HVT dividend yield calculator – Haverty Furniture Companies Declares 0.3 Cash Dividend

June 12, 2023

🌥️Dividends Yield

Haverty Furniture Companies ($NYSE:HVT) Inc. has just announced a 0.3 cash dividend on June 8 2023. This dividend payment marks the fourth consecutive year that the company has issued an annual dividend per share of 1.12, 1.09, and 0.97 USD over the last 3 years, providing investors with dividend yields of 3.58%, 3.83%, and 2.84%, on average, for a yield of 3.42%. This is an attractive dividend offering, and is sure to draw attention from potential investors. The ex-dividend date for this offering is June 5 2023, so those looking to take advantage of this dividend should consider investing before this date.

This dividend could be especially attractive for those looking to diversify their portfolio with dividend stocks, as HAVERTY FURNITURE COMPANIES offers a relatively stable and reliable dividend yields over the years. This could be an attractive investment opportunity for those looking to diversify their portfolio and add long term income streams to their investments.

Price History

Following the announcement, the company’s share price opened at $29.2 and closed at $28.6, representing a 2.2% decrease from the previous closing price of $29.3. The company has been emphasizing dividend payments as a way of rewarding its shareholders for their continued support and loyalty. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HVT. More…

| Total Revenues | Net Income | Net Margin |

| 1.03k | 82.37 | 8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HVT. More…

| Operations | Investing | Financing |

| 41.51 | -27.86 | -55.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HVT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 648.41 | 352 | 17.79 |

Key Ratios Snapshot

Some of the financial key ratios for HVT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.1% | 62.6% | 10.3% |

| FCF Margin | ROE | ROA |

| 1.3% | 23.0% | 10.3% |

Analysis

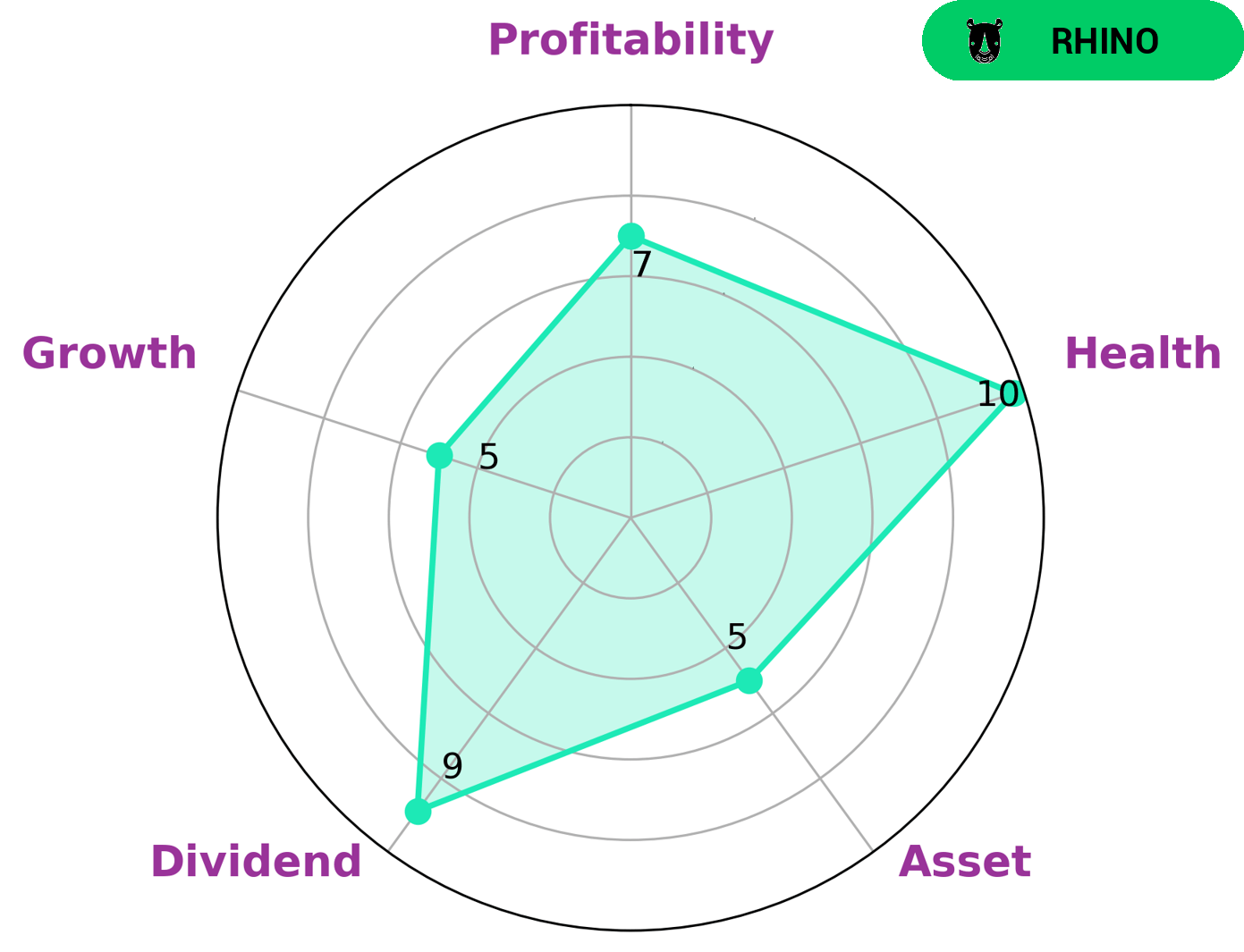

At GoodWhale, we have conducted an analysis of HAVERTY FURNITURE COMPANIES’s wellbeing. Based on our Star Chart, we have classified HAVERTY FURNITURE COMPANIES as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. This type of company is likely to be attractive to investors who are seeking moderate returns over a long-term investment period. In terms of financial health, HAVERTY FURNITURE COMPANIES has a high score of 10/10, indicating that it has a strong cashflow and is capable of sustaining operations during times of crisis. With regards to its financial performance, HAVERTY FURNITURE COMPANIES is performing strongly in terms of dividend payments and profitability, and moderately in terms of asset growth. This suggests that there is potential for investors to generate moderate returns from investing in the company. More…

Peers

The furniture market is highly competitive, with many companies vying for market share. Among these is Haverty Furniture Companies Inc, which competes with the likes of Maisons du Monde France SA, Temple & Webster Group Ltd, Arhaus Inc, and others. In order to succeed, Haverty Furniture must offer a unique and appealing product that resonates with consumers.

– Maisons du Monde France SA ($OTCPK:MDOUF)

With a market cap of 423.92M as of 2022, Maisons du Monde France SA is a large company with a ROE of 9.35%. The company specializes in selling furniture and home decor items.

– Temple & Webster Group Ltd ($ASX:TPW)

Temple & Webster Group Ltd is an online home furnishings and decor retailer based in Australia. As of 2022, the company had a market capitalization of 677 million Australian dollars and a return on equity of 8.34%. The company sells a range of home furnishings and decor products through its website, including furniture, homewares, and lighting. It also offers a home styling service, which provides customers with advice on how to style their homes.

– Arhaus Inc ($NASDAQ:ARHS)

Arhaus Inc. is a publicly traded company with a market capitalization of $1.17 billion as of 2022. The company’s return on equity, a measure of profitability, was 50.99% as of the same year. Arhaus is a retailer of home furnishing products, specializing in sofas, chairs, and other upholstered items. The company operates a chain of retail stores in the United States and also offers its products online.

Summary

Investing in Haverty Furniture Companies is a good decision for investors who are looking for consistent dividend yields. Over the last three years, the company has paid out an average yield of 3.42%. Specifically, the dividends paid out were 1.12, 1.09 and 0.97 USD per share, which provided yields of 3.58%, 3.83%, and 2.84%, respectively. This reliable and steady income stream makes Haverty Furniture Companies an attractive investment for those seeking steady returns.

Recent Posts