ITMG stock dividend – PT Indo Tambangraya Megah Tbk Declares Cash Dividend of 6416.0

April 7, 2023

Dividends Yield

PT Indo Tambangraya Megah Tbk has declared a cash dividend of 6416.0 on April 5 2023. This dividend represents a consistent annual dividend per share of 0.47 USD over the last three years, totaling a 19.65% dividend yield. It is important to remember that dividends represent a portion of the company’s profits and are not guaranteed.

When it comes to investing, it is always best to do your due diligence and research thoroughly before making any decisions. By considering the history of stability as well as the current dividend rate offered by PT INDO TAMBANGRAYA MEGAH TBK ($IDX:ITMG), you can decide for yourself if this company is a good fit for your investment strategy.

Market Price

The dividend will be paid out of the company’s funds, which are derived primarily from its coal mining operations. It is the fifth consecutive year that ITM has issued dividends to its shareholders, reflecting the company’s financial stability and strong performance in an industry that has seen growing volatility in recent times. The cash dividend is expected to bring benefits to existing shareholders, as well as new investors looking to enter the company’s stock portfolio.

In addition, the dividend also serves as an indication of the company’s commitment to rewarding shareholders for their ongoing support and faith in ITM’s success. The declaration of dividends is an important milestone for ITM, and one that the company takes very seriously. As a result, investors can be assured that ITM will continue to strive for strong financial performance in order to bring long-term value to its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ITMG. More…

| Total Revenues | Net Income | Net Margin |

| 3.64k | 1.2k | 35.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ITMG. More…

| Operations | Investing | Financing |

| 1.33k | -71.25 | -504.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ITMG. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.64k | 689.9 | 1.73 |

Key Ratios Snapshot

Some of the financial key ratios for ITMG are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.5% | 111.2% | 42.6% |

| FCF Margin | ROE | ROA |

| 35.2% | 49.6% | 36.6% |

Analysis

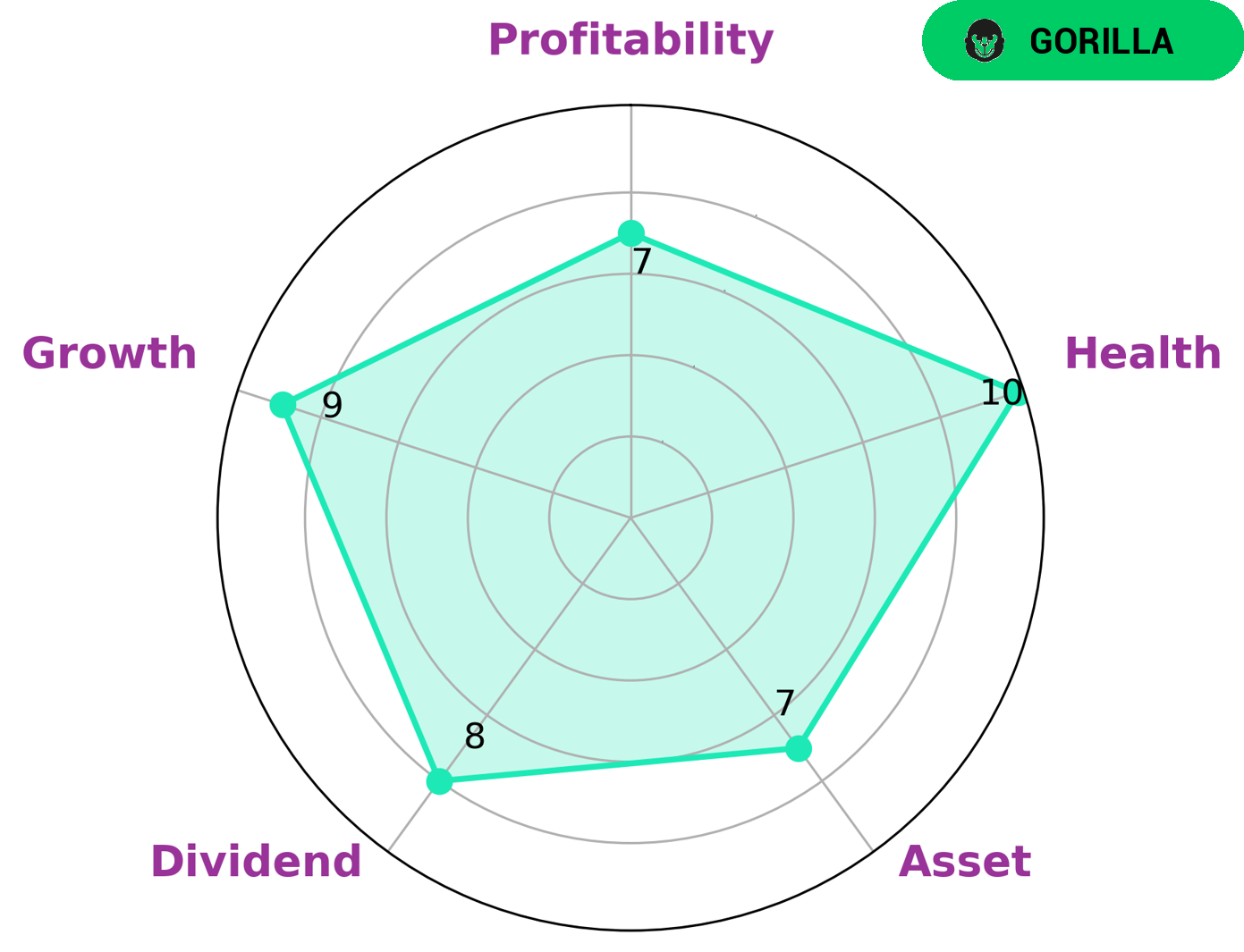

GoodWhale has conducted an analysis of the financials for PT INDO TAMBANGRAYA MEGAH TBK and based on our Star Chart, the company has a high health score of 10/10. This is indicative of its ability to sustain future operations in times of crisis, due to its strong cashflows and debt. In addition, we have classified PT INDO TAMBANGRAYA MEGAH TBK as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given this strength in asset, dividend, growth, and profitability, PT INDO TAMBANGRAYA MEGAH TBK is likely to be of interest to investors who are looking for strong and stable companies with lasting performance. Furthermore, given the company’s ability to remain healthy even in times of crisis, it is likely to be of particular interest to investors who are looking for companies that can withstand economic downturns. More…

Peers

The competition between PT Indo Tambangraya Megah Tbk and its competitors, including PT Harum Energy Tbk, PT Adaro Energy Indonesia Tbk, and Golden Energy and Resources Ltd, has been fierce in the Indonesian coal mining industry. With all four companies vying for the limited resources, each has been hard-pressed to develop strategies and tactics in order to gain a competitive edge.

– PT Harum Energy Tbk ($IDX:HRUM)

PT Harum Energy Tbk is a leading Indonesian-based coal mining company that operates in East and South Kalimantan. With a market cap of 21.11T as of 2023, PT Harum Energy is one of the largest publicly traded companies in Indonesia. The company’s strong return on equity (ROE) of 40.82% reflects its commitment to delivering value to shareholders. PT Harum’s sound financial performance is enabled by its diversified portfolio of coal mining operations, its efficient production processes, and its disciplined approach to capital allocation.

– PT Adaro Energy Indonesia Tbk ($IDX:ADRO)

Adaro Energy Indonesia Tbk is a leading Indonesian coal mining company and one of the largest coal producers in the world. The company has a market capitalization of 94.23T as of 2023, making it one of the most valuable firms in the region. Its Return on Equity (ROE) is also extremely impressive at 48.28%, which is among the highest in the energy sector. This ROE speaks to the firm’s ability to generate a high level of returns from its assets and investments. Adaro Energy’s strong financial position and robust cash flows enable it to continue development projects and carry out sustainable mining activities for long-term success.

– Golden Energy and Resources Ltd ($SGX:AUE)

Golden Energy and Resources Ltd is a leading integrated energy and mining company that operates in Indonesia. The company is involved in the production of coal and related energy activities, and also owns and operates several coal mines. As of 2023, the company has a market cap of 2.69B, and an impressive Return on Equity of 101.67%. This impressive ROE indicates that the company is able to generate profits from the investments it has made in its business, which has translated into higher returns for shareholders. The company is well-positioned to benefit from the growing demand for energy in Indonesia, making it an attractive investment prospect for long-term investors.

Summary

Investing in PT INDO TAMBANGRAYA MEGAH TBK (ITM) is a solid option given its consistent dividend yield of 19.65% over the past 3 years. This high yield indicates that ITM is a reliable and steady investment with a strong potential for returns. The company has demonstrated a commitment to its shareholders by consistently paying out dividends, and its financials are stable enough to support this dividend payout.

ITM also offers investors a diversified portfolio due to its presence in a range of industries. Investing in ITM can be a sound and profitable choice for investors looking to maximize returns.

Recent Posts