EFN dividend – Element Fleet Management Announces 0.1 Cash Dividend

June 9, 2023

🌥️Dividends Yield

On June 1, 2023, Element Fleet Management ($TSX:EFN) announced a 0.1 cash dividend for its shareholders. This marks the third consecutive year that it has distributed a dividend yield of 2.19%, with 0.36 CAD, 0.33 CAD, and 0.27 CAD dividends per share in 2021, 2022, and 2023, respectively. If you are interested in investing in dividend stocks, ELEMENT FLEET MANAGEMENT could be an option for you – with the ex-dividend date set to be on June 29 2023.

This dividend is a great way to generate passive income while potentially benefitting from long-term growth. With a commitment to its shareholders, Element Fleet Management is a great investment for those seeking a reliable dividend stream.

Market Price

The announcement saw a slight increase of 0.4% in the stock’s closing price, with the stock opening at CA$20.6 and closing at CA$20.7 compared to the previous closing price of CA$20.6. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for EFN. More…

| Total Revenues | Net Income | Net Margin |

| 2.1k | 396.61 | 20.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for EFN. More…

| Operations | Investing | Financing |

| -474.32 | -68.9 | 805.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for EFN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.07k | 11.21k | 9.4 |

Key Ratios Snapshot

Some of the financial key ratios for EFN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.8% | 7.0% | 27.0% |

| FCF Margin | ROE | ROA |

| -26.0% | 9.6% | 2.3% |

Analysis – EFN Intrinsic Value Calculation

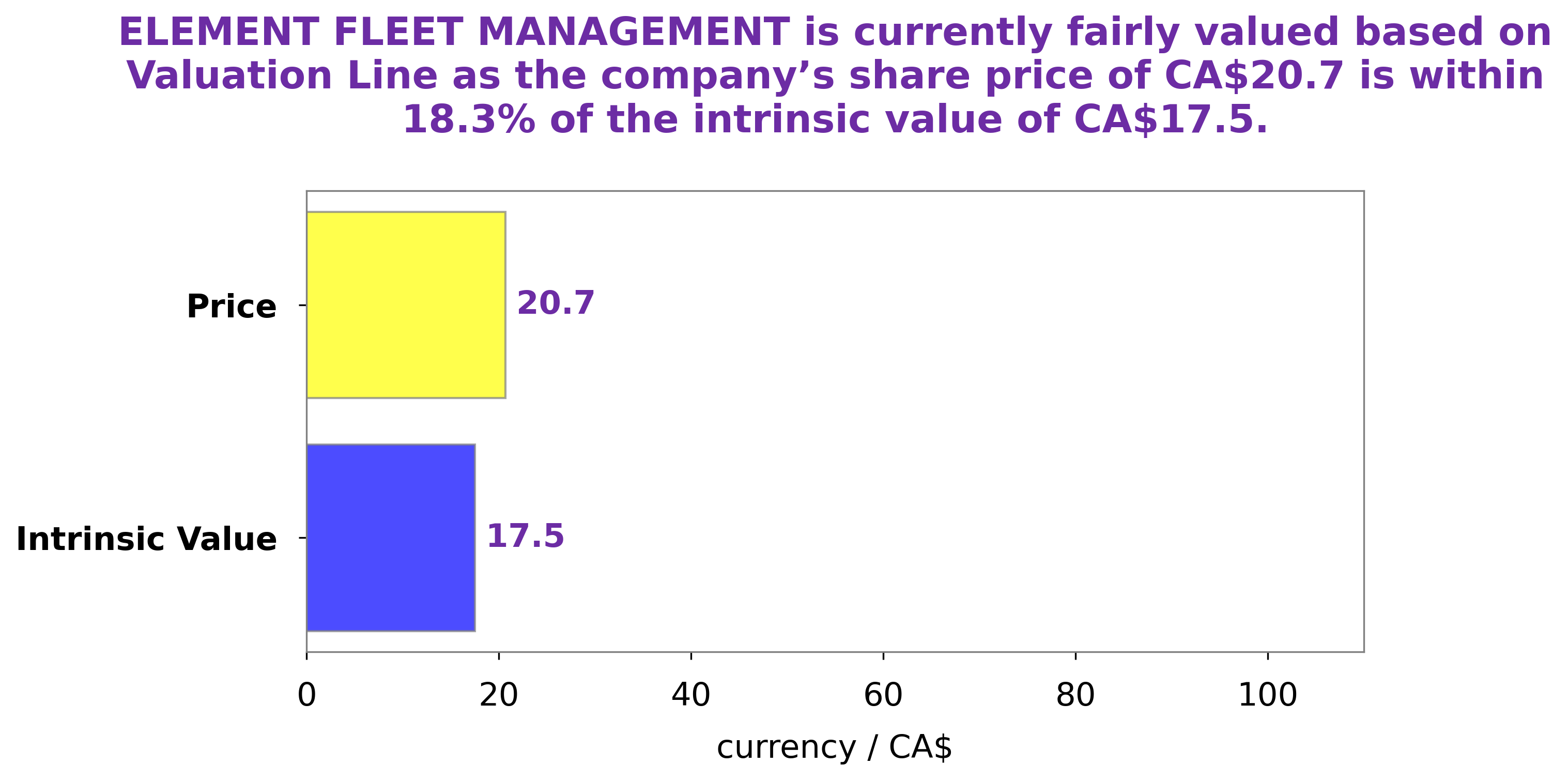

At GoodWhale, we analyze the financials of ELEMENT FLEET MANAGEMENT to provide investors with a comprehensive overview. After running our proprietary Valuation Line, we have determined that the intrinsic value of ELEMENT FLEET MANAGEMENT share is around CA$17.5. At the current market price of CA$20.7, the stock is fairly priced but overvalued by 18.4%. More…

Peers

It is a leader in the industry, offering innovative technology and comprehensive fleet management solutions. It is a leader amongst its competitors, RBG Holdings PLC, Thorn Group Ltd, and Tokyo Century Corp, all of which specialize in fleet management services.

– RBG Holdings PLC ($LSE:RBGP)

RBG Holdings PLC is a UK-based company that specializes in the engineering, design, and installation of professional audio and video systems for home, commercial, and broadcast applications. With a market cap of 46.24M as of 2023, the company has seen increased investors’ interests in its products and services. Its Return on Equity (ROE) of 11.07% helps it generate high returns from its equity investments, resulting in strong financial performance. RBG Holdings PLC is an attractive investment for investors, providing high returns and the potential for future growth.

– Thorn Group Ltd ($ASX:TGA)

Thorn Group Ltd. is an ASX listed company that provides consumer finance solutions to customers in need of short-term credit. With a market cap of 40.67M as of 2023, it has been able to maintain a strong position in the industry. Moreover, it has been able to generate a return on equity of 2.27%, which is indicative of the company’s strong financial health.

– Tokyo Century Corp ($TSE:8439)

Tokyo Century Corp is a Japan-based company that provides financial services and leasing solutions to a range of clients. It has a market capitalization of 583.51 billion as of 2023, making it one of the largest companies in the country. Its Return on Equity (ROE) is also impressive, coming in at 2.3%. This indicates a strong financial performance and suggests that the company is generating solid profits from its operations.

Summary

Element Fleet Management is an attractive option for investors seeking a consistent dividend yield. Over the last three years, Element Fleet Management has distributed an average dividend yield of 2.19%. In 2021, they paid out 0.36 CAD per share, followed by 0.33 CAD and 0.27 CAD in 2022 and 2023, respectively. Given their track record of reliable dividend payments, Element Fleet Management is a company to consider for long-term, passive income investments.

Recent Posts