Good Will Instrument dividend calculator – Good Will Instrument Co Ltd Announces 2.0 Cash Dividend

June 3, 2023

☀️Dividends Yield

Good Will Instrument ($TWSE:2423) Co Ltd has recently announced that they will be paying out a 2.0 cash dividend on June 2 2023. This news may be of interest to investors who are looking for dividend stocks to invest in. The company has had a consistent dividend payout over the past three years. They have distributed an annual dividend per share of 1.5 TWD, 1.5 TWD and 1.2 TWD respectively in 2021, 2022 and 2023.

This translates into dividend yields of 5.28%, 5.28% and 4.89% for this year, last year and the year before respectively, with an average dividend yield of 5.15%. The ex-dividend date for this dividend is June 20 2023, so investors must own the stock at least one trading day before that date in order to be eligible for the cash dividend payment. All in all, GOOD WILL INSTRUMENT may be a great dividend stock option for those who are looking for steady dividend payouts.

Share Price

This was revealed when the company’s stock opened at NT$39.2 and closed at NT$38.6, marking a slight decrease of 0.1% from its last closing price of 38.7. The dividend is payable to all shareholders on record date yet to be declared. The company has reportedly been performing well in the market and this dividend is seen as an acknowledgement of the trust and loyalty the shareholders have in the company. With this dividend announcement, GOOD WILL INSTRUMENT looks forward to continuing to deliver strong returns for its shareholders in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Good Will Instrument. More…

| Total Revenues | Net Income | Net Margin |

| 2.9k | 392.08 | 13.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Good Will Instrument. More…

| Operations | Investing | Financing |

| 192.69 | -4.21 | -225.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Good Will Instrument. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.75k | 1.32k | 18.16 |

Key Ratios Snapshot

Some of the financial key ratios for Good Will Instrument are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.2% | 11.0% | 17.9% |

| FCF Margin | ROE | ROA |

| 4.8% | 12.8% | 8.6% |

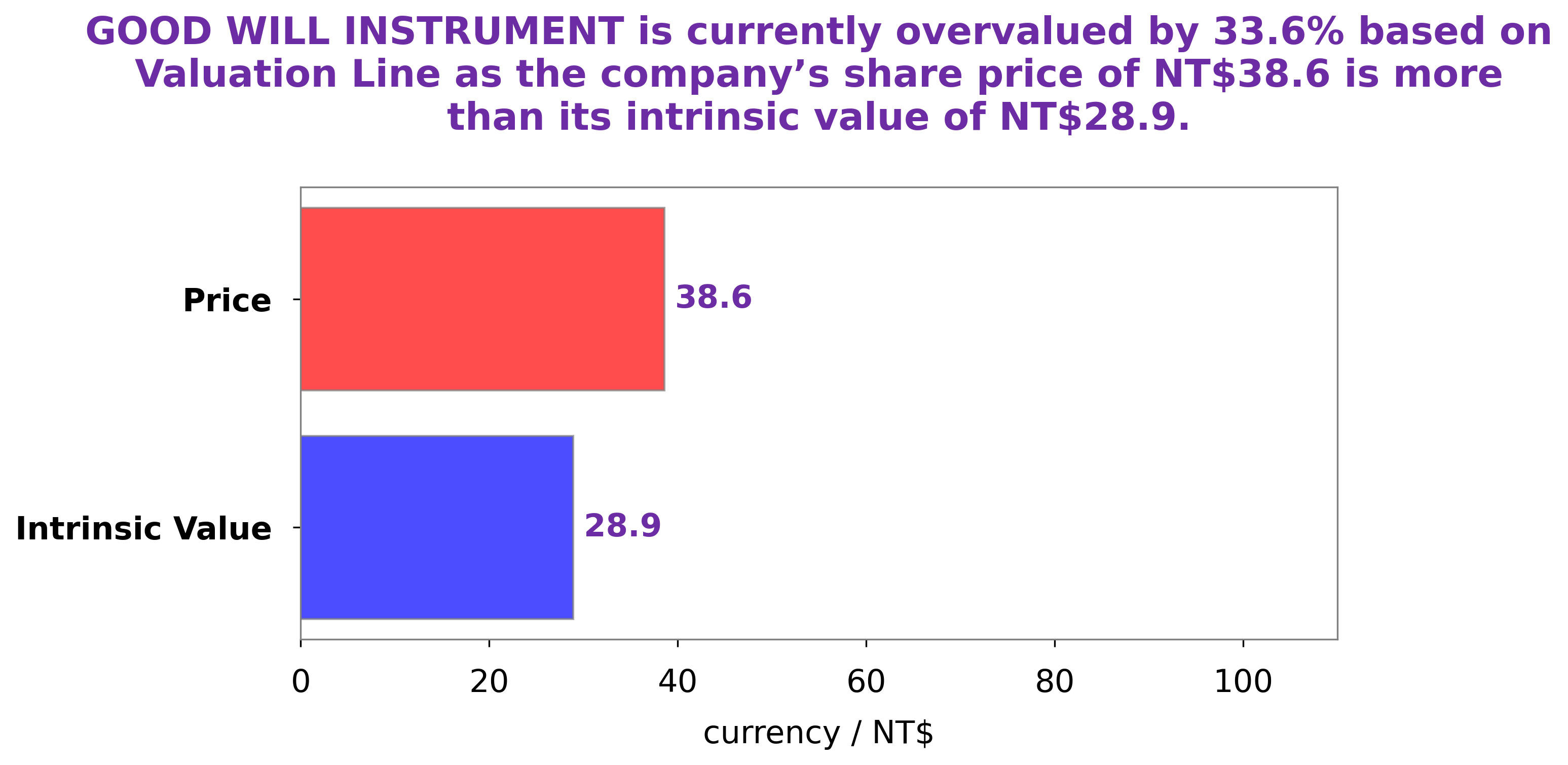

Analysis – Good Will Instrument Stock Fair Value Calculation

At GoodWhale, we analyze the financials of GOOD WILL INSTRUMENT to determine its fair value. Our proprietary Valuation Line suggests that the fair value of GOOD WILL INSTRUMENT is around NT$28.9. However, currently the stock is trading at NT$38.6, which is an overvaluation of 33.5%. This means that investors are paying more for the stock than its intrinsic value. As a result, we suggest investors to be cautious with their investments in GOOD WILL INSTRUMENT. More…

Peers

The competition between Good Will Instrument Co Ltd and its competitors, Suzhou Sushi Testing Group Co Ltd, Nireco Corp, and Hioki E.E. Corp, has become increasingly fierce in recent years. All of the companies are striving to stay ahead of the competition to gain a larger market share and greater profits. Each company has its own unique advantages that it uses to differentiate itself from the competition, but ultimately, it will be the company that can offer the most competitive pricing, superior product quality, and outstanding customer service that will come out on top.

– Suzhou Sushi Testing Group Co Ltd ($SZSE:300416)

The Suzhou Sushi Testing Group Co Ltd, based in China, is a leading provider of food safety and testing services. The company has a market capitalization of 10.57 billion in 2023, indicating a strong presence in the industry. Additionally, the company boasts a Return on Equity (ROE) of 10.68%, reflecting the company’s ability to generate a profit from its investments. As one of the largest food testing companies in the world, Suzhou Sushi Testing Group Co Ltd is committed to providing safe and reliable food testing services to its customers.

– Nireco Corp ($TSE:6863)

Nireco Corp is a Japanese manufacturing company that produces a wide range of products including semiconductor materials, medical products, and industrial machinery. As of 2023, the company has a market capitalization of 7.23 billion and a Return on Equity of 4.3%. The market cap is an indication of the total value of the company’s stock and signals how much investors are willing to pay for it. The Return on Equity measures the amount of profit generated relative to the amount of shareholders’ equity. This indicates that Nireco Corp has managed to generate a healthy return on the money that shareholders have invested in the company.

Summary

Good Will Instrument is a viable option for investors looking for dividend stocks. Over the last three years, the company has distributed an annual dividend per share of 1.5, 1.5 and 1.2 TWD, providing average dividend yields of 5.28%, 5.28% and 4.89%, respectively. Analyzing the company’s potential for long-term dividends, as well as its current dividend yield, could be a beneficial strategy for investors who may be considering investing in Good Will Instrument. Additionally, evaluating the company’s financials, management team, market capitalization, and overall performance could also be beneficial when assessing whether Good Will Instrument is the right investment for your portfolio.

Recent Posts