dividend yield of 2.97%, 2.99% and 2.09%, with an average yield of 2.68%. This demonstrates that investors can expect a steady stream of income while holding JOYFUL HONDA’s shares, making it an attractive option for those looking for a reliable dividend payer.

Recent Posts