EFN dividend yield – Element Fleet Management Corp Announces 0.1 Cash Dividend

March 13, 2023

Dividends Yield

Element Fleet Management ($TSX:EFN) Corp recently announced a cash dividend of 0.1 CAD per share on March 7, 2023. This dividend continues a long-standing tradition of ELEMENT FLEET MANAGEMENT providing dividends to its shareholders, which in the past three years have been 0.31 CAD, 0.27 CAD and 0.2 CAD per share, resulting in dividend yields of 2.42%, 1.98% and 1.68% respectively with an average dividend yield of 2.03%. If you are looking to invest in dividend stocks, ELEMENT FLEET MANAGEMENT could be a good choice. The ex-dividend date for this dividend is set for March 30, 2023.

Share Price

The stock opened at CA$20.2 and closed at CA$19.6, representing an increase of 0.7% from the prior closing price of CA$19.4. This dividend is part of the company’s commitment to providing a strong return to its shareholders. The announcement of the dividend comes on the heels of a successful quarter for Element Fleet Management Corp, which has seen its overall stock market value rise significantly in recent months. As the company continues to invest in its fleet management services, the dividend serves as a tangible reward for those investing in the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for EFN. More…

| Total Revenues | Net Income | Net Margin |

| 1.96k | 381.57 | 21.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for EFN. More…

| Operations | Investing | Financing |

| 229.63 | -65.61 | -7.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for EFN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.33k | 10.65k | 9.38 |

Key Ratios Snapshot

Some of the financial key ratios for EFN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.0% | 6.7% | 28.2% |

| FCF Margin | ROE | ROA |

| 8.2% | 9.5% | 2.4% |

Analysis

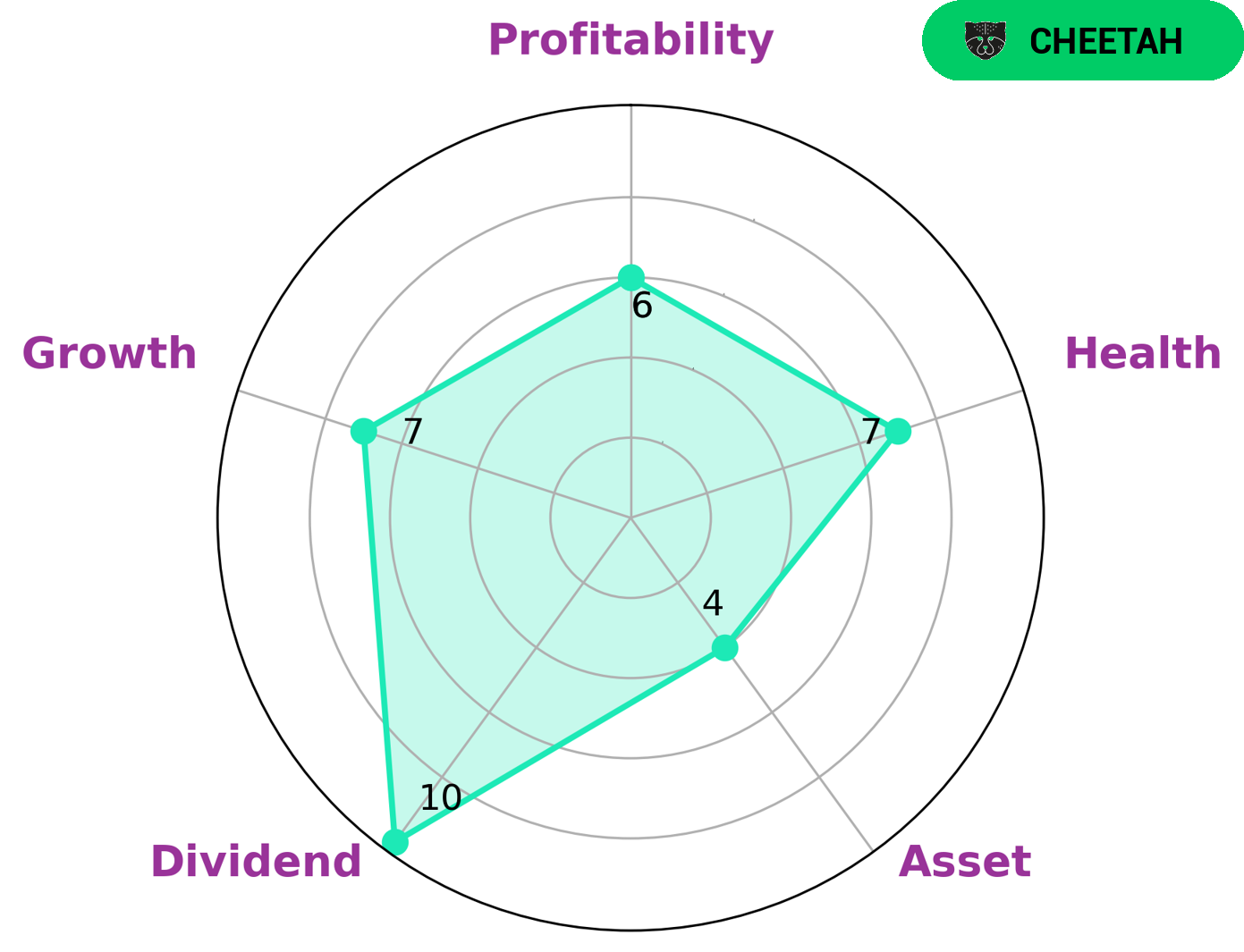

GoodWhale recently conducted an analysis of ELEMENT FLEET MANAGEMENT’s financials. Based on our Star Chart, ELEMENT FLEET MANAGEMENT is classified as a ‘cheetah’: a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. ELEMENT FLEET MANAGEMENT has a high health score of 7/10, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. When it comes to investment potential, ELEMENT FLEET MANAGEMENT has strengths in dividend, growth, and medium in asset and profitability. Thus, investors who are looking for capital appreciation and long-term growth may be interested in such company. We recommend that potential investors take into account the company’s financials, industry trends, and other factors before investing in ELEMENT FLEET MANAGEMENT. More…

Peers

It is a leader in the industry, offering innovative technology and comprehensive fleet management solutions. It is a leader amongst its competitors, RBG Holdings PLC, Thorn Group Ltd, and Tokyo Century Corp, all of which specialize in fleet management services.

– RBG Holdings PLC ($LSE:RBGP)

RBG Holdings PLC is a UK-based company that specializes in the engineering, design, and installation of professional audio and video systems for home, commercial, and broadcast applications. With a market cap of 46.24M as of 2023, the company has seen increased investors’ interests in its products and services. Its Return on Equity (ROE) of 11.07% helps it generate high returns from its equity investments, resulting in strong financial performance. RBG Holdings PLC is an attractive investment for investors, providing high returns and the potential for future growth.

– Thorn Group Ltd ($ASX:TGA)

Thorn Group Ltd. is an ASX listed company that provides consumer finance solutions to customers in need of short-term credit. With a market cap of 40.67M as of 2023, it has been able to maintain a strong position in the industry. Moreover, it has been able to generate a return on equity of 2.27%, which is indicative of the company’s strong financial health.

– Tokyo Century Corp ($TSE:8439)

Tokyo Century Corp is a Japan-based company that provides financial services and leasing solutions to a range of clients. It has a market capitalization of 583.51 billion as of 2023, making it one of the largest companies in the country. Its Return on Equity (ROE) is also impressive, coming in at 2.3%. This indicates a strong financial performance and suggests that the company is generating solid profits from its operations.

Summary

Element Fleet Management is a company that offers dividend-paying stocks to investors. Over the past three years, the company has offered an annual dividend of 0.31, 0.27 and 0.2 CAD per share, resulting in a dividend yield of 2.42%, 1.98% and 1.68% respectively, with an average yield of 2.03%. For those looking to invest in dividend stocks, Element Fleet Management may be an attractive option, offering competitive dividend yields compared to other stocks in the industry.

Recent Posts