Furuya Metal dividend yield – Furuya Metal Co Ltd Announces 255.0 Cash Dividend

June 7, 2023

🌥️Dividends Yield

FURUYA METAL ($TSE:7826) Co Ltd is pleased to announce that on June 1, 2023 it will pay a cash dividend of 255.0 JPY per share. This dividend has been paid annually for the last three years, and was set at 255.0 JPY and 80.0 JPY for 2021 and 2022, respectively. With a dividend yield of 4.02% and 1.04% in 2021 and 2022, respectively, the average dividend yield is 3.03%. For investors looking for a stock with an attractive dividend, FURUYA METAL may be a great option. The ex-dividend date is June 29 2023, so be sure to check that out if you are interested in investing in this stock.

Additionally, with the increasing demand for metal products, the company is expected to show strong growth in the coming years.

Stock Price

This closing price is 0.5% lower than the previous close of JP¥9670.0, suggesting that the announcement had a modestly negative impact on the company’s stock price. The dividend will be paid at the end of this month, and shareholders of record as of the end of the day on the fixed date will receive the dividend. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Furuya Metal. More…

| Total Revenues | Net Income | Net Margin |

| 48.49k | 9.35k | 19.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Furuya Metal. More…

| Operations | Investing | Financing |

| -814 | -2.31k | 2.38k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Furuya Metal. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 77.53k | 37.59k | 5.41k |

Key Ratios Snapshot

Some of the financial key ratios for Furuya Metal are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 35.0% | 58.5% | 26.8% |

| FCF Margin | ROE | ROA |

| -6.4% | 20.9% | 10.5% |

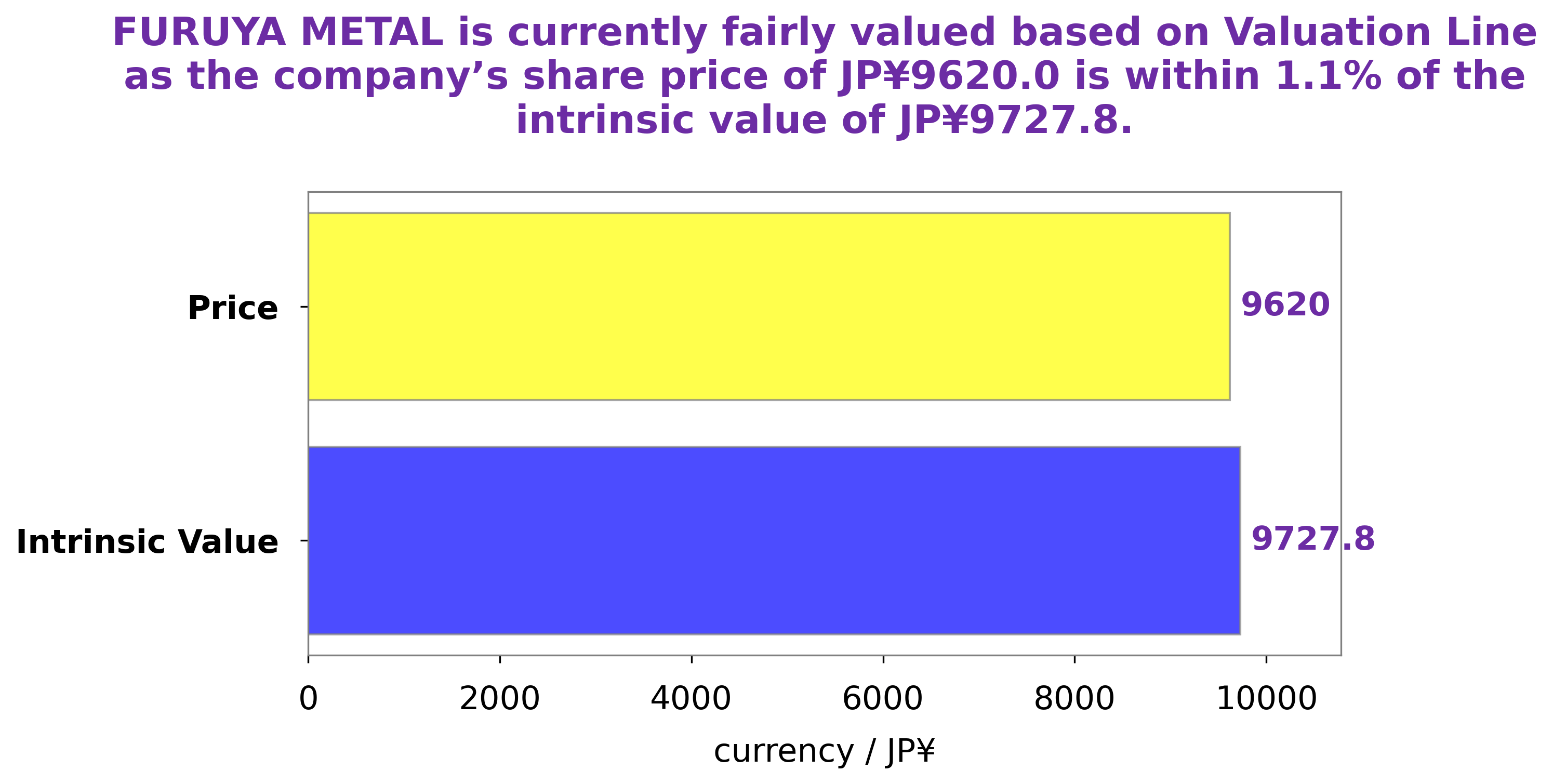

Analysis – Furuya Metal Intrinsic Value

After conducting an analysis of the fundamentals of FURUYA METAL, our proprietary Valuation Line has estimated the intrinsic value of its stock to be around JP¥9727.8. Currently, the price of FURUYA METAL stock is traded at JP¥9620.0, making it a fair price, albeit undervalued by 1.1%. As such, this presents an attractive opportunity for investors who are looking to purchase FURUYA METAL stock at a discounted rate. More…

Peers

Each company is striving to develop and deliver the best products and services in order to gain an edge over the competition. All four companies have been actively working to improve their processes and remain competitive in the market. It is a battle of innovation and resources as they strive to become the leader in their respective industries.

– Restar Holdings Corp ($TSE:3156)

Restar Holdings Corp is a leading provider of food and beverage services, operating a large number of restaurants throughout the world. As of 2023, the company had a market cap of 65.07 billion and a Return on Equity of 9.75%. The market capitalization is a measure of the estimated value of the company as determined by the stock market and tells investors how much a business is worth. A high market capitalization means the company has a larger value and size than its competitors and is in a strong financial position. The Return on Equity measures the company’s profitability which indicates the performance of the company and how well it can use its shareholders’ money and investments to create profit. In this case, Restar Holdings Corp had an ROE of 9.75%, indicating that the company was able to generate profits from its shareholders’ investments.

– Amtech Systems Inc ($NASDAQ:ASYS)

Amtech Systems Inc is a global supplier of production and automation systems and related supplies for the manufacture of solar cells, LED, semiconductor, and related products. With a market capitalization of 133.64M, the company has a strong presence in the solar cell and LED technology sectors. The Return on Equity of 0.58% shows that the company is able to generate returns for its shareholders. The company has a track record of consistent profits and steady growth, as evidenced by its balance sheet. Amtech Systems Inc continues to be a leader in its field, providing innovative solutions to the manufacturing industry.

– Vishay Intertechnology Inc ($NYSE:VSH)

Vishay Intertechnology Inc is a global manufacturer of passive components and discrete semiconductors. Founded in 1962, the company has grown to become one of the world’s leading manufacturers of resistors, capacitors, inductors, thermistors, and transistors. With a market cap of 3.18B as of 2023, Vishay is a large and well-established corporation. Its Return on Equity (ROE) of 19.36% indicates that the company has managed to generate great profits from their equity investments and is a strong indicator of the company’s financial health.

Summary

Investing in FURUYA METAL can be a good way to generate steady income through dividends. For the last three years, FURUYA METAL has consistently paid an annual dividend of 255.0 JPY per share. This year, however, the dividend was reduced to 80.0 JPY per share, resulting in an average dividend yield of 3.03%.

Despite the decrease, the dividend yield is still relatively attractive compared to other available investments. Investing in FURUYA METAL may be a wise choice for investors seeking a reliable source of income with relatively low risk.

Recent Posts