HPT dividend calculator – Home Pottery PCL Declares 0.0212 Cash Dividend

June 2, 2023

🌥️Dividends Yield

Home Pottery PCL recently announced their latest cash dividend of 0.0212 THB per share on May 25 2023. For investors looking for stocks with high dividend yields, Home Pottery Public ($SET:HPT) could be an option. The company has paid out an annual dividend per share of 0.04, 0.04, and 0.01 THB in 2021, 2022, and 2023 respectively, resulting in dividends yields of 4.58%, 4.58%, and 0.85% for each respective year. This yields an average dividend yield of 3.34%.

To receive the upcoming dividend, the ex-dividend date for this year is May 9 2023. With thier consistent dividend payouts and high dividend yields, Home Potter Public could be an attractive option for those looking to invest in a dividend stock.

Market Price

The stock opened at THB0.7 and closed at the same price, down by 2.8% from the previous closing price of THB0.7. Home Pottery Public remains committed to providing long-term value for all its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HPT. More…

| Total Revenues | Net Income | Net Margin |

| 300.18 | 31.12 | 10.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HPT. More…

| Operations | Investing | Financing |

| 44.13 | -14.46 | -24.21 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HPT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 374.06 | 49.21 | 0.48 |

Key Ratios Snapshot

Some of the financial key ratios for HPT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.0% | 39.8% | 12.6% |

| FCF Margin | ROE | ROA |

| 0.9% | 7.4% | 6.3% |

Analysis

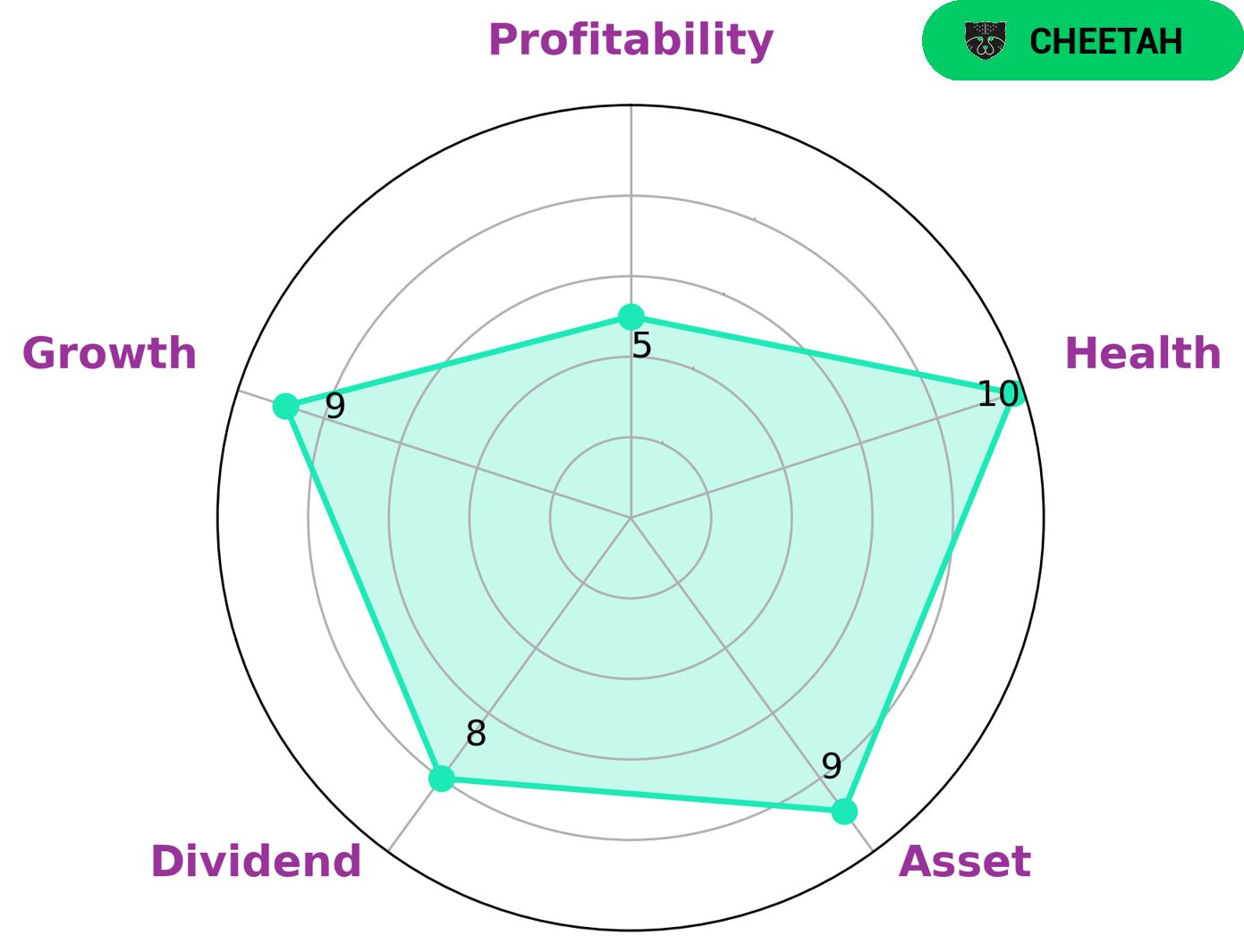

At GoodWhale, we conducted an analysis of HOME POTTERY PUBLIC’s wellbeing. According to our Star Chart, HOME POTTERY PUBLIC is strong in asset, dividend, and growth, while medium in profitability. HOME POTTERY PUBLIC has a high health score of 10/10 with regard to its cashflows and debt, which means that it is capable to safely ride out any crisis without the risk of bankruptcy. Furthermore, we classified HOME POTTERY PUBLIC as a ‘cheetah’, a type of company we conclude that achieved high revenue or earnings growth but is considered less stable due to lower profitability. We believe that investors who have a higher risk appetite and an inclination towards growth stocks may be interested in such a company. These investors would likely be attracted to the high revenue or earnings growth that HOME POTTERY PUBLIC presents, despite the risks that comes with it. More…

Peers

It is one of the leading players in the field, alongside Royal Orchid Hotel (Thailand) PCL, Minor International PCL, and Brjast D AD. Home Pottery PCL seeks to provide high quality service and to create memorable experiences for its customers.

– Royal Orchid Hotel (Thailand) PCL ($SET:ROH)

Royal Orchid Hotel (Thailand) PCL is one of the leading hospitality companies in Thailand. The company is listed on the Stock Exchange of Thailand (SET) and has a market cap of 3.02 billion as of 2023. Furthermore, the company has a Return on Equity (ROE) of 6.48%, indicating a sound financial performance. The company operates a number of hotels, resorts and spas in Thailand and other countries, offering customers a wide range of services and amenities. The company also provides event management services to its customers. In addition, Royal Orchid Hotel (Thailand) PCL has a strategic alliance with some of the largest hospitality groups around the world, allowing them to offer even more to their customers.

– Minor International PCL ($SET:MINT)

Minor International PCL is a Bangkok, Thailand-based international hotel, restaurant, and lifestyle brand company. It owns and operates hotels, resorts, spas, restaurants, lifestyle retail stores, and other service-oriented businesses across the globe. The company has a market capitalisation of 185.97 billion US dollars as of 2023, which makes it one of the largest companies in Thailand. Additionally, its return on equity (ROE) stands at 16.22%, which is an indication of strong profitability and financial stability. Minor International PCL has been able to generate significant returns on its equity investments over the years, which has enabled it to expand its portfolio and increase its market capitalisation.

Summary

Home Pottery Public is a great investment option for those looking for stocks with high dividend yields. Over the past three years, its annual dividend per share has been 0.04, 0.04, and 0.01 THB, resulting in a 2021-2023 average yield of 3.34%. The company has consistently paid out dividends with excellent returns, making it an attractive option for investors seeking regular income.

As the company is listed on the stock exchange, the share price can vary, meaning there is potential to generate further returns on investment. Investors should take into consideration the company’s risk profile and research thoroughly before investing in Home Pottery Public.

Recent Posts