Garmin Ltd dividend yield – GARMIN LTD Declares 0.73 Cash Dividend for Shareholders

March 19, 2023

Dividends Yield

On March 1 2023, GARMIN LTD ($NYSE:GRMN) declared a cash dividend of 0.73 USD per share for its shareholders. This marks another consecutive year where GARMIN LTD has issued an annual dividend per share of 2.86 USD, offering a dividend yield of 2.66%. With an average dividend yield of 2.66%, GARMIN LTD may be a great option for investors looking for dividend stocks. The next ex-dividend date is March 14 2023, which is when shareholders need to own the stock in order to receive the dividend payment. This is an exciting announcement for GARMIN LTD shareholders as it reflects the company’s strong financial position and its commitment to rewarding shareholders.

This dividend payout will surely be welcomed by shareholders and will provide them with a steady income stream. GARMIN LTD has proven itself to be a reliable source of dividend income and has been paying consistent dividends for the last 3 years. The company’s commitment to its shareholders ensures that they can reap the benefits of investing in the company’s stocks.

Stock Price

As a result, its stock opened at $97.8 and closed at $96.8, representing a 1.4% drop from the prior closing price of $98.1. This dividend payment is one more example of their commitment to providing value to their shareholders and customers alike. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Garmin Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 4.86k | 973.59 | 20.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Garmin Ltd. More…

| Operations | Investing | Financing |

| 788.26 | -145.12 | -840.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Garmin Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.73k | 1.53k | 32.38 |

Key Ratios Snapshot

Some of the financial key ratios for Garmin Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.0% | 2.8% | 21.1% |

| FCF Margin | ROE | ROA |

| 11.2% | 10.6% | 8.3% |

Analysis

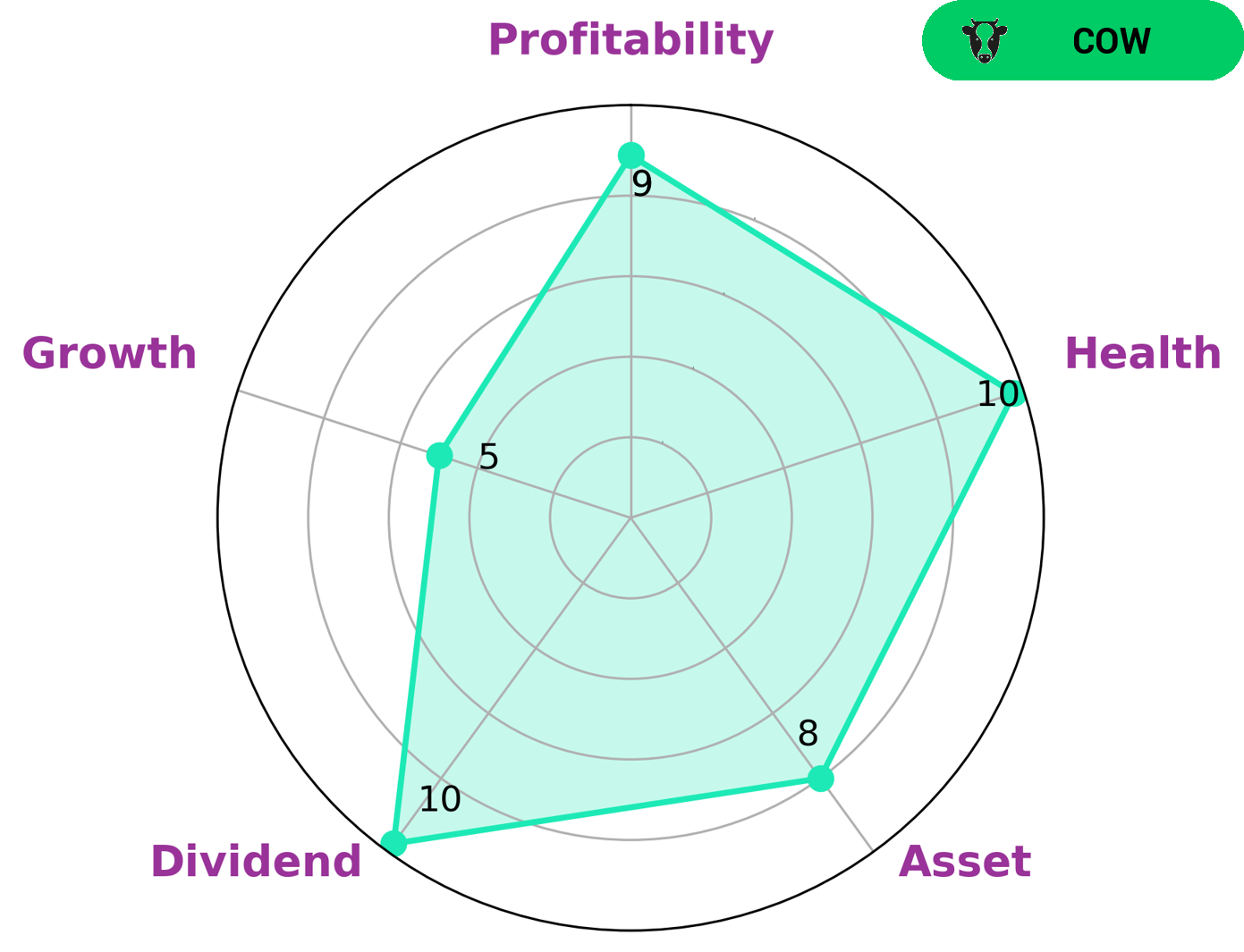

GoodWhale’s analysis of GARMIN LTD‘s fundamentals shows that it is a very healthy company. Our Star Chart analysis gave GARMIN LTD a health score of 10/10, indicating that its cashflows and debt are strong enough to easily withstand any potential crises. Additionally, GARMIN LTD’s asset and dividend management, as well as its profitability, are both considered strong. Its growth potential is considered to be medium. Based on these findings, GARMIN LTD can be classified as a ‘cow’, referring to companies with a track record of paying out consistent and sustainable dividends. This type of company is likely to be attractive to dividend investors, as well as investors interested in stable, long-term investments. More…

Peers

Its competitors include NetApp Inc, Jiangsu Leike Defense Technology Co Ltd, and Red Cat Holdings Inc.

– NetApp Inc ($NASDAQ:NTAP)

NetApp Inc is a American multinational storage and data management company headquartered in Sunnyvale, California. It is a member of the NASDAQ-100 and S&P 500. The company was founded in 1992 with an initial public offering in 1995. NetApp offers a wide range of products and services for enterprise storage, including software-defined storage, flash storage, converged systems, data management, and more. The company has a market cap of $14.66B as of 2022 and a Return on Equity of 100.42%.

– Jiangsu Leike Defense Technology Co Ltd ($SZSE:002413)

Jiangsu Leike Defense Technology Co Ltd is a Chinese company that specializes in the development and manufacture of defense products. The company has a market cap of 6.76B as of 2022 and a Return on Equity of -4.34%. Jiangsu Leike Defense Technology Co Ltd’s products include missiles, armored vehicles, and other defense products. The company is headquartered in Nanjing, China.

– Red Cat Holdings Inc ($NASDAQ:RCAT)

Red Cat Holdings Inc is a development stage company that focuses on acquiring, developing, and commercializing technology in the field of 3D printing. The company was founded in 2013 and is headquartered in Vancouver, Canada.

Red Cat has a market cap of $76.86M as of 2022 and a ROE of -11.27%. The company focuses on acquiring, developing, and commercializing technology in the field of 3D printing.

Summary

Investing in GARMIN LTD can be a wise decision for those looking for a steady income. For the past three years, the company has maintained an impressive dividend yield of 2.66%, offering a consistent return of 2.86 USD per share. GARMIN LTD is thus a reliable choice for investors looking for reliable returns without having to take on large risks. Moreover, the company’s financials are sound and its prospects appear to be positive, making it a great option for investors.

Recent Posts