Cubesmart dividend yield – Fight Inflation with CubeSmart and Mid-America Apartment REITs, Both of Which are Increasing Dividends

December 16, 2023

🌧️Trending News

CUBESMART ($NYSE:CUBE): In the current economic climate, one of the biggest challenges facing investors is finding ways to fight inflation. Luckily, there are a few options available that can help. One option is to invest in CubeSmart and Mid-America Apartment REITs, both of which have recently increased their dividend payments. CubeSmart is a publicly-traded real estate investment trust focused on the self-storage industry.

Mid-America Apartment Communities is another publicly-traded REIT focused on the multifamily real estate sector. It too has seen strong growth in recent years, resulting in an increase in its dividend payments. Both companies have demonstrated consistent growth over the past few years, and their recent dividend increases are a sign of further success in the future.

Dividends – Cubesmart dividend yield

Over the last three years, CUBESMART has issued an annual dividend per share of 1.96, 1.78, and 1.45 USD, with dividend yields from 2021 to 2023 of 4.47%, 4.04%, and 3.17%. This averages out to a dividend yield of 3.89%, which allows investors to benefit from the increased dividends while fighting inflation. If you are keen on dividend stocks as a way to combat inflation, CUBESMART could be an option worth considering.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cubesmart. CubeSmart_and_Mid-America_Apartment_REITs_Both_of_Which_are_Increasing_Dividends”>More…

| Total Revenues | Net Income | Net Margin |

| 1.05k | 379.95 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cubesmart. CubeSmart_and_Mid-America_Apartment_REITs_Both_of_Which_are_Increasing_Dividends”>More…

| Operations | Investing | Financing |

| 610.11 | -72.37 | -536.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cubesmart. CubeSmart_and_Mid-America_Apartment_REITs_Both_of_Which_are_Increasing_Dividends”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.23k | 3.36k | 12.48 |

Key Ratios Snapshot

Some of the financial key ratios for Cubesmart are shown below. CubeSmart_and_Mid-America_Apartment_REITs_Both_of_Which_are_Increasing_Dividends”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 45.3% |

| FCF Margin | ROE | ROA |

| – | – | – |

Stock Price

On Friday, CUBESMART stock opened at $45.5 and closed at $45.2, down by 0.5% from the previous closing price of 45.5. Both companies recently declared an increase in dividends to their shareholders. CubeSmart is a real estate investment trust that specializes in self-storage properties. This represents an increase of 3% from the previous quarter’s dividend. Live Quote…

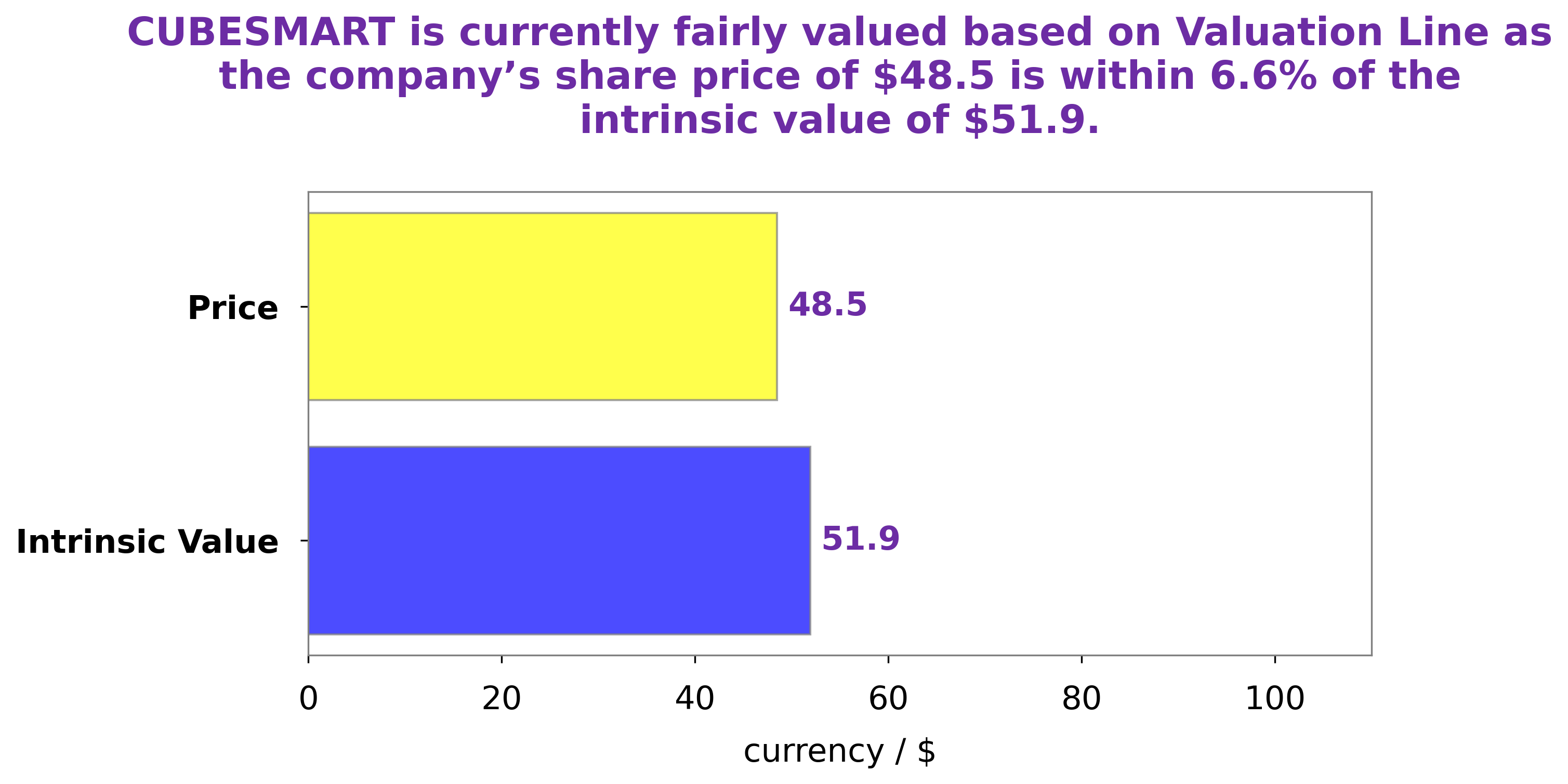

Analysis – Cubesmart Intrinsic Value Calculator

At GoodWhale, we have conducted an in-depth analysis of CUBESMART’s financials. Our proprietary Valuation Line has determined the fair value for CUBESMART stock to be around $39.0. Currently, CUBESMART shares are trading at $45.2, meaning that the stock is presently overvalued by 15.8%. We believe that this overvaluation does not accurately reflect the fundamentals of the company, and may be unsustainable in the long term. CubeSmart_and_Mid-America_Apartment_REITs_Both_of_Which_are_Increasing_Dividends”>More…

Peers

CubeSmart is in the business of self-storage. Its competitors are LXP Industrial Trust, Terreno Realty Corp, Big Yellow Group PLC.

– LXP Industrial Trust ($NYSE:LXP)

LXP Industrial Trust is a publicly traded real estate investment trust that owns and operates a portfolio of light industrial properties in the United States. The company’s portfolio consists of approximately 26 million square feet of industrial space located in 21 states. LXP Industrial Trust is headquartered in Dallas, Texas.

– Terreno Realty Corp ($NYSE:TRNO)

Terreno Realty Corp is a real estate investment trust that primarily acquires, owns, and operates industrial properties in key logistics markets in the United States. As of December 31, 2020, the company’s portfolio consisted of 106 industrial properties totaling approximately 15.4 million square feet of leasable space.

– Big Yellow Group PLC ($LSE:BYG)

Big Yellow Group PLC is a United Kingdom-based self-storage company. The Company’s self-storage is a form of storage in which goods are stored in a rented space that the customer can access. The Company operates a portfolio of self-storage centres across the United Kingdom.

Summary

CubeSmart is a real estate investment trust (REIT) that offers investors an attractive way to combat inflation through dividend hikes. The company focuses on the self-storage sector, and provides storage solutions for a variety of customers across the United States. Its strong balance sheet, steady portfolio of investments, and diversified portfolio of customers make CubeSmart an appealing option for investors looking for a reliable source of income. As demand for storage solutions continues to rise, CubeSmart is well-positioned to continue delivering attractive dividends to investors.

Recent Posts