Excel Cell Electronic dividend calculator – EXCEL CELL ELECTRONIC Co. Ltd. Declares 1.0 Cash Dividend

March 24, 2023

Dividends Yield

On March 10 2023, EXCEL CELL ELECTRONIC ($TWSE:2483) Co. Ltd. declared a 1.0 Cash Dividend. For the past three years, EXCEL CELL ELECTRONIC has been issuing annual dividends per share of 1.0 TWD. This puts their dividend yield for the period 2022 to 2023 at 4.27%, which is higher than the average dividend yield of 4.27%. The ex-dividend date for this dividend is March 30, 2023.

Investing in EXCEL CELL ELECTRONIC may thus be worth considering for those keen on dividend stocks, as they could generate positive returns from their investment with the dividend this company provides. Furthermore, investing in a such a stock can help to provide a steady income stream and act as a cushion to any market volatility.

Price History

The company’s stock opened at NT$26.8 and closed at NT$26.2, representing a 2.8% drop from the previous closing price of NT$27.0. This dividend declaration follows the company’s strong financial performance in the first quarter of this year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Excel Cell Electronic. More…

| Total Revenues | Net Income | Net Margin |

| 2.23k | 167.82 | 7.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Excel Cell Electronic. More…

| Operations | Investing | Financing |

| 329.75 | -340.42 | 220.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Excel Cell Electronic. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.53k | 1.91k | 23.89 |

Key Ratios Snapshot

Some of the financial key ratios for Excel Cell Electronic are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.6% | 84.0% | 10.7% |

| FCF Margin | ROE | ROA |

| -6.2% | 5.7% | 3.3% |

Analysis

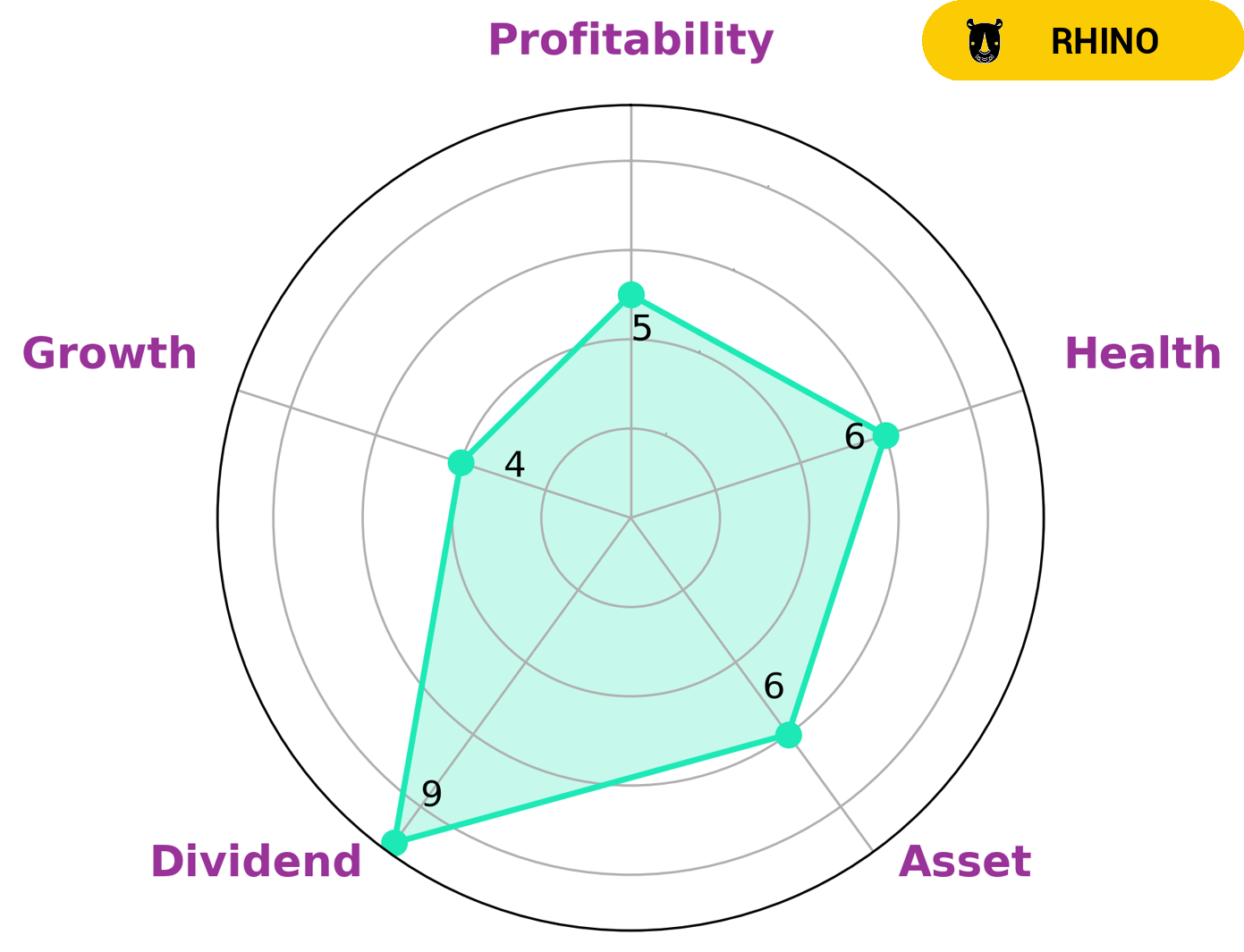

GoodWhale has conducted a financial analysis of EXCEL CELL ELECTRONIC and used its Star Chart to classify the company as a ‘rhino’, which is a type of company that has achieved moderate revenue or earnings growth. This type of company may attract investors who are looking for moderate and sustainable returns, as well as those who are interested in dividend payments. According to our analysis, EXCEL CELL ELECTRONIC is strong in dividend payments, and medium in terms of asset growth, profitability, and health score. The health score of 6/10 indicates that it is able to sustain future operations even in times of economic crisis. Therefore, investors who are looking for moderate and sustainable returns may find EXCEL CELL ELECTRONIC to be an attractive investment opportunity. More…

Peers

Excel Cell Electronic Co Ltd faces stiff competition from its rivals Sunyes Electronic Manufacturing (Guangdong) Holding Co Ltd, Arch Meter Corp, and XGD Inc in the consumer electronics market. Companies in this sector are constantly striving to produce cutting-edge products, deliver superior customer service, and offer competitive prices in order to stay ahead of the competition.

– Sunyes Electronic Manufacturing (Guangdong) Holding Co Ltd ($SZSE:002388)

Sunyes Electronic Manufacturing (Guangdong) Holding Co Ltd is a leading manufacturer and distributor of electronic products and services. As of 2023, the company has a market capitalization of 3.72 billion and a Return on Equity of 3.18%. Market capitalization is an indicator of the company’s value and size, while return on equity is an indicator of how efficiently the company is using investors’ money to generate profit. Sunyes Electronic Manufacturing (Guangdong) Holding Co Ltd has a strong market cap and ROE, making it a reliable and profitable investment.

– Arch Meter Corp ($TPEX:4588)

Amer Meter Corp is an energy measurement and management solutions provider. The company has a market cap of 2.38B as of 2023, reflecting a strong financial performance and indicative of its overall significance in the industry. Its Return on Equity (ROE) is a remarkable 24.88%, indicating that Amer Meter Corp is able to generate higher returns on its assets and equity than its peers. The company’s market cap and ROE demonstrate that it is well positioned to continue to be a leader in the energy measurement and management sector.

– XGD Inc ($SZSE:300130)

XGD Inc is a technology company headquartered in California. It is known for its innovative products, services, and solutions related to enterprise software, cloud computing, and data analytics. As of 2023, XGD Inc has a market capitalization of 9.53 billion dollars. This represents the total value of all XGD’s outstanding shares. XGD Inc also has a Return on Equity (ROE) of 8.32%, reflecting the company’s ability to generate a return on its shareholders’ equity. This is quite impressive, especially considering the competitive landscape that the company operates in. XGD Inc has been able to grow its market cap, while maintaining a healthy ROE, which speaks volumes of its financial health and performance.

Summary

EXCEL CELL ELECTRONIC is a company worth considering for those seeking dividend stocks, as it has issued annual dividends per share of 1.0 TWD for the past three years with a dividend yield of 4.27%. The average dividend yield of 4.27% for the period 2022 to 2023 is higher than the market average and indicates that the stock may generate consistent returns. Investors should research and analyze the company’s performance and fundamentals before investing and should also be aware of any potential risks associated with the stock.

Recent Posts