HLD dividend calculator – Henderson Land Development Co Ltd Announces 1.3 Cash Dividend

June 2, 2023

🌥️Dividends Yield

Henderson Land Development ($BER:HLD) Co Ltd announced on June 1 2023 that it would be distributing a Cash Dividend of 1.3 HKD. This dividend is unchanged from previous years, with the company having issued the same annual dividend per share of 1.8 HKD for the past 3 years. The total average dividend yield for the stock currently stands at 49.18%, making it an attractive option for investors looking to receive regular dividends from their investments. The ex-dividend date is set for June 7 2023, allowing investors to purchase the stock and receive the dividend if held prior to the ex-dividend date.

HENDERSON LAND DEVELOPMENT has been providing consistent dividends for investors for the past 3 years, and its high dividend yield makes it a solid consideration for those looking to invest in stocks that provide a steady income. With the upcoming ex-dividend date, now is an ideal time to invest in the company and gain access to the substantial dividend.

Share Price

The stock opened and closed at €2.8, down by 3.4% from the previous closing price of €2.9. This dividend has been declared as a return to shareholders, as well as a sign of the company’s financial strength and stability. The company has been committed to delivering profitable returns to their shareholders, and the 1.3 cash dividend is evidence of this commitment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HLD. More…

| Total Revenues | Net Income | Net Margin |

| 25.55k | 9.24k | 36.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HLD. More…

| Operations | Investing | Financing |

| 11.13k | 12.15k | -21.3k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HLD. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 529.79k | 184.64k | 67.74 |

Key Ratios Snapshot

Some of the financial key ratios for HLD are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.8% | -10.9% | 46.5% |

| FCF Margin | ROE | ROA |

| 43.6% | 2.3% | 1.4% |

Analysis

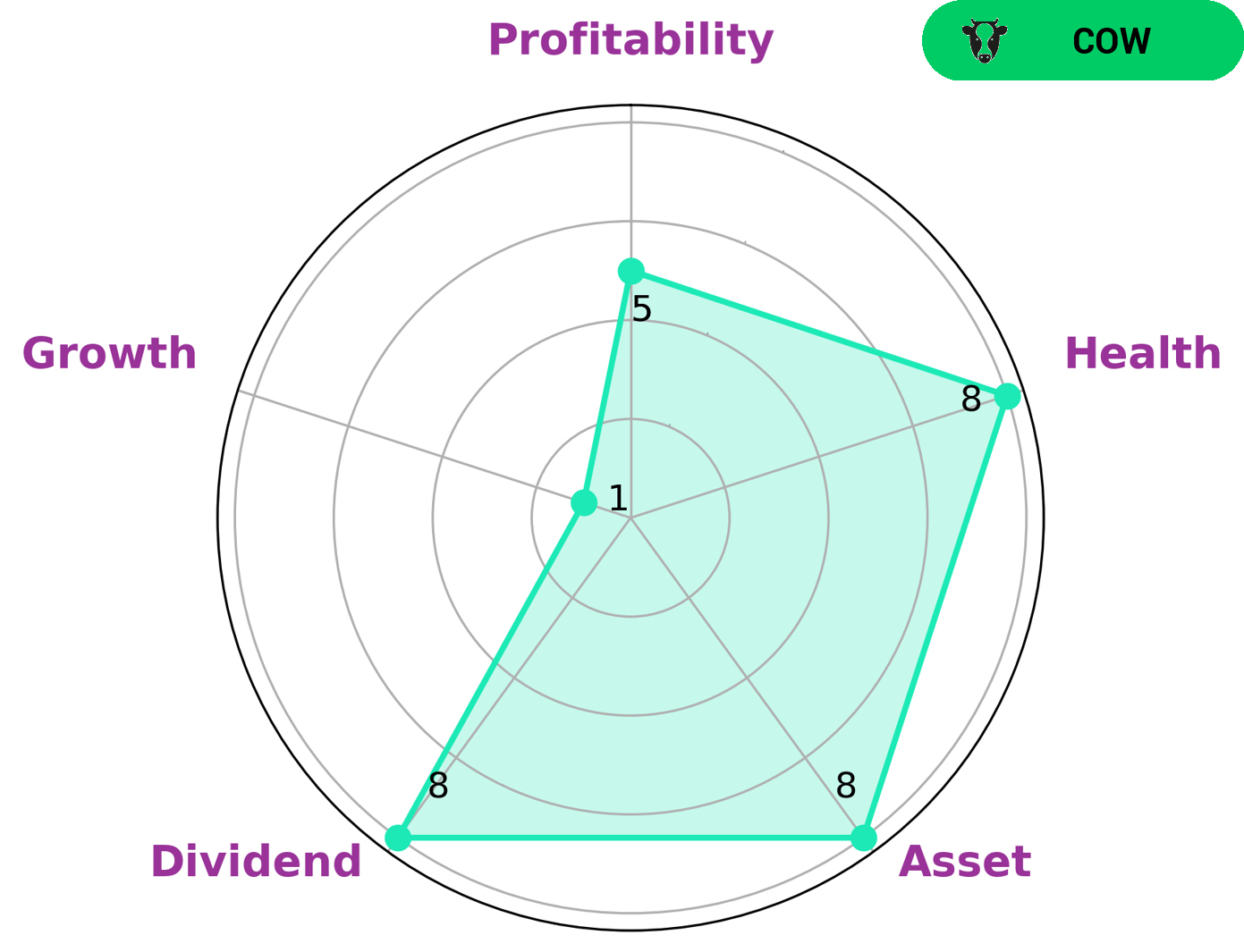

At GoodWhale, we analyzed the fundamentals of HENDERSON LAND DEVELOPMENT, and using our Star Chart, we found that it is strong in asset and dividend, and medium in profitability and weak in growth. We also gave it a health score of 8/10, as its cashflows and debt seem to suggest that it is capable of repaying debt and funding future operations. Based on this analysis, we classified HENDERSON LAND DEVELOPMENT as a “cow”, meaning that it has a track record of paying out consistent and sustainable dividends. As such, investors who value dividend yields and consistent returns may find HENDERSON LAND DEVELOPMENT to be an attractive option for their portfolio. More…

Summary

HENDERSON LAND DEVELOPMENT is an ideal candidate for dividend-paying investors. For the past three years, the company has issued the same annual dividend per share of 1.8 HKD, resulting in a total average dividend yield of 49.18%. This is significantly higher than the average for the Hang Seng Index, providing investors with a higher rate of return on their investments.

Furthermore, the consistency of the dividend payments and the fact that they have been maintained over a three year period suggest a degree of stability in the company’s financial performance. As such, investing in HENDERSON LAND DEVELOPMENT may provide investors with higher returns than other stocks within their portfolio.

Recent Posts