EXR dividend calculator – How Extra Space Storage’s Consistent Dividends Make it a Top Investment Choice

April 6, 2023

Trending News ☀️

Extra Space Storage ($NYSE:EXR) (ESS) is one of the leading providers of self-storage in the United States. With its commitment to superior customer service and innovative technology, ESS is a popular choice for both investors and customers alike. One of the reasons I love investing in Extra Space Storage is because of its consistent dividend yields. These dividends have grown steadily over time and provide investors with a reliable source of income. This dividend is paid out to shareholders monthly, making it an ideal choice for investors who are looking for a steady stream of income.

ESS is also committed to returning excess free cash flow to shareholders through regular share repurchases and special dividends. This commitment has made the company’s dividend even more attractive over time, proving to be one of the best investments available in the self-storage sector. In addition to its competitive dividend yields, ESS also offers investors the potential for capital gains. As a result, Extra Space Storage is an excellent investment choice that provides investors with a reliable source of income and the potential for capital appreciation.

Dividends – EXR dividend calculator

EXTRA SPACE STORAGE is a top investment choice due to its consistent dividend payments. Over the last three years, EXTRA SPACE STORAGE has issued annual dividends per share of 6.0 USD, making it a reliable long-term investment. Its dividend yields from 2022 to 2022 have been 3.27%, averaging a dividend yield of 3.27%.

This makes EXTRA SPACE STORAGE a great option for those seeking dividend stocks. If you are looking for a reliable dividend stock, EXTRA SPACE STORAGE is definitely worth considering.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for EXR. More…

| Total Revenues | Net Income | Net Margin |

| 1.92k | 859.49 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for EXR. More…

| Operations | Investing | Financing |

| 1.24k | -1.65k | 431.86 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for EXR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.17k | 8.09k | 24.34 |

Key Ratios Snapshot

Some of the financial key ratios for EXR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 53.9% |

| FCF Margin | ROE | ROA |

| – | – | – |

Stock Price

On Wednesday, its stock opened at $160.2 and closed at $160.0, a small but noticeable decrease of 0.1% from its prior closing price of $160.2. This small drop in share price has not hindered the company’s ongoing commitment to providing its shareholders with consistent dividend payments. This payout rate has been fairly stable over the last five years and provides investors with a reliable source of income. Furthermore, the company has steadily increased its dividend payments over the years, providing even more incentive for investors to buy and hold the stock.

Not only do investors receive regular income, they can also benefit from any price appreciation that their shares may experience over time. This makes Extra Space Storage an attractive option for both income-seeking investors and those looking for long-term capital gains. Live Quote…

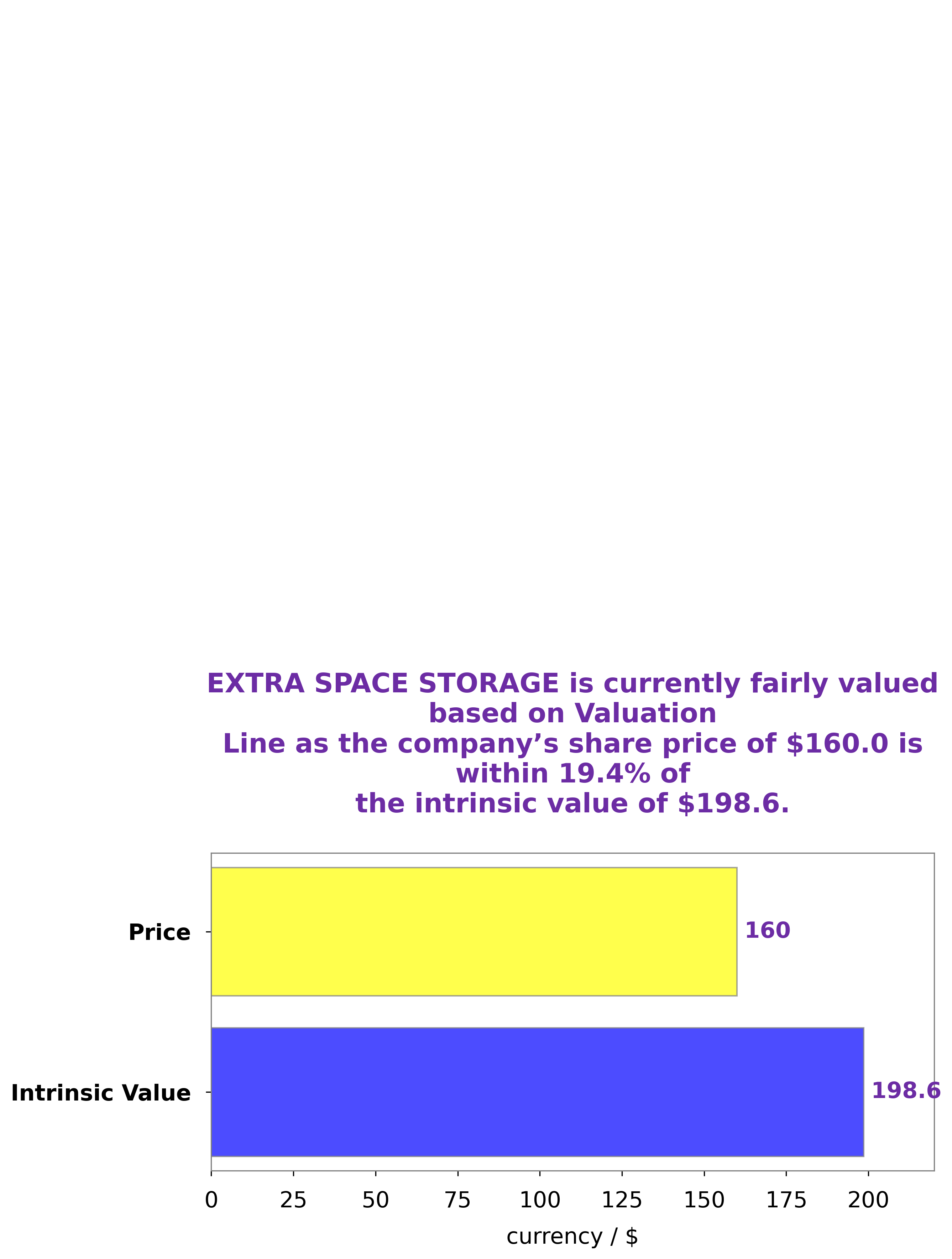

Analysis – EXR Intrinsic Value Calculator

At GoodWhale, we recently conducted an analysis of EXTRA SPACE STORAGE’s well-being. After a lengthy assessment, we concluded that the fair value of their share is around $198.6, which we calculated using our proprietary Valuation Line. Currently, EXTRA SPACE STORAGE stock is being traded at a price of $160.0 – significantly undervalued by 19.4%. Our conclusion is that this represents a great opportunity for investors to buy EXTRA SPACE STORAGE stocks while they are still undervalued. More…

Peers

Extra Space Storage Inc is one of the leading self-storage providers in the United States. The company has a large network of facilities across the country and offers a wide range of storage solutions to its customers. Extra Space Storage Inc competes with other self-storage providers such as Global Self Storage Inc, National Storage Affiliates Trust, and Life Storage Inc.

– Global Self Storage Inc ($NASDAQ:SELF)

Global Self Storage is a publicly traded real estate investment trust that owns, operates, and develops self storage properties. Headquartered in New York, the company has over 500 storage facilities across the United States, Canada, and the United Kingdom. Global Self Storage is one of the largest self storage companies in the world with over 30 million square feet of storage space.

– National Storage Affiliates Trust ($NYSE:NSA)

National Storage Affiliates Trust is a publicly traded real estate investment trust focused on the ownership, operation and acquisition of self storage properties located throughout the United States. The company has a market cap of $3.68 billion as of March 2022. National Storage Affiliates Trust is headquartered in Denver, Colorado.

– Life Storage Inc ($NYSE:LSI)

As of 2022, Life Storage Inc has a market cap of 8.69B. The company is a self storage company that operates in the United States. The company has over 850 locations in 38 states.

Summary

Extra Space Storage (NYSE: EXR) is a great dividend stock for investors due to its strong financials, consistent dividend payments, and above-average yield. The company also has a healthy balance sheet with over $1 billion in cash and no long-term debt. It is well-positioned for the long-term with its strong financials, consistent dividends, and potential for capital appreciation.

Recent Posts