Heartland Group dividend calculator – Heartland Group Holdings Ltd Declares 0.055 Cash Dividend

March 19, 2023

Dividends Yield

On March 2 2023, Heartland Group ($NZSE:HGH) Holdings Ltd declared a 0.055 cash dividend. This marks the third year in a row wherein HEARTLAND GROUP has been issuing annual dividends per share; the last 3 years’ dividends amount to 0.11, 0.12, and 0.06 NZD respectively, with corresponding dividend yields of 4.98%, 5.63%, and 4.21%. Collectively, this gives an average dividend yield of 4.94%. Thus, if you are looking to invest in dividend stocks, you may want to consider adding HEARTLAND GROUP to your list of options with an ex-dividend date of March 7 2023.

Stock Price

HEARTLAND GROUP stock opened at NZ$1.8 and closed at NZ$1.8, down by 0.6% from the prior closing price of NZ$1.8. For shareholders, this dividend announcement is a positive sign of growth and potential future returns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Heartland Group. More…

| Total Revenues | Net Income | Net Margin |

| – | 96.27 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Heartland Group. More…

| Operations | Investing | Financing |

| 142.16 | -154.27 | 189.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Heartland Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.44k | 6.42k | – |

Key Ratios Snapshot

Some of the financial key ratios for Heartland Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.5% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

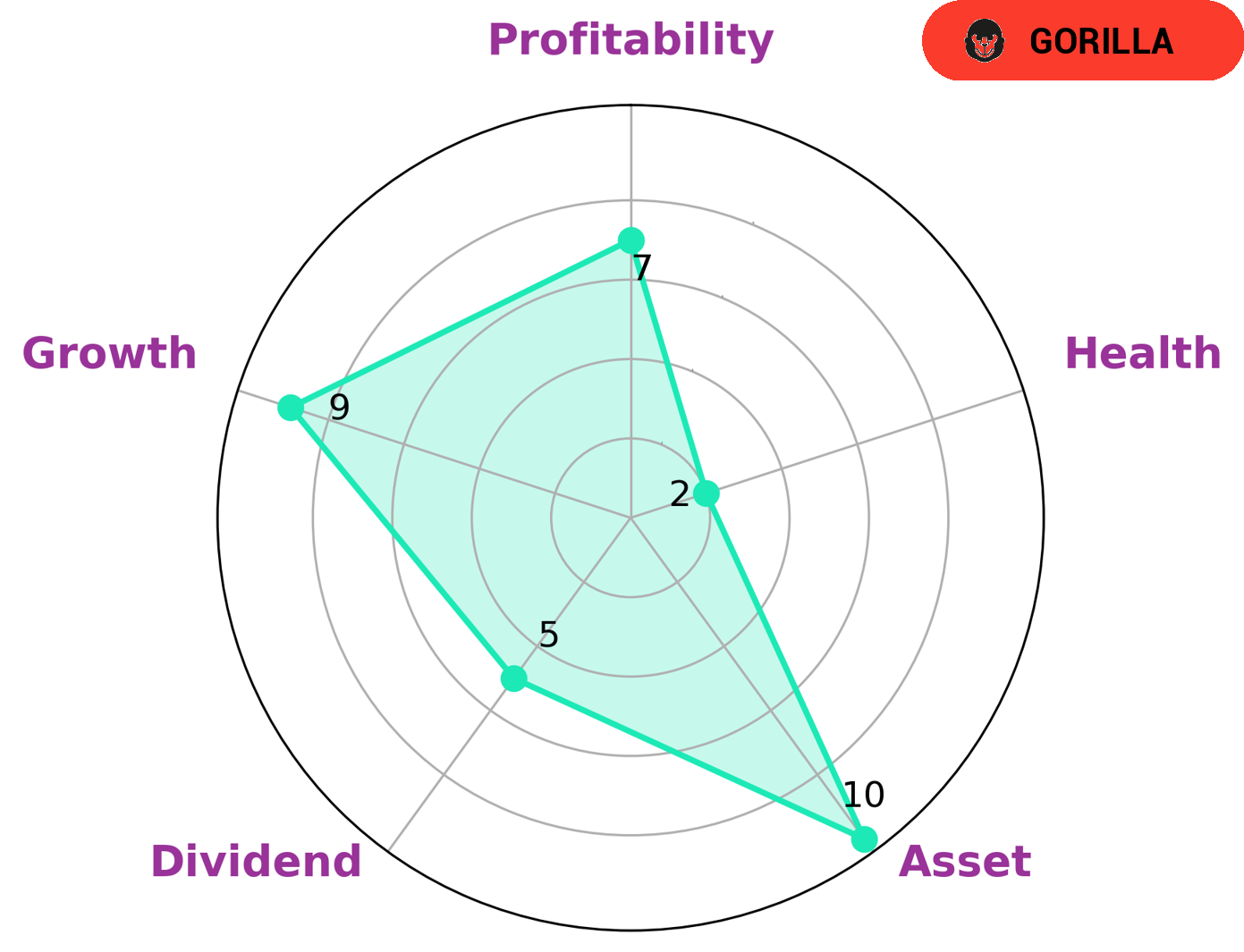

At GoodWhale, we have conducted an analysis of HEARTLAND GROUP‘s financials and the results show that the company has a low health score of 2/10 with regard to its cashflows and debt. This indicates that HEARTLAND GROUP is less likely to safely ride out any crisis without the risk of bankruptcy. On a more positive note, the company is strong in growth, profitability, and asset, and of medium strength in dividend. Furthermore, our analysis has classified HEARTLAND GROUP as a ‘gorilla’, a type of company that we conclude has achieved stable and high revenue or earning growth due to its strong competitive advantage. This means that HEARTLAND GROUP could be an attractive investment opportunity for investors looking for a long-term return on their investment. More…

Peers

The company offers a wide range of products and services to its customers, including savings and loan products, credit cards, home loans, and investment products. Heartland Group Holdings Ltd has a strong presence in the Australian market, with a network of branches and ATMs across the country. The company competes with other leading banks and financial institutions in Australia, such as Sidney Federal Savings & Loan Association, Magyar Bancorp Inc, and Can Fin Homes Ltd.

– Sidney Federal Savings & Loan Association ($OTCPK:SFSA)

Magyar Bancorp Inc is a bank holding company. The Company’s principal activity is to serve as the holding company for Magyar Bank (the Bank). The Bank is a New Jersey-chartered commercial bank. The Bank offers a range of deposit and loan products to individuals and businesses in its primary market area, which includes Middlesex, Union and Somerset counties, New Jersey. It provides a range of services, including demand deposit accounts, savings accounts, money market deposit accounts, certificates of deposit, commercial and consumer loans, home equity loans and lines of credit, and other services.

– Magyar Bancorp Inc ($NASDAQ:MGYR)

Can Fin Homes Ltd is a housing finance company that provides loans for the purchase or construction of homes in India. As of 2022, the company has a market cap of 69.99B. The company was founded in 1987 and is headquartered in Bangalore, India.

Summary

Investing in HEARTLAND GROUP is a good choice for income investors looking for consistent returns. The company has been issuing dividends per share annually over the past three years at an average of 0.11, 0.12 and 0.06 NZD respectively, resulting in an average dividend yield of 4.94%. This is a healthy yield and indicates that investors can expect regular returns from this stock. Furthermore, the dividend yields for 2021 to 2023 are 4.98%, 5.63% and 4.21% respectively, indicating that the returns should remain consistent over the next few years.

Recent Posts