HILS dividend yield – Hill and Smith PLC Announces 0.22 Cash Dividend

June 3, 2023

🌥️Dividends Yield

This is the same annual dividend per share that the company has paid for the past three years, offering a yield of 2.42% for the period from 2022 to 2024. This news might be of particular interest to investors seeking dividend-paying stocks, as HILL & SMITH ($LSE:HILS) could be a good option with an ex-dividend date of June 1 2023. With this dividend, Hill and Smith PLC demonstrates their commitment to providing their shareholders with an attractive return on their investment.

Market Price

This announcement led to the stock price of HILL & SMITH opening at £14.7 and closing at £14.9, up by 1.5% from its previous closing price of £14.7. This is a signal to investors that the company is performing well and is confident in its future, which has helped to increase the share price. Investors will now be looking forward to receiving their dividend payments and hoping that the stock will continue to perform well in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HILS. More…

| Total Revenues | Net Income | Net Margin |

| 732.1 | 56.7 | 9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HILS. More…

| Operations | Investing | Financing |

| 49.6 | 14 | -58.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HILS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 694.3 | 299.3 | 4.93 |

Key Ratios Snapshot

Some of the financial key ratios for HILS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.8% | 12.0% | 10.5% |

| FCF Margin | ROE | ROA |

| 3.9% | 12.3% | 6.9% |

Analysis

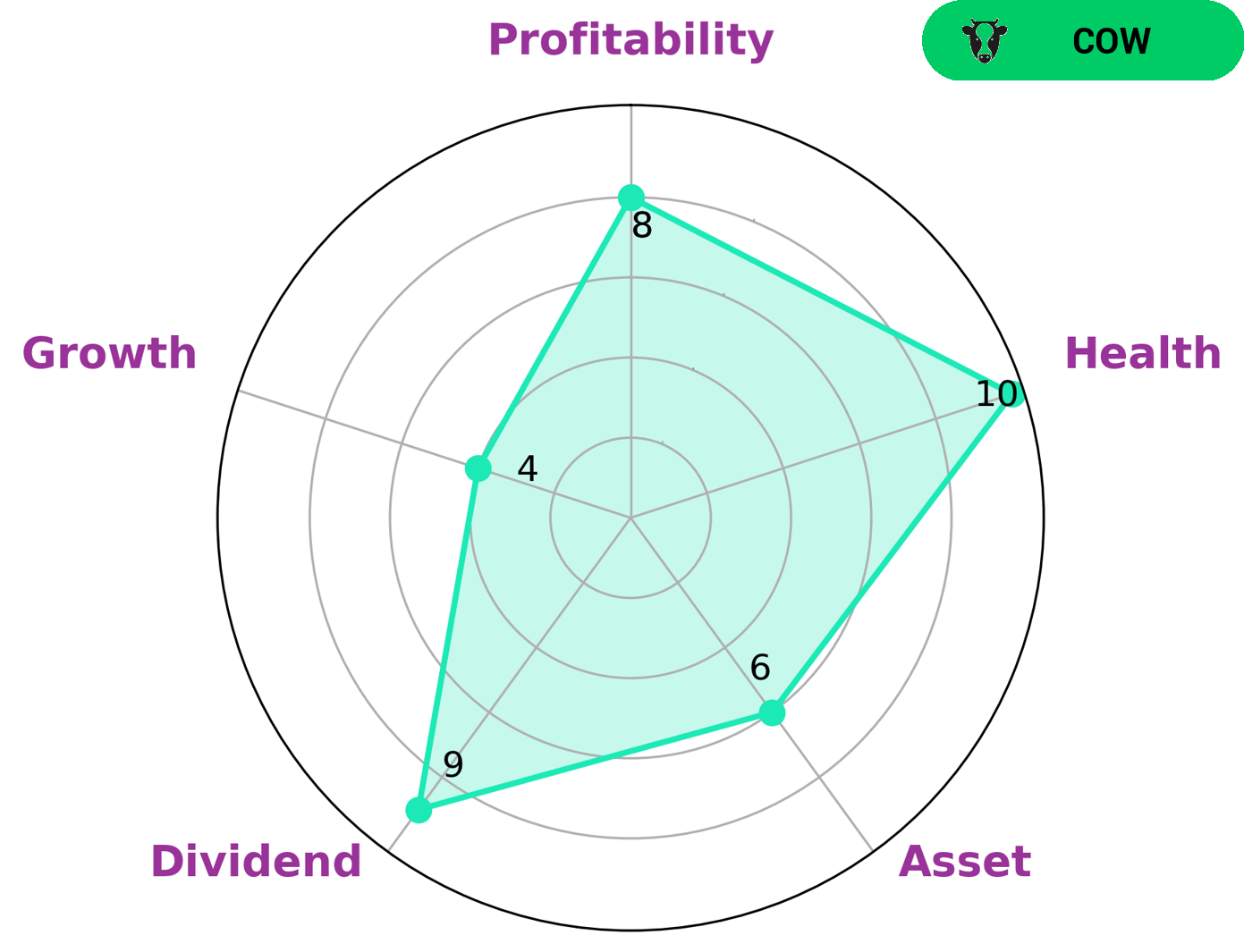

GoodWhale has conducted an extensive analysis of HILL & SMITH’s financials and classified the company as a “cow”, a type of company that has a track record of paying out consistent and sustainable dividends. We believe that this type of company would be of particular interest to investors looking for dividend-producing investments. In terms of financials, HILL & SMITH is strong in dividend payments and profitability, and medium in asset growth. Moreover, HILL & SMITH passed our health test with a score of 10/10, which indicates that the company is able to pay off its debt and fund future operations. This makes HILL & SMITH a sound investment choice for dividend seekers. More…

Peers

The company competes with other leading infrastructure companies such as MBL Infrastructures Ltd, IL&FS Engineering and Construction Co Ltd, J Kumar Infraprojects Ltd.

– MBL Infrastructures Ltd ($BSE:533152)

MBL Infrastructures Ltd is an Indian infrastructure development company. The company’s core businesses are in the areas of roads, bridges, flyovers, airports, power transmission and distribution, water and sewerage pipelines. As of March 31, 2019, the company had a market capitalization of Rs 2,14,000 million and a return on equity of -2.02%.

– IL&FS Engineering and Construction Co Ltd ($BSE:532907)

IL&FS Engineering and Construction Co Ltd is an engineering, procurement and construction company that provides services to the infrastructure sector in India. The company has a market cap of 2.02B as of 2022 and a ROE of 7.54%. The company’s main businesses include transportation, power, water and wastewater treatment, and oil and gas. The company has a strong presence in India with a large project portfolio and a strong execution track record.

– J Kumar Infraprojects Ltd ($BSE:532940)

The company has a market cap of 20.79B as of 2022 and a Return on Equity of 11.41%. The company is engaged in the business of infrastructure development and construction. The company has a strong presence in the road, highway, bridges, flyovers, buildings, power plants, dams, canals and irrigation projects. The company has a strong track record of execution and has completed many prestigious projects. The company has a strong order book and is well positioned to benefit from the growing infrastructure development in the country.

Summary

Investors considering HILL & SMITH should be aware that the company has paid a steady annual dividend of 0.32 GBP per share over the past three years, yielding an average of 2.42% annually. Looking ahead, investors should research the company’s financials to gain an understanding of future growth prospects and dividend payments. Long term investors may benefit from HILL & SMITH’s history of stable returns and reliable dividends. Short-term investors should focus on the company’s quarterly reports and stock price performance to remain informed of any changes in HILL & SMITH’s financial health.

Recent Posts