HLF dividend yield – High Liner Foods Declares 0.13 Cash Dividend

June 11, 2023

🌥️Dividends Yield

High Liner Foods ($TSX:HLF) Inc. recently declared a cash dividend of 0.13 USD per share on May 26 2023. This follows on from its tradition of consistently paying out dividends to its shareholders since 2021, when it declared an annual dividend of 0.35 USD per share, followed by 0.33 and 0.25 in 2022 and 2023 respectively. The dividend yields of 2021 to 2023 stood at 3.46%, 3.37% and 2.38% respectively, averaging out to a yield of 3.07%.

This is a great news for investors who are looking for dividend stocks, as it offers a great opportunity for them to add HIGH LINER FOODS to their list of considerations. The ex-dividend date has been set at May 31 2023, and investors should ensure that their purchases are made prior to the ex-dividend date for them to be eligible for the cash dividend payout.

Market Price

The stock of High Liner Foods opened at CA$14.8 on Friday and closed at CA$14.5, representing a 0.1% increase from the previous closing price of CA$14.5. The company has had a long history of consistently rewarding its shareholders with dividends. The announcement of the dividend payment is a clear indication of the confidence that the company has in its financial position and operations. This is good news for current shareholders as well as potential investors who are looking for a steady return from an established and growing company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HLF. More…

| Total Revenues | Net Income | Net Margin |

| 1.1k | 53.97 | 4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HLF. More…

| Operations | Investing | Financing |

| -43.5 | -21.57 | 69.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HLF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 955.28 | 572.61 | 11.47 |

Key Ratios Snapshot

Some of the financial key ratios for HLF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.8% | 11.6% | 7.4% |

| FCF Margin | ROE | ROA |

| -5.9% | 13.6% | 5.4% |

Analysis

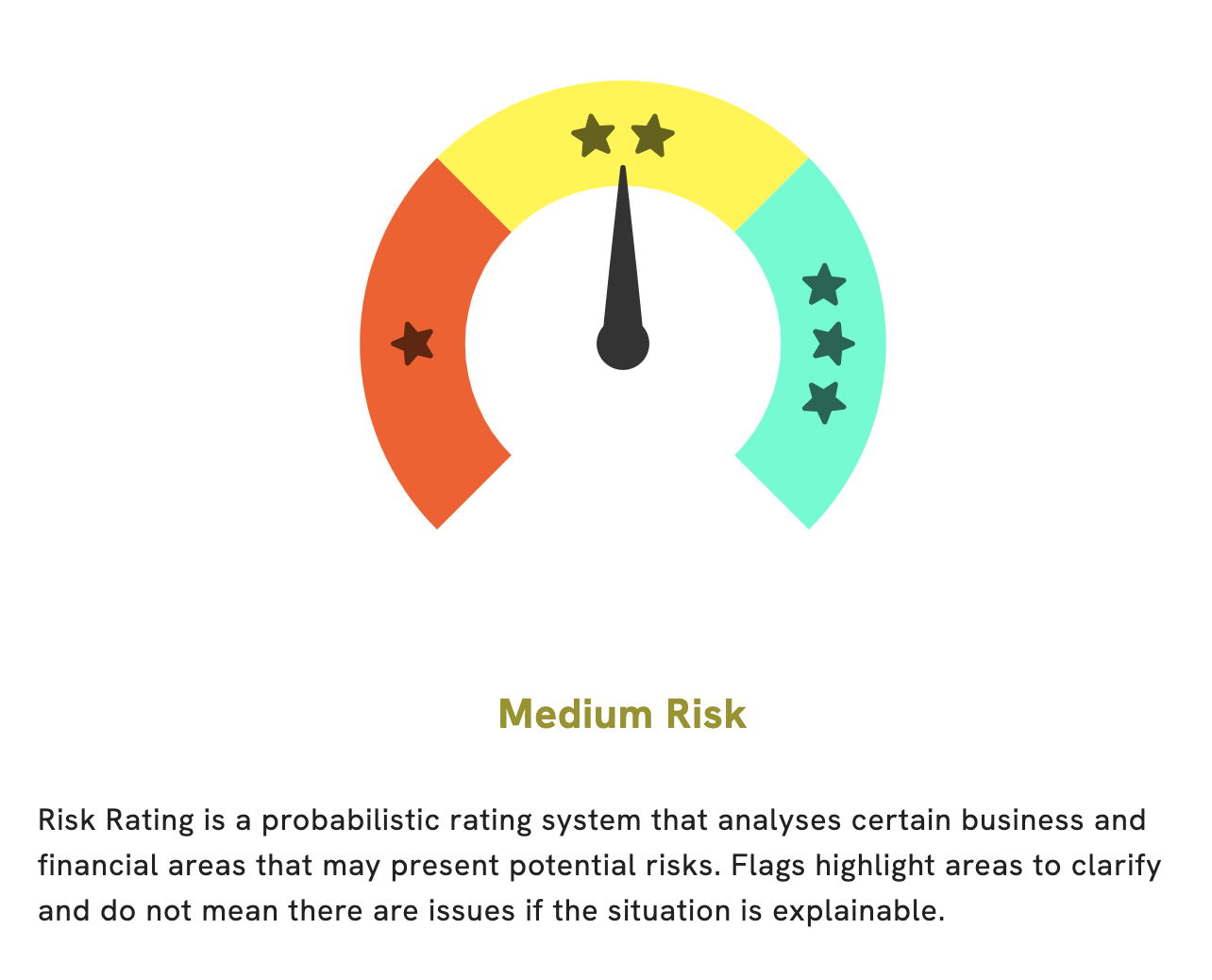

At GoodWhale, we believe in making smart investments. That’s why we have done an extensive financial analysis of HIGH LINER FOODS, so you can make an informed decision about investing in the company. According to our Risk Rating, HIGH LINER FOODS is a medium risk investment, in terms of financial and business aspects. We’ve also detected two risk warnings in the income sheet and balance sheet – become a registered user to check them out and learn more about what they mean for your potential investment. With the help of GoodWhale, you can make sure you’re making smart investments and maximizing your returns. More…

Peers

The company operates in the United States and Canada. High Liner Foods is the largest seafood processor in North America, with products sold under the High Liner, Fisher Boy, Sea Cuisine, and C. Wirthy & Co. brands in the United States, and High Liner, Fisher Boy, Sea Cuisine, Greenseas, Maitre Pierre, Ocean Cuisine, Springs River, and Voltigeur brands in Canada. The company was founded in 1899. High Liner Foods’ competitors include The Simply Good Foods Co, Mowi ASA, Millennium Global Holdings Inc.

– The Simply Good Foods Co ($NASDAQ:SMPL)

The Simply Good Foods Co is a food company that focuses on providing healthy food options. The company has a market cap of 3.71B as of 2022 and a Return on Equity of 7.5%. The company’s focus on healthy food options has made it a popular choice among consumers looking for healthier alternatives. The company’s products are available in a variety of retail outlets, including grocery stores, health food stores, and online retailers.

– Mowi ASA ($OTCPK:MHGVY)

Mowi ASA is a Norwegian seafood company that is involved in the farming, processing, and selling of salmon and other fish products. The company has a market capitalization of 7.84 billion as of 2022 and a return on equity of 17.38%. Mowi ASA is the world’s largest salmon farming company and is headquartered in Bergen, Norway. The company has operations in Ireland, Scotland, the Faroe Islands, Chile, and Canada.

– Millennium Global Holdings Inc ($PSE:MG)

Millennium Global Holdings Inc is a holding company that owns and operates businesses in the financial services industry. The company has a market cap of 251.19M and a ROE of 2.81%. The company provides financial services including asset management, capital markets, and advisory services. The company operates in the United States, Europe, Asia, and the Middle East.

Summary

Investing in HIGH LINER FOODS could be a promising venture for investors due to its dividend history. Over the last three years, the company has paid an average dividend of 0.35 USD per share, yielding 3.07% annually. These dividends have been consistent, with 0.35 USD in 2021, 0.33 USD in 2022 and 0.25 USD in 2023, resulting in dividend yields of 3.46%, 3.37% and 2.38% respectively. The company’s strong track record of paying consistent dividends make it an attractive investment prospect.

Recent Posts