IIPR stock dividend – Don’t Let its Dividend Yields Fool You: Innovative Industrial Properties

May 23, 2023

Trending News 🌥️

Innovative Industrial Properties ($NYSE:IIPR) (IIP) is a real estate investment trust (REIT) that focuses on the emerging medical-use cannabis industry in the United States. It recently started trading on the New York Stock Exchange, and its stock has been steadily increasing in value.

However, investors should not let the high dividend yield fool them. IIP owns and leases properties to medical marijuana companies across the United States. The company’s portfolio is diversified across states with various laws and regulations around the cannabis industry. IIP also has a platform of capital to finance acquisitions and other investments. IIP’s stock is relatively expensive based on its price-to-earnings ratio, but it also has a dividend yield that is much higher than that of other REITs. This yield is possible because IIP’s portfolio of properties is unique and is expected to grow in value over time. Moreover, as more states legalize medical marijuana, IIP is likely to benefit from increased demand for its services. In conclusion, while IIP has an attractive dividend yield, investors should consider several other factors before investing in this stock. IIP’s portfolio of properties is unique and has potential for growth, and it is likely to benefit from increased demand in the medical marijuana industry. However, investors should do their research before making any investment decision.

Dividends – IIPR stock dividend

INNOVATIVE INDUSTRIAL PROPERTIES (IIP) is a real estate investment trust that specializes in the acquisition, ownership, and management of properties leased to state-licensed operators for medical-use and adult-use cannabis facilities. IIP has had a steady increase in its annual dividend per share over the last three years, with a pay at 7.15, 7.1, and 5.72 USD. This increase is reflected in the dividend yields of 7.08%, 5.63%, and 2.67% from 2021 to 2023, with an average dividend yield of 5.13%. If you are looking for stocks that can provide reliable dividend yields, INNOVATIVE INDUSTRIAL PROPERTIES should definitely be on your radar.

This company has proven its ability to consistently deliver on its dividend payouts, making it a great investment option for those who seek steady income from their investments. With a reliable track record of dividend payouts, IIP is an attractive option for dividend investors looking to diversify their portfolios.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for IIPR. More…

| Total Revenues | Net Income | Net Margin |

| 287.92 | 158.08 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for IIPR. More…

| Operations | Investing | Financing |

| 238.86 | -377.78 | 133 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for IIPR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.41k | 455.09 | 69.35 |

Key Ratios Snapshot

Some of the financial key ratios for IIPR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 58.9% |

| FCF Margin | ROE | ROA |

| – | – | – |

Share Price

Don’t let its dividend yields fool you; Innovative Industrial Properties (IIP) is a stock that should be on your radar. On Monday, IIP stock opened at $67.9 and closed at $69.6, up by 2.5% from its last closing price of $67.9. This growth is indicative of the company’s potential and its business model. IIP specializes in the acquisition, ownership, and management of specialized industrial properties leased to state-licensed operators for their regulated medical-use cannabis facilities. It is the first and only real estate company in the United States that focuses on such properties. As this sector continues to grow, IIP is poised to deliver strong returns to its shareholders.

In addition, IIP has developed a unique model to capitalize on this growth, with a focus on long-term leases that include fixed rent increases and tenant improvement allowances. This model provides the company with a steady stream of income and sets it apart from other real estate companies. Furthermore, IIP pays out quarterly dividends to its shareholders, making it an attractive investment opportunity. Overall, IIP is an innovative industrial property company that should not be overlooked. Its growth potential and unique business model make it an attractive option for investors looking to capitalize on the growing cannabis market. Live Quote…

Analysis

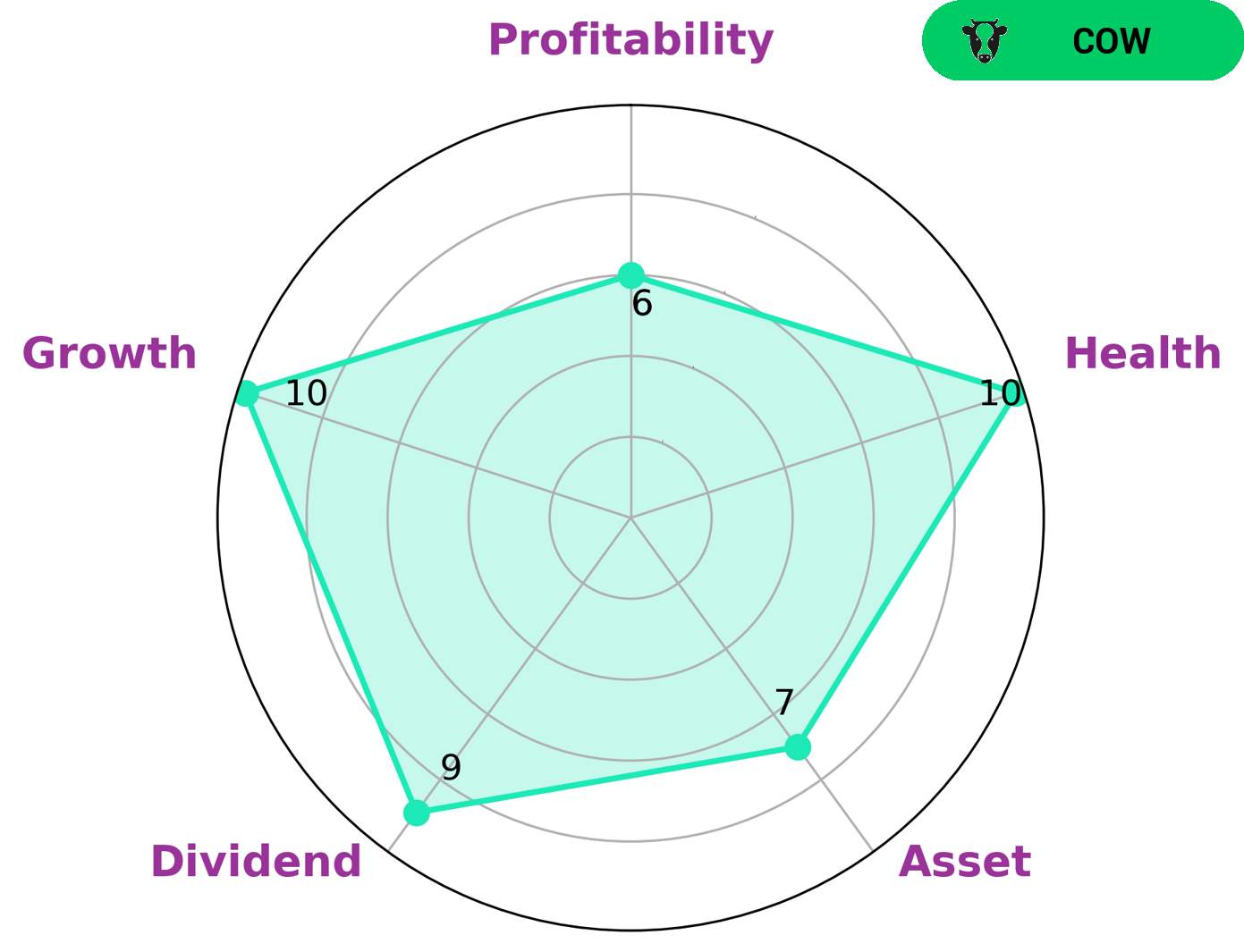

GoodWhale has conducted a deep dive analysis on the fundamentals of INNOVATIVE INDUSTRIAL PROPERTIES. Through our analysis, we have concluded that INNOVATIVE INDUSTRIAL PROPERTIES is classified as a “cow,” a type of company that has a track record of paying out consistent and sustainable dividends. This makes INNOVATIVE INDUSTRIAL PROPERTIES an attractive option for investors looking for reliable dividend income. INNOVATIVE INDUSTRIAL PROPERTIES is strong in asset, dividend, growth, and medium in profitability. Furthermore, our analysis shows that INNOVATIVE INDUSTRIAL PROPERTIES has a high health score of 10/10 considering its cashflows and debt, and is thus capable to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The company’s competitors include Realty Income Corp, Prologis Inc, and Crown Castle International Corp.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation is a real estate investment trust that focuses on the ownership of net-leased commercial properties in the United States. As of December 31, 2020, the Company owned 6,573 properties across 49 states and Puerto Rico. The Company’s leased properties are primarily leased to retail (70.3%), industrial (12.8%), healthcare (9.4%), and other commercial tenants (7.5%).

– Prologis Inc ($NYSE:PLD)

Prologis Inc is a leading global provider of logistics real estate with a focus on the industrial sector. As of 2022, the company has a market cap of 100.2 billion. Prologis owns and operates approximately 585 million square feet of industrial space in 19 countries. The company’s properties are located in key markets around the world, including North America, Europe, Asia and Latin America. Prologis’ focus on the industrial sector provides its customers with access to a wide range of logistics solutions, including warehouses, distribution centers, last-mile facilities and transshipment hubs.

– Crown Castle International Corp ($NYSE:CCI)

Crown Castle International Corp is a holding company that provides wireless infrastructure services in the United States. Its primary business is owning, operating, and leasing wireless communications towers and small cell nodes. As of 2021, the company had approximately 40,000 wireless communications towers and approximately 60,000 small cell nodes across the United States. The company was founded in 1994 and is headquartered in Canonsburg, Pennsylvania.

Summary

However, investors should be aware that high dividend yields can be a sign of potential risks and should not be the sole factor when considering this stock. A thorough analysis should be conducted to ensure that INN offers a favorable risk/reward ratio. This should include research on the company’s financials, management team, and competitive landscape. The company also has recently formed a joint venture with New York REIT that could potentially become a long-term source of growth.

Ultimately, it is important to remember that dividend yields are just one part of an investment decision. Doing research and understanding the company fundamentals are key when assessing whether INN is a good fit for an investor’s portfolio.

Recent Posts