Guangdong Land dividend yield calculator – Guangdong Land Holdings Ltd Declares Cash Dividend of 0.08

June 10, 2023

🌥️Dividends Yield

On June 1st 2023, Guangdong Land ($SEHK:00124) Holdings Ltd declared a cash dividend of 0.08 HKD per share. This has been the company’s third consecutive year of issuing a dividend, totaling 0.13 HKD per share over the past three years, resulting in an average yield of 15.95%. As a result of this dividend, anyone interested in investing in stocks with high dividend yields may want to consider GUANGDONG LAND as an option. For those who decide to invest in this company, the ex-dividend date has been set on June 21st. This means that shareholders who own the stock before the ex-dividend date are eligible to receive dividends.

Furthermore, anyone who buys the stock on or after the ex-dividend date will not be entitled to receive the dividends. By declaring this dividend, GUANGDONG LAND is showing their commitment to creating value for their shareholders and providing them with an incentive to remain invested in the company’s stock. Investors should take this into consideration when making their decisions and weigh the risks and rewards of investing in GUANGDONG LAND.

Stock Price

Despite the news, GUANGDONG LAND’s stock opened and closed at HK$0.8 per share, indicating that investors have yet to respond to the dividend payout.

In addition, GUANGDONG LAND’s board of directors has authorized the company to repurchase up to 10% of its issued shares. The company plans to use the funds generated by the repurchasing program to invest in new projects and increase the company’s value in the long-term. GUANGDONG LAND is one of China’s largest real estate developers, and its global operations span across a number of industries including residential and commercial real estate, construction, hospitality, and more. The company has grown significantly since its founding and is now an influential player in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Guangdong Land. More…

| Total Revenues | Net Income | Net Margin |

| 1.38k | 392.69 | 28.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Guangdong Land. More…

| Operations | Investing | Financing |

| -6.66k | -1.48k | 8.44k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Guangdong Land. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 48.92k | 40.3k | 4.55 |

Key Ratios Snapshot

Some of the financial key ratios for Guangdong Land are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -9.1% | 117.3% | 63.6% |

| FCF Margin | ROE | ROA |

| -485.3% | 6.9% | 1.1% |

Analysis

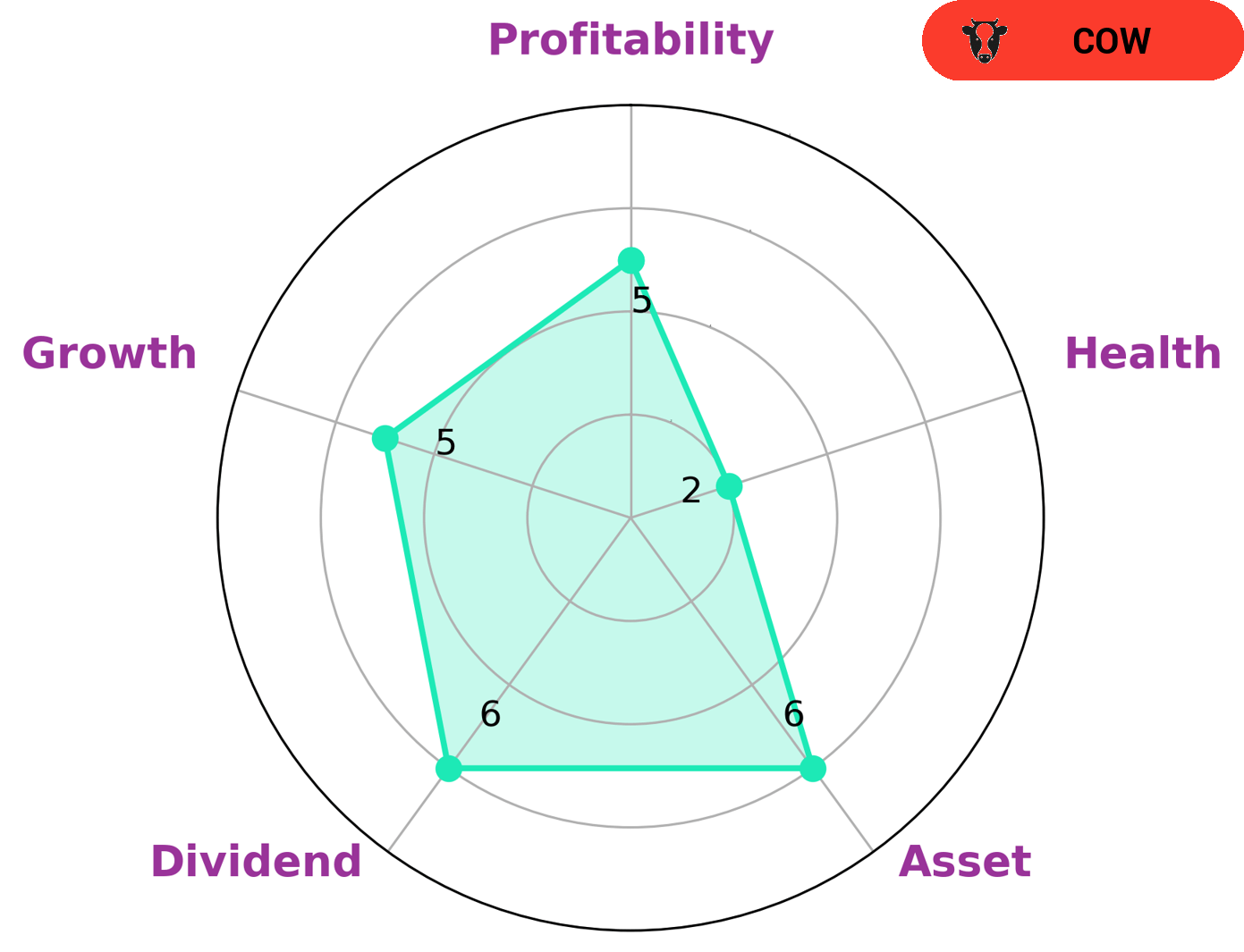

GoodWhale has conducted an analysis of the fundamentals of GUANGDONG LAND. Upon review, our Star Chart indicates that GUANGDONG LAND has a low health score of 2/10 with regard to its cashflows and debt, making it less likely to safely ride out any crisis without the risk of bankruptcy. Despite this, GUANGDONG LAND is classified as a ‘cow’, a type of company we conclude has the track record of paying out consistent and sustainable dividends. We believe investors looking for reliable income streams would be interested in GUANGDONG LAND. Specifically, our analysis shows that the company is strong in asset, dividend, growth, and profitability. While it may not be the most exciting investment option, it does offer a reliable source of income that doesn’t require in-depth understanding of the market. More…

Peers

The competition between Guangdong Land Holdings Ltd and its competitors – Yuexiu Property Co Ltd, Mustera Property Group Ltd, and Selangor Dredging Bhd – is fierce. These companies are all striving to dominate the real estate market, and their success depends on their ability to outmanoeuvre their competition. With each company bringing their own unique strategies and strengths to the table, it will be interesting to see who comes out on top.

– Yuexiu Property Co Ltd ($SEHK:00123)

Yuexiu Property Co Ltd is a leading real estate developer based in China. With a market cap of 36.66B as of 2023, the company is a major player in the industry. Its Return on Equity (ROE) of 15.6% is a good indication of its financial strength and performance. The company has grown significantly since its founding in 1996, and it currently owns and operates a wide range of properties across China. It has also been expanding into markets outside of China, including the United States and Hong Kong. With its strong financials and growth potential, Yuexiu Property Co Ltd is well-positioned to continue its success in the future.

– Mustera Property Group Ltd ($ASX:MPX)

Mustera Property Group Ltd is a real estate company based in the UK. The company is engaged in the acquisition, development and management of commercial, residential and industrial properties. As of 2023, Mustera Property Group Ltd has a market capitalization of 39.66 million, which indicates its overall market value. Additionally, the company has a Return on Equity of -3.19%, which is indicative of its financial performance during a given period. This figure is calculated by taking the net income of the company and dividing it by the shareholders’ equity.

– Selangor Dredging Bhd ($KLSE:2224)

Selangor Dredging Bhd is a diversified engineering and construction company based in Malaysia. It is engaged in the construction and engineering of ports, harbours, airports, roads, bridges and other large-scale infrastructure projects. As of 2023, the company has a market cap of 198.15M and a Return on Equity of 1.27%. The market cap of Selangor Dredging Bhd reflects investors’ confidence in the company’s ability to generate future returns and shows its potential to grow over time. The Return on Equity ratio is an indicator of the company’s ability to generate profits from its invested capital and shows that the company is utilizing its resources efficiently.

Summary

GUANGDONG LAND is a stock that has been consistently offering high dividend yields over the past three years. With an average yield of 15.95%, it may be an attractive option for investors who are looking to maximize their returns. Financial metrics and risk indicators such as the dividend payout ratio, debt-to-equity ratio, and earnings per share can help to further gauge the potential profitability of the stock. Overall, GUANGDONG LAND has shown itself to be a reliable stock with high dividend returns, and it may be an enticing choice for those looking to make an investment.

Recent Posts