Haynes International dividend yield calculator – Haynes International Announces Dividend of $0.22 Per Share

May 10, 2023

Trending News ☀️

Haynes International ($NASDAQ:HAYN), Inc., a leading producer of high-performance nickel- and cobalt-based alloys, has announced the declaration of a dividend of $0.22 per share to be paid out by the board. Haynes International, Inc. is a major international producer of high-performance alloys that are used in a variety of industries, such as aerospace, chemical processing, and petrochemical. Their alloys are known for their superior strength and durability, and they are widely used in aircraft engines and other mission-critical components.

The company also produces products for other industries, such as investment castings and forge stock. Haynes International has earned a reputation for innovation and quality, and has become a global leader in the production of advanced alloys.

Dividends – Haynes International dividend yield calculator

HAYNES INTERNATIONAL recently announced a dividend of $0.22 per share. This is the latest in a series of annual dividends the company has issued over the last three years, all of which were for $0.88 USD per share. The dividend yields for 2021 to 2023 are 1.9%, 2.28%, and 3.12%, respectively, with an average dividend yield of 2.43%. This makes HAYNES INTERNATIONAL a noteworthy option if investors are seeking a dividend stock.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Haynes International. More…

| Total Revenues | Net Income | Net Margin |

| 559.43 | 51.73 | 9.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Haynes International. More…

| Operations | Investing | Financing |

| -62.4 | -14.68 | 81.94 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Haynes International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 687.66 | 281.9 | 30.84 |

Key Ratios Snapshot

Some of the financial key ratios for Haynes International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | 35.5% | 12.6% |

| FCF Margin | ROE | ROA |

| -13.8% | 11.1% | 6.4% |

Market Price

The news of the dividend announcement caused the company’s stock to open at $46.4, but close at $46.0, down 0.8% from the previous closing price. This dividend will be paid out of available funds and is intended to return value to the company’s shareholders. Live Quote…

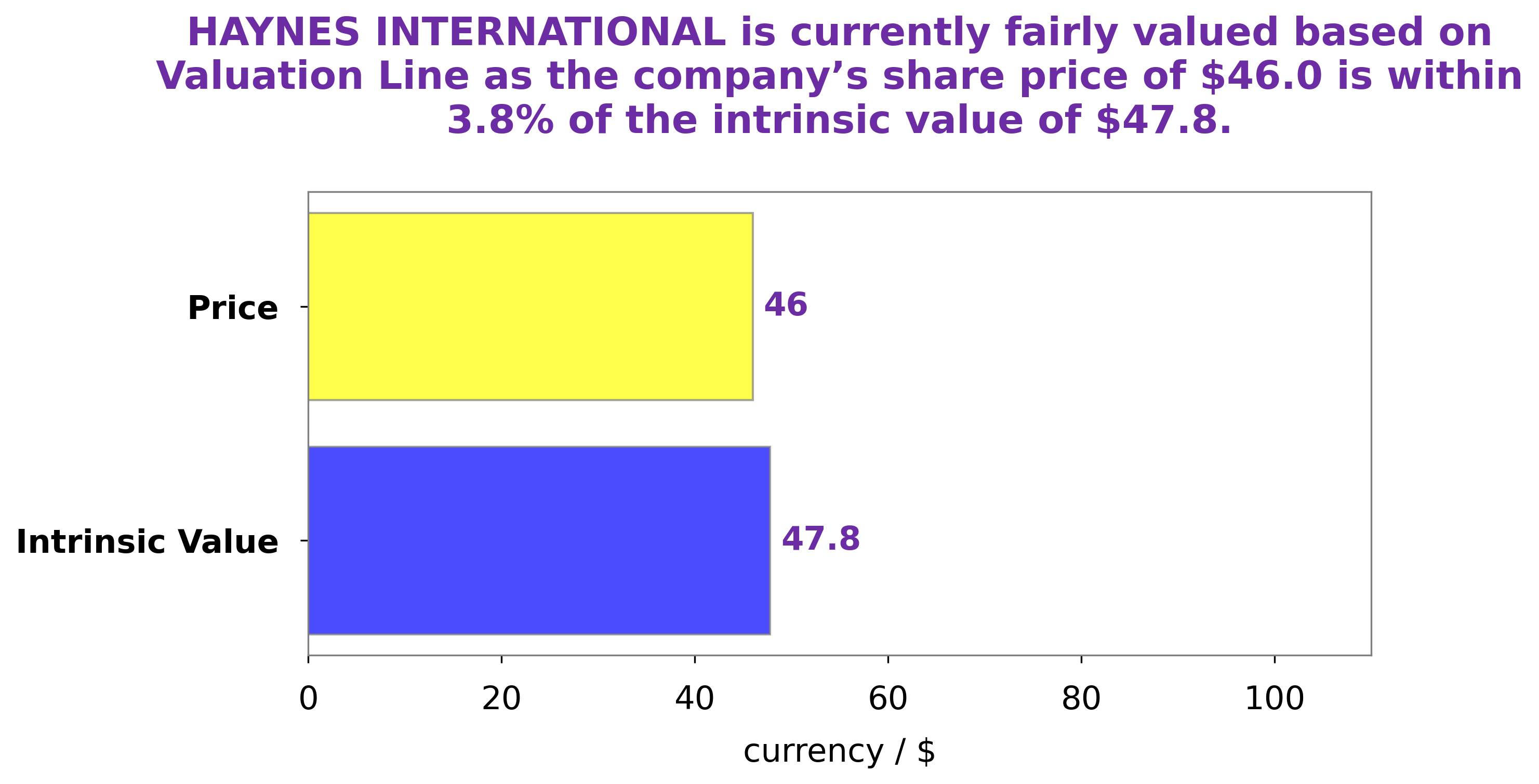

Analysis – Haynes International Intrinsic Stock Value

At GoodWhale, we have conducted an analysis of HAYNES INTERNATIONAL‘s fundamentals and calculated their fair value to be around $47.8. This was determined using our proprietary Valuation Line, which takes into account the company’s financial performance, including its balance sheet and income statement. At the time of writing, HAYNES INTERNATIONAL’s stock is being traded at $46.0, which represents a 3.7% discount from the fair value calculated by our Valuation Line. This makes it a potentially attractive buying opportunity for investors looking for an undervalued stock. More…

Peers

The company’s alloys are used in a variety of industries, including aerospace, chemical processing, and power generation. Haynes International‘s main competitors are Allegheny Technologies Inc, Thermodynetics Inc, HydrogenPro AS.

– Allegheny Technologies Inc ($NYSE:ATI)

Allegheny Technologies Inc is a specialty metals company with a market cap of 3.88B as of 2022. They have a Return on Equity of 13.59%. The company produces and sells a variety of specialty metals and alloys, including stainless steel, titanium, and nickel-based alloys. They serve a wide range of industries, including aerospace, chemical processing, oil and gas, and power generation.

– Thermodynetics Inc ($OTCPK:TDYT)

Thermodynetics Inc is a company that manufactures and sells heat exchangers and related products. The company has a market capitalization of 97.5 million and a return on equity of 831.89%. The company’s products are used in a variety of industries, including automotive, aerospace, and chemical processing. Thermodynetics has a strong market presence and is a leading supplier of heat exchangers in North America. The company’s products are backed by a team of experienced engineers and a quality management system that is ISO 9001:2008 certified.

– HydrogenPro AS ($OTCPK:HYPRF)

Hydrogen Pro AS has a market cap of 186.33M as of 2022. It is a Return on Equity of -9.52%. The company produces hydrogen fuel cells and related technologies. Its products are used in a variety of applications, including transportation, stationary power, and portable power.

Summary

Haynes International, Inc. is an attractive option for investors due to its announcement of a dividend of $0.22 per share. With these positive indicators, Haynes International appears to be an attractive buy for investors looking for long-term growth potential and income generation.

Recent Posts