Hooker Furnishings dividend calculator – Hooker Furnishings Corp Declares 0.22 Cash Dividend

March 20, 2023

Dividends Yield

On March 7th, 2023, Hooker Furnishings ($NASDAQ:HOFT) Corp declared a 0.22 cash dividend to shareholders. For those investors who are looking for dividend stocks, Hooker Furnishings could be a great choice. The company has been distributing dividends per share of 0.8 USD, 0.74 USD, and 0.66 USD for the past three years. This results in a dividend yield of 3.51%, 3.51%, and 2.3% for the years 2021-2023, which averages out to a yield of 3.11%.

The ex-dividend date for the year 2023 is set to be March 16th. As such, investors should act fast to take advantage of this lucrative opportunity.

Share Price

The stock opened at $20.1 and closed at $20.6, representing an increase of 1.2% from the previous day’s closing price of $20.3. This dividend declaration comes as a sign of the company’s commitment to rewarding its shareholders with a substantial return on their investments. This cash dividend is an indication that HOOKER FURNISHINGS is in a strong financial situation and is ready to deliver sustained returns in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hooker Furnishings. More…

| Total Revenues | Net Income | Net Margin |

| 586.61 | 9.39 | 1.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hooker Furnishings. More…

| Operations | Investing | Financing |

| -26.91 | -29.55 | 5.75 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hooker Furnishings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 400.25 | 140.66 | 22.73 |

Key Ratios Snapshot

Some of the financial key ratios for Hooker Furnishings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.2% | -27.9% | 2.2% |

| FCF Margin | ROE | ROA |

| -5.2% | 3.1% | 2.0% |

Analysis

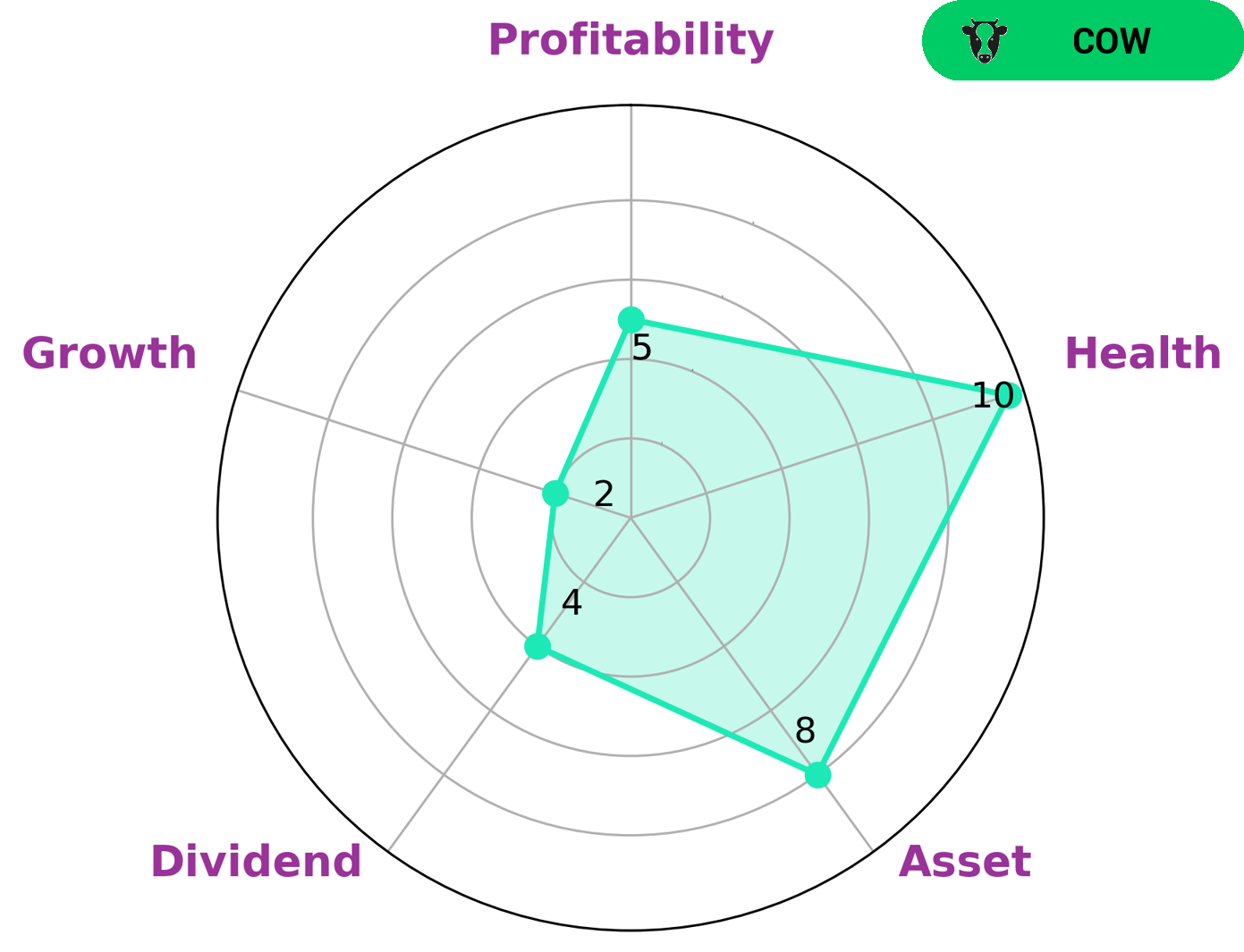

After analyzing the fundamentals of HOOKER FURNISHINGS with GoodWhale, we have determined that the company has a strong financial health score of 10/10. This suggests that the company has the ability to sustain future operations in difficult times. In terms of its financial performance, HOOKER FURNISHINGS is strong in assets, medium in dividend, profitability and weak in growth. Based on our assessment of the company’s performance, we have classified it as a ‘cow’, a type of company with a track record of paying out consistent and sustainable dividends. Investors who are looking for steady and reliable income streams may find this company an attractive option. Furthermore, as the company has a strong financial health score, investors can also expect their investments to be secure. More…

Peers

Hooker Furnishings Corp has been a leader in the home furnishings industry for over 75 years, offering a wide range of quality and stylish products to customers all over the world. Along with Hooker Furnishings Corp, other major players in the market include Savimex Corp, A-Zenith Home Furnishings Co Ltd and Shashwat Furnishing Solutions Ltd, all of whom offer competitive products and services in the home furnishings sector.

– Savimex Corp ($HOSE:SAV)

A-Zenith Home Furnishings Co Ltd is a furniture retailer and manufacturing company that specializes in custom-made furniture pieces for the home. As of 2022, the company has a market capitalization of 1.38 billion dollars, which is an indication of its relative size in the furniture industry. The company also has a Return on Equity (ROE) of -11.08%, which suggests that it is not making the most efficient use of its capital. This could be due to a number of factors such as operational inefficiencies, over-investment in certain areas, or poor management decisions. While the company may not currently be performing at its peak, its market cap indicates that it is still a large player in the industry.

– A-Zenith Home Furnishings Co Ltd ($SHSE:603389)

Shashwat Furnishing Solutions Ltd is a leading player in the home furnishing solutions industry. It has a market cap of 80.39M as of 2022, making it one of the largest companies in the sector. The company specializes in providing a wide range of home furnishing solutions, such as curtains, blinds, upholstery, and customized furniture. It also offers interior design services and installation of home furnishing products. It operates through a network of more than 1,000 distributors and dealers across India. The company has also diversified its services to include online sales, branding, and marketing services.

Summary

Hooker Furnishings is a viable investment option for those looking for a dividend stock. Over the past three years, the company has issued yearly dividends per share of 0.8, 0.74, and 0.66 USD respectively. As of 2021 to 2023, the dividend yields stand at 3.51%, 3.51%, and 2.3%, resulting in an average dividend yield of 3.11%.

For investors looking to create a reliable and consistent income stream, Hooker Furnishings offers a stable dividend yield with the potential for growth. As such, it may be a wise choice for investors seeking a reliable dividend stock.

Recent Posts