DEA dividend yield calculator – Easterly Government Properties: Unlocking the Potential of a High-Yielding Dividend Stock

April 4, 2023

Trending News 🌥️

Easterly Government Properties ($NYSE:DEA) (EGP) is a high-yielding dividend stock, currently offering a dividend yield of 7.71%. Investing in a dividend stock such as EGP can be an attractive option for investors looking for an income stream, but it is important to understand the risks involved before making any decisions. These properties range from industrial to office buildings and warehouses, among others. In addition, its balance sheet is bolstered by a high occupancy rate and long-term government lease agreements, making it an attractive option for investors seeking stable income streams.

However, there are certain risks investors should be aware of before investing in EGP stock. For instance, EGP’s properties are concentrated in a small number of metropolitan areas, making them vulnerable to local economic downturns.

In addition, its reliance on government tenants means that its rent revenues can be adversely affected by fluctuations in the federal budget. Despite the risks associated with investing in EGP stock, it offers attractive returns and the potential to be a successful long-term investment. However, it is important to do thorough research and consider all potential risks before making any investments.

Dividends – DEA dividend yield calculator

Over the last three years, the company has maintained a steady dividend per share of $1.06 annually. This dividend yield of 5.54% over the 2022-2022 timeframe is attractive for investors looking for a high-yielding dividend stock. Furthermore, Easterly has a solid portfolio of properties with a long-term lease structure in place with U.S. government tenants, providing a reliable and consistent revenue stream.

Despite this, the company remains undervalued in the market, providing an additional incentive for investors interested in its stock. With these strong fundamentals in place, Easterly Government Properties is poised to become an even more attractive dividend stock option in the future.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for DEA. More…

| Total Revenues | Net Income | Net Margin |

| 293.61 | 30.93 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for DEA. More…

| Operations | Investing | Financing |

| 125.94 | -69.1 | -59.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for DEA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.83k | 1.42k | 13.71 |

Key Ratios Snapshot

Some of the financial key ratios for DEA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 24.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Share Price

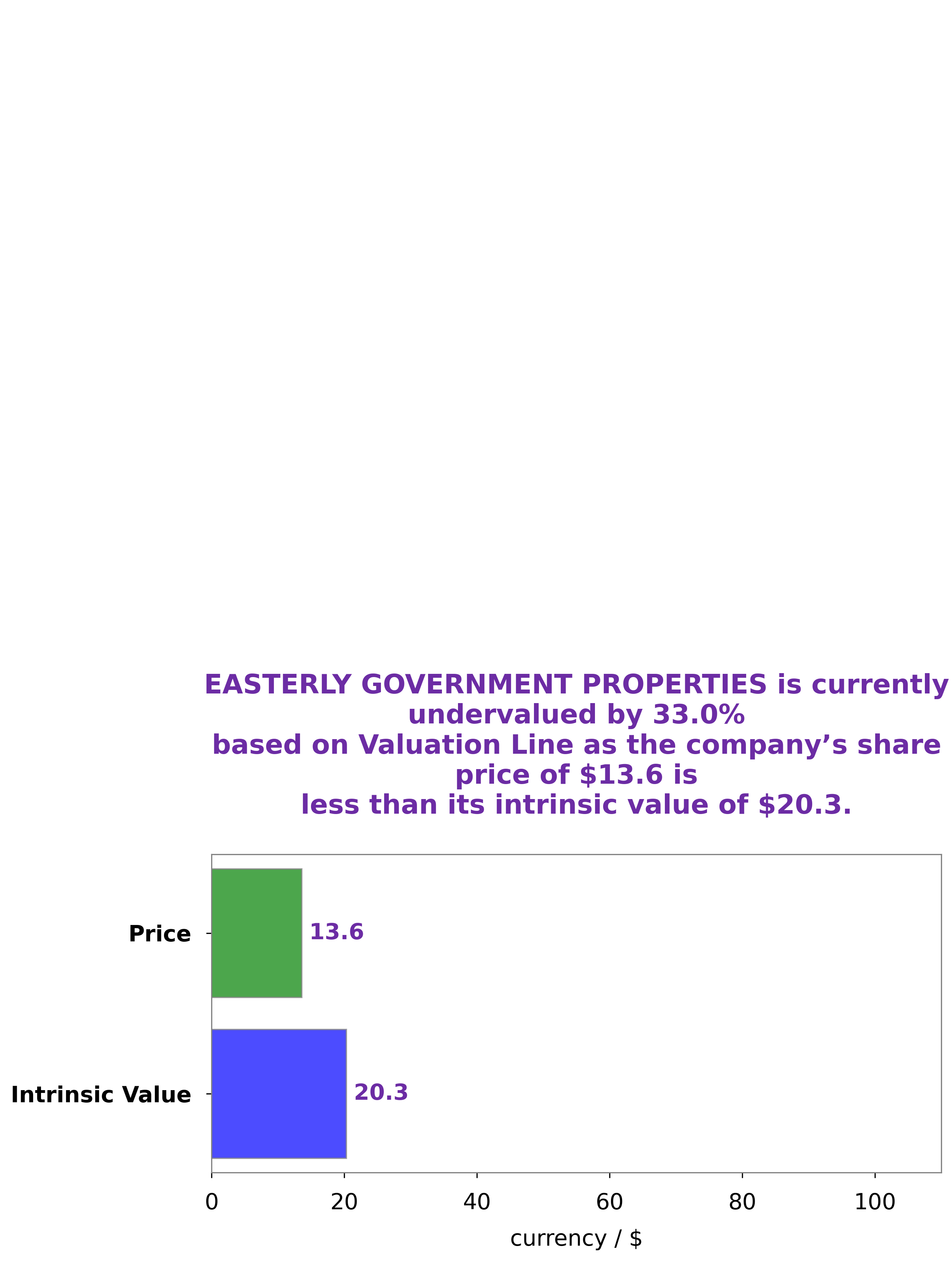

On Monday, the stock opened at $13.8 and closed at $13.6, representing a slight 0.9% decrease from its last closing price of 13.7. This slight dip in price could be an ideal opportunity for investors to buy in at a lower cost and take advantage of EASTERLY GOVERNMENT PROPERTIES’ high-yielding dividend. Investors should also be aware of the potential upside of this stock, as it can provide a steady stream of income while also increasing in value over time. For those looking to add a secure and reliable dividend stock to their portfolio, EASTERLY GOVERNMENT PROPERTIES may be worth considering. Live Quote…

Analysis – DEA Intrinsic Value

GoodWhale recently conducted an analysis of EASTERLY GOVERNMENT PROPERTIES’ wellbeing. After conducting a thorough assessment, we determined that their fair value share is around $20.3, which is calculated using our proprietary Valuation Line. Currently, EASTERLY GOVERNMENT PROPERTIES’ stock is traded at $13.6, representing an undervaluation of 32.9%. We believe that this undervaluation presents a great opportunity for investors to capitalize on the potential upside. More…

Peers

Government Properties Income Trust is a real estate investment trust that owns and operates U.S. federal, state, and local government facilities. The company was founded in 2009 and is headquartered in Boston, Massachusetts. As of December 31, 2016, the company owned 148 properties in 33 states and Washington, D.C.

– Seritage Growth Properties ($NYSE:SRG)

Heritage Growth Properties is a publicly traded real estate investment trust that owns, operates, and develops high-quality, well-occupied office properties in the United States. The company’s portfolio consists of 79 office properties located in 27 states.

– Medalist Diversified REIT Inc ($NASDAQ:MDRR)

Diversified REIT Inc is a real estate investment trust that owns, operates, and develops a portfolio of properties in the United States. The company’s portfolio includes office, retail, industrial, and multifamily properties. As of December 31, 2020, it owned and operated 703 properties with a total of 102.4 million square feet of space.

– Deutsche Konsum REIT-AG ($LTS:0RDE)

Deutsche Konsum REIT-AG is a Germany-based company that focuses on the retail sector. The company invests in shopping centers and retail parks. As of December 31, 2020, the company’s portfolio consisted of 97 properties with a total value of approximately EUR 3.6 billion.

Summary

Easterly Government Properties is a REIT that invests in government-leased buildings, providing investors with a 7.71% dividend yield. In order to evaluate the safety of the dividend, investors should consider the company’s financials, including its debt-to-equity ratio, current ratio, cash flow, and occupancy rate. Moreover, investors should pay attention to the company’s projected earnings growth, as well as the overall strength of the sector it operates in.

Additionally, they should consider the potential risks associated with investing in REITs, such as interest rate risk and regulatory changes. By performing a thorough analysis of Easterly Government Properties, investors can make an informed decision on whether the 7.71% dividend yield is safe.

Recent Posts