Enlink Midstream dividend yield – EnLink Midstream LLC Declares $0.125 Cash Dividend

April 21, 2023

Dividends Yield

ENLINK ($NYSE:ENLC): On April 20, 2023, EnLink Midstream LLC declared a $0.125 cash dividend to shareholders of record. EnLink Midstream is a great option for dividend investors, as it has consistently issued a dividend of 0.45 USD per share over the last 3 years, which is equivalent to an average dividend yield of 4.79%. The ex-dividend date for this most recent dividend is April 27. Given the consistent dividend yield and steady income stream, EnLink Midstream is an attractive option for investors seeking a reliable source of income. With its dividends, EnLink Midstream offers a variety of opportunities for long-term growth and a secure investment.

As such, it is an ideal choice for those who are looking for a steady return on their investment. Its portfolio includes liquids-focused midstream infrastructure, services, and solutions that connect producers to downstream energy markets. The company’s commitment to delivering strong dividends and steady performance makes it an attractive option for income-seeking investors.

Stock Price

Following the announcement, the stock opened at 10.2 and closed at 10.1, down 1.7% from its prior closing price. This marks the company’s twelfth consecutive quarterly cash dividend payment, as it continues its commitment to providing value to its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Enlink Midstream. More…

| Total Revenues | Net Income | Net Margin |

| 9.53k | 361.3 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Enlink Midstream. More…

| Operations | Investing | Financing |

| 1.05k | -773 | -279.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Enlink Midstream. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.65k | 5.74k | 2.79 |

Key Ratios Snapshot

Some of the financial key ratios for Enlink Midstream are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.4% | 17.6% | 6.8% |

| FCF Margin | ROE | ROA |

| 7.5% | 31.4% | 4.7% |

Analysis

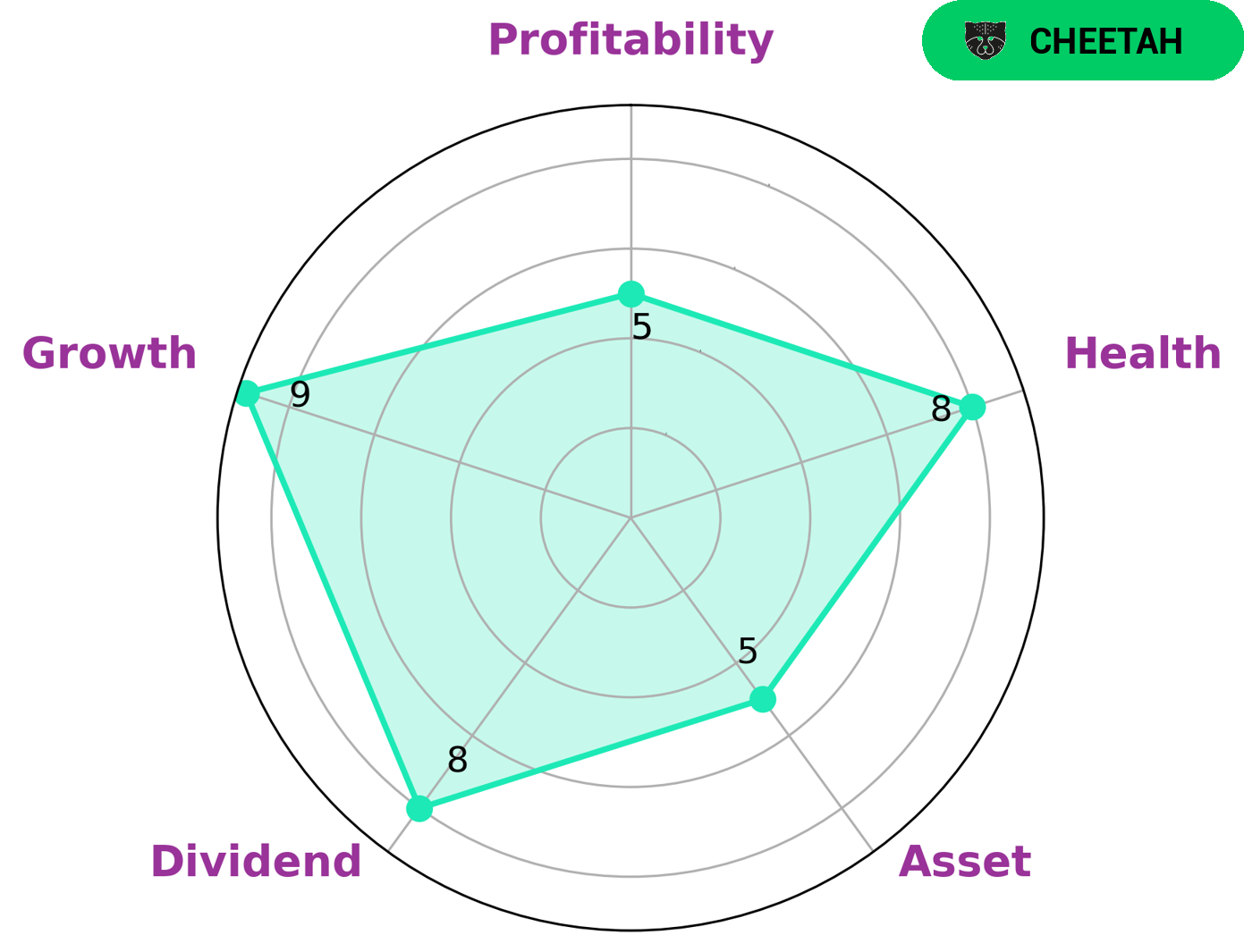

At GoodWhale, we conducted an analysis of ENLINK MIDSTREAM‘s fundamentals and classified them through our Star Chart. Surprisingly, ENLINK MIDSTREAM falls into the ‘cheetah’ category, which is a type of company that achieved high revenue or earnings growth in the past but is considered less stable due to low profitability. This type of company may be attractive to investors who value higher returns but with a greater degree of risk. In terms of financial health, ENLINK MIDSTREAM scores 8/10. This suggests that the company is capable of sustaining future operations in times of crisis, making it attractive to those investors who want to make sure their returns are secure. Finally, in terms of performance, ENLINK MIDSTREAM is strong in dividend and growth, and medium in asset and profitability. This indicates that the company is well-positioned to generate returns for investors while still being able to manage its risks appropriately. More…

Peers

The company has a large network of pipelines and facilities that span across the United States. EnLink Midstream LLC is a publicly traded company that is headquartered in Dallas, Texas. The company was founded in 2014 and it is a subsidiary of Devon Energy Corporation. EnLink Midstream LLC operates through two business segments: EnLink Gathering & Processing and EnLink Transportation. The company has a workforce of over 2,000 employees. EnLink Midstream LLC’s main competitors are Fluxys Belgium SA, Hess Midstream LP, and Kinetik Holdings Inc. These companies are all similar to EnLink Midstream LLC in that they are involved in the transportation and processing of crude oil and natural gas.

– Fluxys Belgium SA ($LTS:0Q7U)

Fluxys Belgium SA is a leading provider of gas transportation and storage services in Belgium. The company has a market capitalization of 2.23 billion and a return on equity of 14.4%. Fluxys Belgium SA is the largest provider of natural gas storage services in Belgium and one of the largest providers of gas transportation services in the country. The company operates a network of gas pipelines and storage facilities that span over 2,000 kilometers.

– Hess Midstream LP ($NYSE:HESM)

Hess Midstream LP is a midstream energy company that owns, operates, develops and acquires pipelines and other midstream assets. The company has a market cap of 1.2B as of 2022 and a Return on Equity of 208.88%. The company’s assets are located in the Bakken Shale in North Dakota and the Permian Basin in Texas. Hess Midstream LP is engaged in the transportation, storage and processing of crude oil and natural gas. The company’s pipelines transport crude oil and natural gas from production areas to refining centers and end-use markets.

Summary

EnLink Midstream is a solid option for dividend investors. With a consistent dividend of 0.45 USD per share over the last three years, the dividend yield has averaged 4.79%. This makes EnLink Midstream an attractive option for income-seeking investors.

Additionally, the company’s financials are sound, with a low debt-to-equity ratio, steady earnings growth over the past five years, and low volatility in the market. Overall, EnLink Midstream offers investors a reliable income stream and a secure investment opportunity.

Recent Posts