Genting Malaysia Bhd dividend – Genting Malaysia Bhd Announces 0.09 Cash Dividend

March 19, 2023

Dividends Yield

On March 2, 2023, Genting Malaysia Bhd ($KLSE:4715) announced that it will pay a 0.09 cash dividend to its shareholders. This is the third dividend payment announced by the company in the last two years, with a per share payout of 0.06 and 0.11 MYR during the past two years. As a result, the dividend yields from 2020 to 2022 stand at 2.01% and 4.61%, respectively, giving an average yield of 3.31%. For those investors looking for dividend stocks, GENTING MALAYSIA BHD may be worth considering, with an ex-dividend date of March 20, 2023.

The company’s strong financial performance and steady income stream make it an attractive option for dividend investors. Its dividend yield is also higher than the average market yield, making it an attractive choice for dividend investors seeking exposure to a safe, established company.

Price History

As a result, GENTING MALAYSIA BHD’s stock opened and closed at RM2.7 on the same day. This dividend reflects GENTING MALAYSIA BHD’s commitment to returning cash to shareholders in order to increase shareholder value. Furthermore, it is expected that the company’s stock will remain stable in the near future. This is beneficial for both investors and consumers, who can expect to see consistent and reliable stock prices from GENTING MALAYSIA BHD. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Genting Malaysia Bhd. More…

| Total Revenues | Net Income | Net Margin |

| 8.6k | -520 | -3.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Genting Malaysia Bhd. More…

| Operations | Investing | Financing |

| 2.36k | -1.13k | -2.86k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Genting Malaysia Bhd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 28.63k | 16.7k | 2.23 |

Key Ratios Snapshot

Some of the financial key ratios for Genting Malaysia Bhd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.1% | -19.0% | 2.1% |

| FCF Margin | ROE | ROA |

| 19.5% | 0.9% | 0.4% |

Analysis

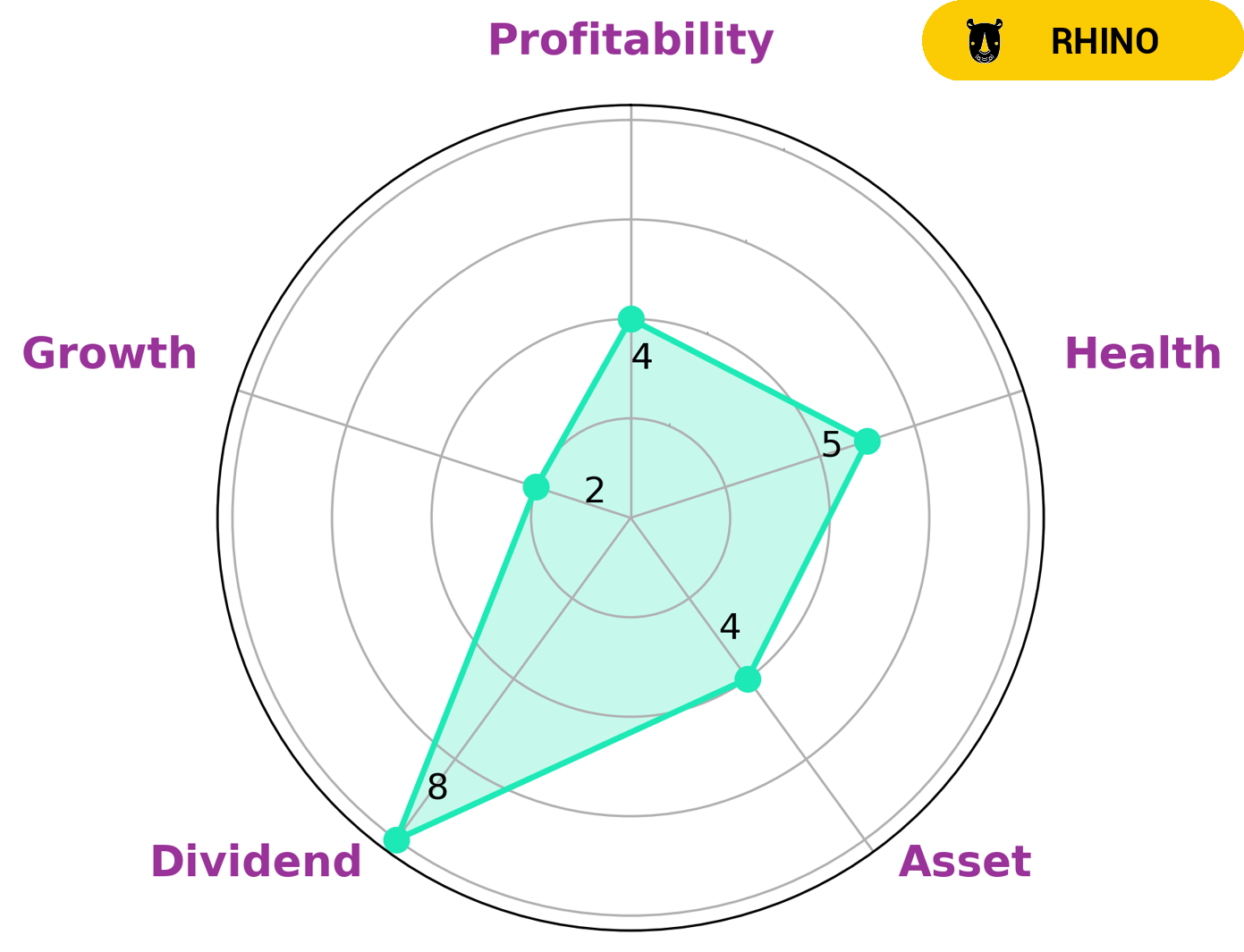

GoodWhale has conducted an evaluation of GENTING MALAYSIA BHD’s fundamentals and according to our Star Chart, they have an intermediate health score of 5/10 with regards to cashflows and debt. This score indicates that the company is likely to be able to pay off its debt and fund future operations. We have classified GENTING MALAYSIA BHD as a ‘rhino’ type of company, meaning that it has achieved moderate revenue or earnings growth. This kind of company may be interesting to investors who are looking for a steady dividend payment, as well as investors who focus on the asset and profitability value of an organization. GENTING MALAYSIA BHD is strong in dividend, medium in asset, profitability and weak in growth. More…

Peers

Genting Malaysia Bhd is one of the leading companies in the gaming and leisure industry, and faces stiff competition from its competitors, including Genting Singapore Ltd, Bloomberry Resorts Corp, and Genting Bhd. All four of these companies are striving to gain market share in the highly competitive gaming and leisure market, and have been engaged in a fierce battle for customers and profits.

– Genting Singapore Ltd ($SGX:G13)

Genting Singapore Ltd is a leading integrated resort operator in the Asia Pacific region. It operates casinos, hotels, shopping malls, and other entertainment facilities. The company has a market capitalization of 12.8B and a Return on Equity of 3.61%. This reflects the company’s strong investment returns, as well as its sound financial position and liquidity. Genting Singapore is well-positioned to capitalize on the growing demand for gaming and entertainment activities in the region, as well as its strategic partnerships with major international entertainment and hospitality players.

– Bloomberry Resorts Corp ($PSE:BLOOM)

Bloomberry Resorts Corp is a Philippine-based leisure and entertainment company that operates integrated resorts and casinos. The company’s market cap as of 2023 is 97.76B, a significant increase from its valuation in previous years. Its Return on Equity (ROE) is also impressive at 20.95%, which indicates that the company is successfully generating profits from its investments. Bloomberry Resorts has clearly enjoyed success in recent years, and its market cap and ROE figures are proof of that.

– Genting Bhd ($KLSE:3182)

Genting Bhd is a diversified leisure, hospitality, and gaming company based in Malaysia. It is the largest listed gaming company in the country, and one of the largest in the world. As of 2023, the company had a market capitalization of 17.56 billion, making Genting Bhd one of the largest publicly traded companies in Malaysia. The company also had an impressive Return on Equity (ROE) of 5.75%, indicating that the company is generating profits efficiently and effectively. This is largely due to their focus on providing high-quality services and experiences in the hospitality and gaming sectors.

Summary

Genting Malaysia BHD is an attractive investing option for dividend seekers. Over the past two years, the company has issued dividends per share of 0.06 MYR and 0.11 MYR, giving dividend yields of 2.01% and 4.61%, respectively. This provides an average dividend yield of 3.31%, making it an attractive option for income investors. The company is well-positioned to generate strong returns in the long-term, given its wide diversification across industries and its strong track record of delivering steady shareholder returns.

Recent Posts