D.UN dividend – Dream Office Real Estate Investment Trust Declares 4.55 Special Dividend

June 10, 2023

☀️Dividends Yield

Dream Office Real ($TSX:D.UN) Estate Investment Trust (DREAM OFFICE) recently declared a special dividend of 4.55 CAD per share for its shareholders on June 1 2023. This dividend is the highest that the trust has ever issued since its establishment in 2021. For investors looking for a dividend stock to add to their portfolio, DREAM OFFICE is an option worth considering. Over the last three years, DREAM OFFICE has consistently issued dividends per share of 1.0 CAD and has seen yields of 5.51%, 4.8%, and 4.5% in 2021, 2022, and 2023 respectively, with an average yield of 4.94%.

With the recent declaration of an even higher dividend, investors can expect even higher yields in the coming years. The ex-dividend date for this stock is June 15 2023 which means that investors need to purchase it before this date in order to be eligible to receive the special dividend. Thus, investors should consider investing in DREAM OFFICE soon if they want to benefit from the special dividend and its long-term potential.

Price History

The stock opened and closed at CA$14.5, a testament to the confidence that investors have in the company. Investors can expect more value to be created by Dream Office Real Estate Investment Trust in the coming quarters as the company continues to focus on investment opportunities and generate solid returns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for D.UN. More…

| Total Revenues | Net Income | Net Margin |

| 194.86 | 12.74 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for D.UN. More…

| Operations | Investing | Financing |

| 68.05 | 125.5 | -189.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for D.UN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.93k | 1.43k | 33.23 |

Key Ratios Snapshot

Some of the financial key ratios for D.UN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 48.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – D.UN Intrinsic Value Calculation

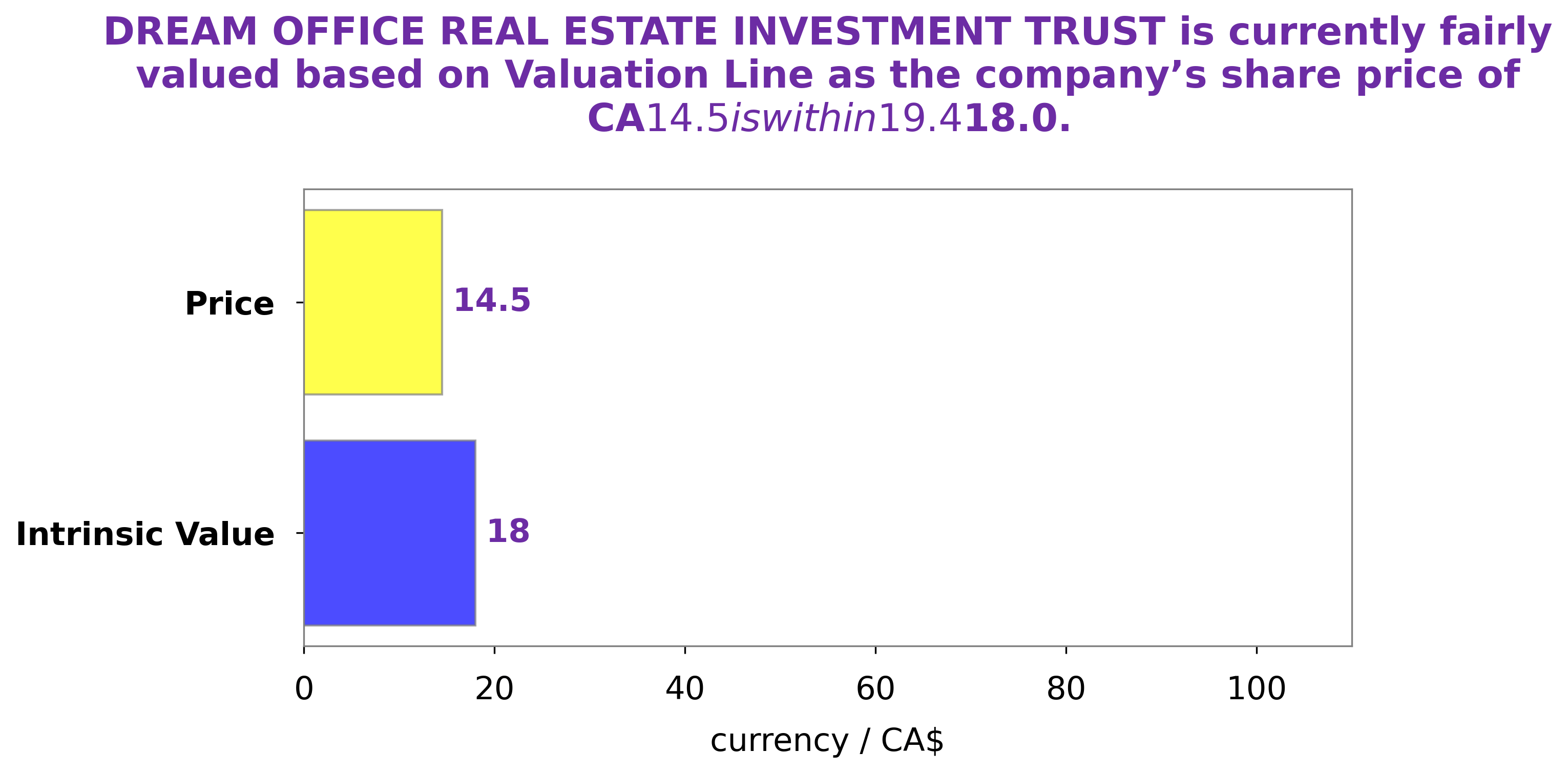

At GoodWhale, we believe that a thorough analysis of DREAM OFFICE REAL ESTATE INVESTMENT TRUST fundamentals should be the foundation of any investor’s decision making process. Our proprietary Valuation Line analysis has calculated the intrinsic value of DREAM OFFICE REAL ESTATE INVESTMENT TRUST shares to be around CA$18.0. At the time of writing, DREAM OFFICE REAL ESTATE INVESTMENT TRUST stock is trading at just CA$14.5, presenting a fair opportunity as it is undervalued by 19.5%. More…

Peers

It competes against Brandywine Realty Trust, Douglas Emmett Inc, and Derwent London PLC for the attention of investors, tenants, and landlords alike. Each of these companies bring their own unique approach to the commercial real estate market and strive to offer the best service and value in order to remain competitive.

– Brandywine Realty Trust ($NYSE:BDN)

Brandywine Realty Trust is a publicly traded real estate investment trust focused on the ownership, management, development, and redevelopment of office, industrial and retail properties in the United States. As of 2023, the company has a market cap of 1.11 billion USD. Brandywine Realty Trust is a leading regional developer and operator of office, industrial, and retail properties in the Mid-Atlantic region. With more than 21 million square feet of office, retail, and industrial properties, the company is well-positioned to capitalize on the changing needs of its tenants and meet the demands of an ever-evolving market. The company’s portfolio of high-quality, well-located assets has enabled it to achieve strong financial metrics and generate attractive returns for its shareholders.

– Douglas Emmett Inc ($NYSE:DEI)

Douglas Emmett Inc is a real estate investment trust (REIT) with a market cap of 2.89B as of 2023. It is an owner, operator, and developer of office and multifamily properties located in California, Hawaii, and the New York Metropolitan area. The company’s portfolio consists of over 140 office and multifamily properties with approximately 31 million square feet of space. Douglas Emmett primarily focuses on investing in existing properties, improving existing properties, and developing new properties. The company has a diversified tenant base with a variety of industries such as technology, entertainment, financial services, and healthcare. Douglas Emmett strives for sustainable growth through long-term strategic investments that produce returns for its shareholders.

– Derwent London PLC ($LSE:DLN)

Derwent London PLC is a real estate investment trust (REIT) listed on the London Stock Exchange that owns and manages a portfolio of commercial properties located in London. As of 2023, Derwent London PLC has a market capitalization of 2.93 billion pounds, making it one of the largest REITs in the UK. The company’s portfolio consists of office, retail, industrial and residential properties, and it primarily focuses on leasing and developing its properties to generate income from rent payments. Derwent London PLC also has a range of development projects in the pipeline, which are expected to add value to its portfolio over the long term.

Summary

DREAM OFFICE REAL ESTATE INVESTMENT TRUST is an attractive option for dividend investing. Analysts are generally positive about the stock, citing its high dividend yield as a major advantage. Given its dividend track record, this could be a great pick for investors seeking reliable dividend income.

Recent Posts