Eastern Company stock dividend – Eastern Company Declares Quarterly Dividend of 11 Cents Per Share

May 2, 2023

Trending News ☀️

Eastern Company ($NASDAQ:EML), a publicly traded company on the stock market, recently announced that it will be paying out a regular quarterly cash dividend of 11 cents per share to its shareholders. This dividend will be paid out on June 15, 2019 and is part of the company’s ongoing commitment to its shareholders. It specializes in a range of products and services, from consumer goods to financial services. With its strong track record of success, the company has earned a reputation for providing high quality products and services to its customers. This dividend payout is just one of the many ways that Eastern Company demonstrates its commitment to its shareholders.

The company has also implemented a number of initiatives over the years that have helped to increase shareholder value. This includes introducing new products and services, expanding into new markets, and investing in research and development. Overall, this dividend payout is a sign of Eastern Company’s continued commitment to its shareholders. With a strong track record of success and a number of initiatives in place that help to increase shareholder value, this dividend payment is sure to make shareholders even more confident in the future of the company.

Dividends – Eastern Company stock dividend

Eastern Company has recently declared a quarterly dividend of 11 cents per share, representing a substantial increase from the previous three years. With this move, Eastern Company has demonstrated its commitment to rewarding shareholders with a steady return on their investment.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Eastern Company. More…

| Total Revenues | Net Income | Net Margin |

| 279.27 | 12.3 | 4.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Eastern Company. More…

| Operations | Investing | Financing |

| 10.46 | 5.09 | -11.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Eastern Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 261.52 | 134.91 | 20.35 |

Key Ratios Snapshot

Some of the financial key ratios for Eastern Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.5% | -9.6% | 6.0% |

| FCF Margin | ROE | ROA |

| 2.5% | 8.3% | 4.0% |

Share Price

This dividend is payable on June 15th to shareholders of record as of June 1st. The news of the dividend declaration had a positive effect on the stock price, with Eastern Company stock opening at $17.7 and closing at the same price. This represents a 1.8% increase from the previous closing price of $17.4. The dividend announcement has been welcomed by investors and is seen as positive news for the company’s prospects going forward. Live Quote…

Analysis

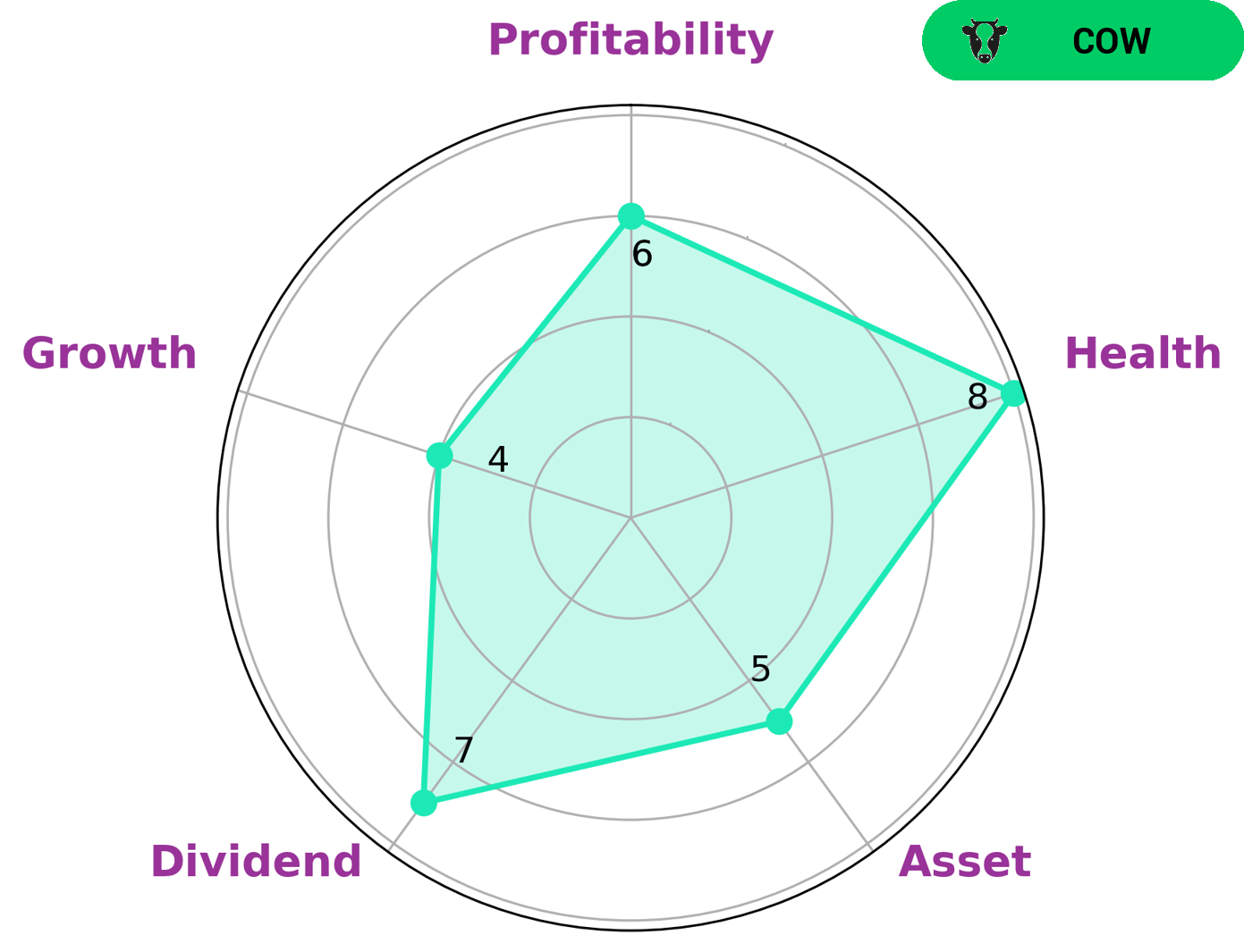

At GoodWhale, we analyzed the financials of EASTERN COMPANY and found that the company has a high health score of 8/10. This indicates that the company has a strong cashflow and debt structure, and is capable of riding out any crisis without the risk of bankruptcy. Our star chart also indicates that EASTERN COMPANY is strong in dividend, and medium in asset, growth, and profitability. Based on this, we classify EASTERN COMPANY as a ‘cow’, which is a type of company that has the track record of paying out consistent and sustainable dividends. Investors who are looking for a safe and reliable way to generate income from their investments may find EASTERN COMPANY to be an attractive option. More…

Peers

The Eastern Co and its competitors, Stanley Black & Decker Inc, Azkoyen SA, and Jiangsu Tongrun Equipment Technology Co Ltd, are all vying for a share of the market in the manufacturing industry. The Eastern Co has been in business for over 100 years and has a well-established reputation.

However, the other companies are all relatively new and are looking to make a name for themselves.

– Stanley Black & Decker Inc ($NYSE:SWK)

Stanley Black & Decker Inc is a leading global provider of tools and storage, commercial electronic security and engineered fastening systems. It has a market cap of 12.46B as of 2022 and a ROE of 4.45%. The company’s products are used in a variety of end markets, including construction, manufacturing, distribution, retail, food and beverage, healthcare, and government.

– Azkoyen SA ($LTS:0DOG)

Azkoyen SA is a Spanish company that manufactures vending machines and other related products. The company has a market cap of 153.59M as of 2022 and a Return on Equity of 11.63%. Azkoyen SA’s products are used in a variety of industries, including food and beverage, retail, and healthcare. The company has a strong presence in Europe and South America, and is expanding its operations into Asia and North America.

– Jiangsu Tongrun Equipment Technology Co Ltd ($SZSE:002150)

Jiangsu Tongrun Equipment Technology Co., Ltd. is engaged in the research, development, production and sale of metallurgical equipment and materials. The Company’s products include electric arc furnace (EAF), ladle refining furnace (LF), vacuum degassing furnace (VD), continuous casting machine (CCM), plate mill, hot rolling mill and cold rolling mill, among others. The Company operates its business in domestic market and overseas market.

Summary

Eastern Company is a viable investment for those seeking long-term growth. The company has declared a regular quarterly dividend of 11 cents per share, payable on June 15th. Financials indicate it is well-capitalized and has healthy cash flow.

In addition, the company has a history of achieving financial milestones and meeting investor expectations. Its core industry is also stable, making it a low-risk option. With strong growth potential and a steady dividend, Eastern Company is an attractive option for investors looking to build wealth in the long term.

Recent Posts