Genuine Parts dividend calculator – Genuine Parts Co. Declares 0.95 Cash Dividend

March 8, 2023

Dividends Yield

GENUINE ($NYSE:GPC): On March 7 2023, A&W Revenue Royalties Income Fund announced a cash dividend of 0.16 per share. This fund has been issuing a steady dividend per share of 1.86 CAD, 1.69 CAD, and 1.02 CAD in the last 3 years. Its dividend yields have been quite profitable, with 4.76%, 4.57%, and 3.26% in 2020, 2021, and 2022 respectively, with an average of 4.2%. This makes it an attractive investment for income investors looking for dividend stocks.

The ex-dividend date for the 0.16 dividend is March 14 2023. A&W REVENUE ROYALTIES could be a great option for investors seeking dividend payouts, and should be taken into consideration.

Market Price

On Tuesday, A&W REVENUE ROYALTIES Income Fund announced that it is paying a cash dividend of 0.16 per share. This dividend will be paid on October 15, 2020 to shareholders of record at the close of business on October 1, 2020. Notably, on the day of the announcement, A&W REVENUE ROYALTIES stock opened at CA$37.7 and closed at CA$37.4, down by 0.3% from its last closing price of CA$37.5. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Genuine Parts. More…

| Total Revenues | Net Income | Net Margin |

| 22.1k | 1.18k | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Genuine Parts. More…

| Operations | Investing | Financing |

| 1.47k | -1.68k | 205.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Genuine Parts. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.5k | 12.69k | 26.89 |

Key Ratios Snapshot

Some of the financial key ratios for Genuine Parts are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.4% | 13.7% | 7.5% |

| FCF Margin | ROE | ROA |

| 5.1% | 27.6% | 6.2% |

Analysis

At GoodWhale, we have conducted an analysis of the fundamentals of A&W REVENUE ROYALTIES. Based on our proprietary Valuation Line, we have concluded that the fair value of A&W REVENUE ROYALTIES’ share is approximately CA$38.3. At the time of writing, the stock is being traded at CA$37.4, indicating that it is currently undervalued by 2.4%. Therefore, this might be an opportune time to invest in A&W REVENUE ROYALTIES. More…

Summary

Investing in A&W REVENUE ROYALTIES is a wise choice for income seekers due to its consistent and reliable dividend yield. Over the past 3 years, the company has paid dividend per share of 1.86 CAD, 1.69 CAD, and 1.02 CAD respectively, with average dividend yields of 4.76%, 4.57%, and 3.26% in 2020, 2021, and 2022. This indicates that A&W REVENUE ROYALTIES is a relatively safe stock for income investors. The average dividend yield over the past 3 years stands at 4.2%.

This offers a steady stream of income for investors looking for consistent returns. Its dividend policy also implies a low risk investment opportunity as there is no short-term capital appreciation potential.

Dividends Yield

UPC Technology Corp announced a 0.2 cash dividend on March 7 2023, making it an attractive choice for dividend investors. The company has made an impressive showing in terms of dividend distribution in the past three years, issuing 1.0 TWD, 1.0 TWD and 0.2 TWD in dividends per share with respective yields of 5.29%, 5.35%, 2.49%, and an average yield of 4.38%. The ex-dividend date for this latest dividend is March 23 2023. For those looking to add a dividend stock to their portfolio, UPC Technology Corp is worth considering.

The company has consistently paid dividends and offers a respectable yield with this latest dividend. Furthermore, the ex-dividend date is still some time off, giving investors ample time to assess their portfolios and make decisions accordingly. Dividends are an important part of investment returns, and UPC Technology Corp’s latest dividend is a strong indicator that the company is financially sound and committed to rewarding its shareholders.

Price History

On Tuesday, UPC TECHNOLOGY Corp. made public the news that they would be paying a cash dividend of 0.2 to shareholders. The company’s stock opened at NT$15.3 and closed at NT$15.4, representing a 0.3% increase from its previous closing price of NT$15.3. This dividend payment is a sign of the company’s financial stability and signals their commitment to rewarding shareholders for their loyalty and support. It is anticipated that this payment will provide a boost to the company’s stock performance in the near future. Live Quote…

Analysis

We at GoodWhale conducted a comprehensive analysis of the fundamentals of UPC TECHNOLOGY. After taking into account the company’s financials, market and industry conditions, and other factors, our proprietary Valuation Line calculation determined that the fair value of UPC TECHNOLOGY is around NT$19.7. Currently, UPC TECHNOLOGY stock is trading at NT$15.4, representing a discount of 22.0% from the estimated fair value. More…

Summary

UPC TECHNOLOGY is an attractive choice for dividend investors. Its dividend yield has been steadily increasing, with an average yield of 4.38% over the past three years. The company has consistently distributed an annual dividend per share of 1.0, 1.0, and 0.2 TWD in that period, reaching a high of 5.35% in the most recent year. Investors should pay attention to any signs of dividend cuts or increases in future years as they assess potential returns on their investments.

Dividends Yield

On March 1 2023, SMK CORPORATION declared a 100.0 cash dividend, which is significantly higher than the annual dividend per share of 70.0, 70.0, and 50.0 JPY for the last three years. Considering the dividend yields for 2021 to 2023, which are 2.61%, 2.61%, and 2.04% respectively, the average dividend yield for SMK CORPORATION is 2.42%. This makes it a viable option for those looking for dividend stocks in the market, with an ex-dividend date on March 30 2023. The increase in dividend declared by SMK CORPORATION demonstrates its commitment to its shareholders and is a positive sign of the company’s financial health. This is also likely to benefit its investors who have come to expect a steady stream of dividends.

Furthermore, the higher dividend also serves as an incentive for potential investors who are looking for potentially lucrative investments in stocks yielding higher dividends. Overall, in spite of the current market conditions, SMK CORPORATION remains confident in its ability to deliver value to its shareholders and prospective investors by providing attractive dividends at higher yields. Investors should keep an eye out for further updates from SMK CORPORATION regarding its dividend policy to make informed decisions about their investments.

Price History

SMK Corporation, a leading provider of technology solutions, has declared a 100.0 cash dividend for its shareholders. The announcement was made on Wednesday and the share prices have reacted positively, closing the day at JP¥2565.0, up by 0.1% from the previous close. This dividend comes as a result of the company’s strong performance in terms of both sales and profits over the last financial year. The company is confident that this move will be beneficial for its shareholders, as it will help them to further benefit from SMK Corporation’s long-term growth potential.

The company is committed to delivering value to its investors in the form of dividends and other returns over the long-term. SMK Corporation is expected to continue its strong performance in the years ahead and expects dividends to remain an important part of its shareholder rewards program. Shareholders are advised to take advantage of this excellent opportunity to further benefit from the company’s success and increase their returns. Live Quote…

Analysis

At GoodWhale, we recently conducted an analysis of SMK CORPORATION’s financials. Our star chart showed that the company is strong in asset and dividend, and medium in growth and profitability. This places SMK CORPORATION in the ‘cheetah’ category of companies, which have achieved high revenue or earnings growth but are considered less stable due to lower profitability. Given its high health score of 8/10 with regard to its cashflows and debt, SMK CORPORATION is capable of safely riding out any crisis without the risk of bankruptcy. This makes it an attractive option for those investors looking for short-term capital gains rather than long-term stability. Additionally, SMK CORPORATION’s strong asset and dividend performance make it attractive for those investors looking for a more balanced portfolio of investments. More…

Summary

Investing in SMK CORPORATION is a wise decision, as the company has been consistently paying dividends over the past three years. In 2021 and 2022, the dividend per share was 70.0 JPY, which translates to a yield of 2.61%. For 2023, the dividend per share was 50.0 JPY, yielding 2.04%.

The average dividend yield for this period is 2.42%. Investors should consider SMK CORPORATION as a safe and reliable dividend paying stock with upside potential.

Dividends Yield

Tomoe Corp recently made an announcement that it will be issuing a 14.0 cash dividend to shareholders on March 1 2023. This marks an increase from the 12.0 JPY dividend per share that was issued in the last three years, and 6.0 JPY in the current year. Consequently, the dividend yields for 2021-2023 have been 3.22%, 3.22%, and 1.75%, respectively. This results in an average yield of 2.73%.

As such, TOMOE CORPORATION might be worth investors’ consideration if they are looking for a dividend stock; the ex-dividend date is March 30 2023. It is important to note that dividends can be unpredictable and can change from year to year. Thus, it is recommended for investors to do their own due diligence and research before making any decisions regarding investing in TOMOE CORPORATION.

Share Price

On Wednesday, TOMOE CORPORATION announced a 14.0 cash dividend to its shareholders. This news saw the stock open at JP¥427.0 and close at JP¥431.0, representing an increase of 0.7% from the prior closing price of JP¥428.0. The dividend will be distributed on a date to be determined by the company, with the ex-dividend date expected to fall in line with the company’s regular practice. This announcement is part of the company’s ongoing efforts to optimize shareholder returns and reward its investors for their support and confidence. Live Quote…

Analysis

At GoodWhale, we have conducted an analysis of the wellbeing of TOMOE CORPORATION. Using our proprietary Valuation Line, we have determined that the intrinsic value of TOMOE CORPORATION share is around JP¥457.8. Based on this figure, we have determined that the price the stock is currently being traded at – JP¥431.0 – is a fair price, but it is undervalued by 5.8%. More…

Summary

TOMOE CORPORATION is an attractive investment option for those looking to benefit from a steady dividend yield. The company has issued an annual dividend per share of 12.0 JPY for the last three years, and 6.0 JPY in the current year, resulting in an average yield of 2.73%. The dividend yields for 2021-2023 have been 3.22%, 3.22%, and 1.75%, respectively. This is an attractive yield for investors seeking a consistent return on their investments.

Additionally, the company has a strong financial position which provides a level of assurance to investors. Taking all of this into consideration, TOMOE CORPORATION is a viable option for those seeking a reliable investment with consistent returns.

Dividends Yield

On March 3 2023, Eagle Bulk Shipping Inc. declared a 0.6 cash dividend to its shareholders. For the last three years they have provided an annual dividend per share of 8.05 USD, yielding an average of 14.59%. This makes EAGLE BULK SHIPPING a great consideration for those looking to invest in dividend stocks. The ex-dividend date for this stock is March 14 2023. Therefore, it is important for investors to take this date into consideration before investing in the company. EAGLE BULK SHIPPING has a long history of providing consistent and reliable returns to investors. Their strong track record of steady dividends indicates that the company is financially sound and can be trusted to continue making prudent financial decisions.

Furthermore, the company is committed to maintaining high standards of corporate governance and has a strong ethical framework. These factors make EAGLE BULK SHIPPING a safe and reliable investment option. For those looking to invest in a dividend stock, EAGLE BULK SHIPPING may be an attractive option. With a reliable track record of providing dividends and a commitment to responsible corporate governance, this company is a safe investment that can yield consistent returns over the long term. Therefore, investors should take the time to consider all the factors involved when investing in EAGLE BULK SHIPPING.

Market Price

The dividend will be paid on August 12th, 2021. On Friday, the company’s stock opened at $59.1 per share and closed at $55.4, a plunge of 15.7% from the prior closing price of $65.7. This marks the second consecutive dividend that the company has declared in 2021, indicating a strong financial performance.

Shareholders should note that this dividend is subject to applicable withholding taxes. Investors are encouraged to consult with their tax advisors for more information on the tax implications of receiving the dividend. Live Quote…

Analysis

At GoodWhale, we have analyzed the financials of EAGLE BULK SHIPPING. Our Star Chart shows that the company is strong in growth, and medium in asset, dividend, and profitability. We classify EAGLE BULK SHIPPING as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its competitive advantage. Investors who are looking for companies with strong competitive advantages, steady revenue growth and lower risk of bankruptcy may find EAGLE BULK SHIPPING attractive. With an intermediate health score of 6/10 with regard to its cashflows and debt, this company is likely to safely ride out any crisis without the risk of bankruptcy. More…

Summary

EAGLE BULK SHIPPING has been a reliable dividend stock for the last three years, paying a steady 8.05 USD per share each year with an impressive average yield of 14.59%. For investors looking to add a reliable dividend stock to their portfolio, EAGLE BULK SHIPPING is an excellent choice with its consistent dividend payments and high potential yield. With a sound history of dividend payments, this stock deserves serious consideration for any investor looking for a reliable income stream.

Dividends Yield

On March 1, 2023, Morita Holdings Corp announced a dividend of 20.0 JPY. This is the third consecutive year that MORITA HOLDINGS has issued an annual dividend per share, with 41.0 JPY in 2021, 40.0 JPY in 2022, and 38.0 JPY in 2023 providing dividend yields of 2.88%, 2.49%, and 2.35%, respectively, with an average yield of 2.57%. The ex-dividend date is on March 30, 2023, making this dividend attractive to those looking to invest in dividend stocks. The company’s decision to issue a dividend reflects its commitment to rewarding its shareholders and investors. This dividend is part of MORITA HOLDINGS’ long-term strategy to generate stable returns for investors, while also providing a means to raise capital for future investments and growth opportunities. The company will continue to focus on providing shareholders and investors with returns that are both reliable and competitive.

In addition, the dividend will strengthen the company’s financial position and help maintain its strong financial track record. For those seeking to invest in a dividend stock, MORITA HOLDINGS is a suitable option. The company’s consistent dividend payments are a sign of its commitment to long-term value creation for shareholders and investors alike. With this decision, MORITA HOLDINGS continues to demonstrate its dedication to creating an environment of investor confidence and financial stability.

Stock Price

On Wednesday, MORITA HOLDINGS announced a 20.0 cash dividend for its shareholders. Shareholders had reason to be pleased as the stock opened at JP¥1213.0 and closed at JP¥1228.0, up by 0.9% from its previous closing price of 1217.0. This marks the fifth consecutive month that Morita Holdings has increased its dividend distribution, demonstrating the company’s commitment to rewarding shareholders. The announcement gave another boost to share prices, generating even more confidence in the company’s reliability and stability. Live Quote…

Analysis

GoodWhale is proud to present an analysis of MORITA HOLDINGS’s fundamentals. From the Star Chart, MORITA HOLDINGS has a high health score of 10/10, meaning it is capable of safely riding out any crisis without the risk of bankruptcy regardless of its cashflows and debt. Furthermore, MORITA HOLDINGS is strong in asset, dividend, and profitability, while weak in growth. As such, MORITA HOLDINGS can be classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. Investors who are looking for a stable cash flow and consistent dividend payments may be particularly interested in such company. Additionally, the high health score shows that MORITA HOLDINGS has a strong financial position, making it a safe investment option for investors who are risk-averse. More…

Summary

MORITA HOLDINGS is an attractive option for dividend investors, offering an average dividend yield of 2.57% over the last three years. The company has issued an annual dividend per share of 41.0 JPY, 40.0 JPY and 38.0 JPY over the same period, respectively, providing dividend yields of 2.88%, 2.49%, and 2.35%. This indicates that the company has been consistent in its dividend payments and is a reliable source of income for investors.

Furthermore, the return of investment from MORITA HOLDINGS’ stock is likely to be attractive, as the company has demonstrated a consistent dividend payment history and positive financial performance. As such, MORITA HOLDINGS is an excellent choice for dividend investors looking for reliable returns.

Dividends Yield

On March 1 2023, Cromwell European REIT announced the declaration of 0.08494 Cash Dividend per share. For the past three years, CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST has been consistently paying out annual dividends per share of 0.14 EUR, 0.17 EUR and 0.19 EUR, resulting in dividend yields of 5.76%, 7.0% and 7.54% respectively from 2020 to 2022, with an average dividend yield of 6.77%. This consecutively increasing dividend payout indicates the trust’s strong financial health and ability to provide steady returns to its investors. If you’re looking for stocks with a solid dividend history, CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST may be worth considering with the ex-dividend date taking place on March 3 2023.

Furthermore, the trust is a well-diversified portfolio with over 8 million square metres of commercial and industrial space across Europe. It offers investors exposure to both residential and non-residential market segments and is an attractive option for those seeking long-term capital growth while at the same time receiving steady income through dividend payments.

Share Price

On Wednesday, Cromwell European Real Estate Investment Trust (REIT) announced that it has declared a 0.08494 Singapore Dollars (SGD) cash dividend per unit for their financial year 2020. The stock opened at SG$1.7 and closed at SG$1.7, up by 1.2% from the prior closing price of SG$1.7. This dividend declaration is a positive indicator of the financial health of Cromwell European REIT and is a testament to the trust’s ability to generate consistent returns for its investors. Live Quote…

Analysis

As GoodWhale’s analysis of CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST’s financials reveals, this company is classified as a ‘cow’ – a type of company that has the track record of paying out consistent and sustainable dividends. Its high health score of 9/10 reveals that it is financially sound and capable of paying off debt and funding future operations. Furthermore, CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST is strong in profitability, medium in asset and weak in dividend and growth. Given its record of consistent dividend payouts and strong financial position, CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST is likely to be of interest to income-seeking investors, as well as those looking for long-term investments with a stable return. More…

Summary

CROMWELL EUROPEAN REAL ESTATE INVESTMENT TRUST is an attractive investment opportunity for those seeking a stable income. Over the past three years, the trust has consistently paid out annual dividends per share of 0.14 EUR, 0.17 EUR and 0.19 EUR, resulting in dividend yields of 5.76%, 7% and 7.54%. This provides an average dividend yield of 6.77%, making it an attractive option for investors looking for a passive income. It appears to be a reliable investment that promises a consistent dividend return.

Dividends Yield

On March 1 2023, Genuine Parts Co. declared that it would be paying a cash dividend of 0.95 USD per share. This marks the fourth consecutive year of dividend payments from GENUINE PARTS, further reinforcing its commitment to shareholders. In the past three years, GENUINE PARTS has paid an annual dividend of 3.58 USD per share, resulting in an average dividend yield of 2.39%. As such, the ex-dividend date has been set for March 2 2023, making this an attractive investment opportunity for those looking to add a dividend stock to their portfolio.

With a dividend yield of 2.39%, GENUINE PARTS is a compelling option for anyone seeking a steady and reliable income stream. Furthermore, since the dividend is checked regularly and declared annually, investors can rest assured knowing their payments are secure.

Market Price

The company’s stock opened at $175.1 on the same day and closed at $170.3, which marked a 3.7% decrease from its prior closing price of $176.9. The cash dividend will be payable on February 15, 2021 to shareholders of record as of February 5, 2021. Live Quote…

Analysis

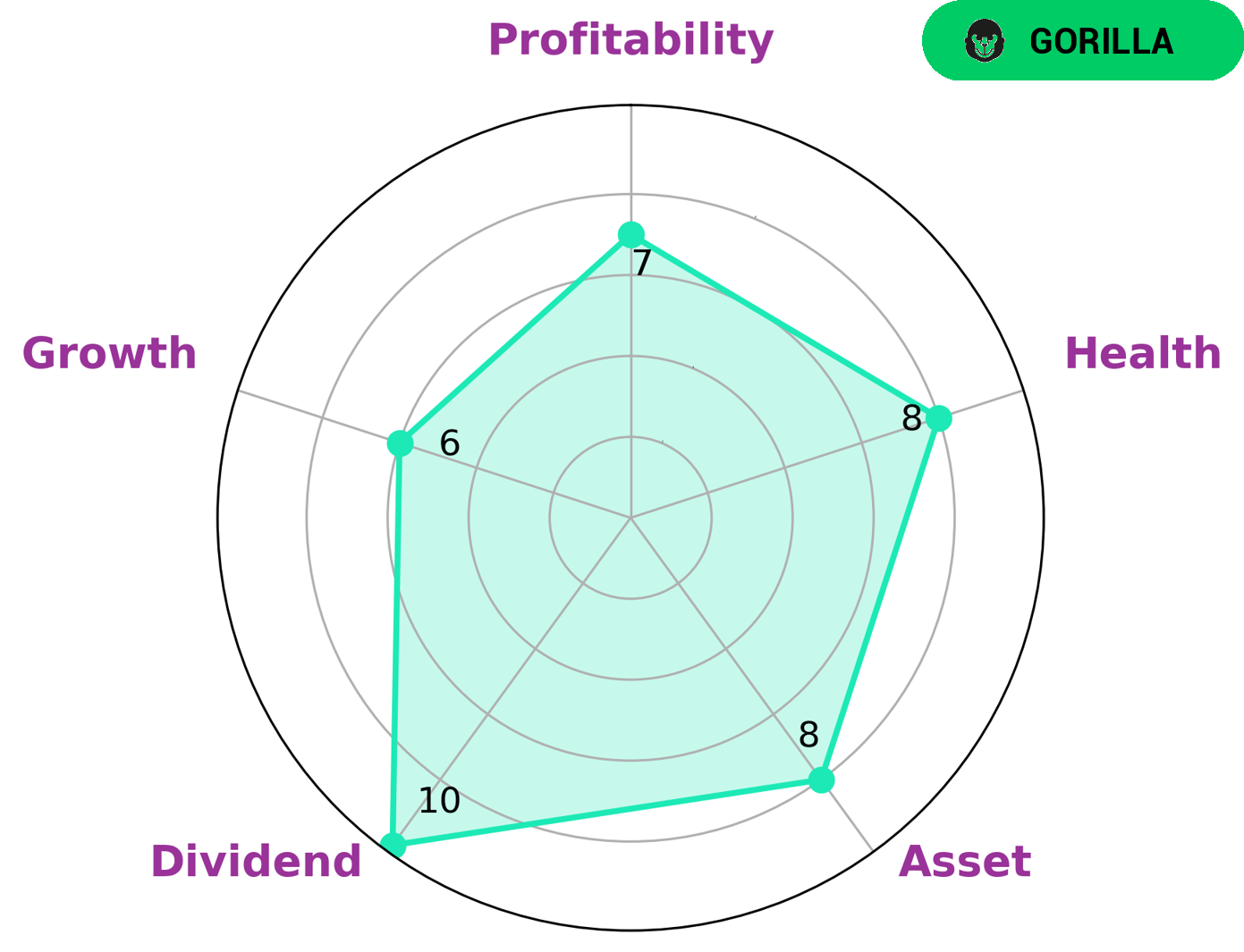

GoodWhale has conducted a wellbeing analysis of GENUINE PARTS. According to our Star Chart, we have given GENUINE PARTS a health score of 8/10 as it is in a strong position in terms of cashflows and debt and is capable of paying off debt and funding future operations. We have also found that GENUINE PARTS is strong in assets, dividends, and profitability and medium in growth. Based on these findings, we have classified GENUINE PARTS as a ‘gorilla’, a company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given the company’s strong position, investors who are looking for consistent returns, such as value investors, growth investors and dividend investors, may be interested in GENUINE PARTS. More…

Peers

The automotive aftermarket is a highly competitive industry with a few large players and many small regional players. The three largest companies in the industry are Genuine Parts Co, Advance Auto Parts Inc, and O’Reilly Automotive Inc. These companies compete against each other for market share, customers, and suppliers.

– Advance Auto Parts Inc ($NYSE:AAP)

Advance Auto Parts is one of the largest automotive aftermarket parts providers in North America, operating over 5,000 stores across the United States, Puerto Rico, and the Virgin Islands. The company also operates e-commerce sites under the names AdvanceAutoParts.com, Carquest.com, and Worldpac.com. Advance Auto Parts serves both professional installer and do-it-yourself customers.

– Aishida Co Ltd ($SZSE:002403)

Aishida Co Ltd is a Japanese company that manufactures and sells industrial machinery. The company has a market cap of 2.87B as of 2022 and a Return on Equity of -1.16%.

– O’Reilly Automotive Inc ($NASDAQ:ORLY)

Based in Springfield, Missouri, O’Reilly Automotive, Inc. is a publicly traded retailer of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States. As of 2021, the company operated 5,374 stores in 47 states.

The company has a market cap of 51.62B as of 2022 and a return on equity of -159.26%. The company’s revenue for 2020 was $11.4 billion.

Summary

Genuine Parts is a compelling investment for those seeking steady dividend income. With a 3.58 USD dividend per share for the past three years, the dividend yield is 2.39%, which is attractive for long-term investors looking for regular income. Analysts suggest that the company is likely to maintain and even increase its dividend in the near term, which could provide an even more attractive yield.

Furthermore, Genuine Parts has a strong balance sheet, with healthy financials and plenty of cash on hand to support dividends. With a solid track record of consistent dividend payments and a positive outlook for future dividends, Genuine Parts is an attractive investment for those seeking a reliable and steady stream of income.

Recent Posts