Crescent Energy dividend calculator – Crescent Energy Co. Declares 0.12 Cash Dividend

June 10, 2023

☀️Dividends Yield

Crescent Energy ($NYSE:CRGY) Co. has declared a cash dividend of 0.12 USD per share on June 8 2023. This makes it a great option for investors looking for dividend yielding stocks. Over the past two years, Crescent Energy Co. has issued annual dividend per share of 0.68 USD and 0.63 USD, which have produced dividend yields of 4.95% and 4.24%, respectively, with an average yield of 4.6%.

The ex-dividend date for this dividend is May 23 2023. The announcement of this dividend makes Crescent Energy Co. an attractive investment for value investors due to its strong and consistent dividend payments over the past two years.

Price History

Following this announcement, CRESCENT ENERGY stock opened at $10.4 and closed at $10.3, down by 1.2% from its prior closing price of 10.4. This dividend payout is seen as a positive step forward for the company, as it indicates a commitment to rewarding its shareholders and providing long-term value for its stakeholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Crescent Energy. More…

| Total Revenues | Net Income | Net Margin |

| 3.05k | 241.47 | 8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Crescent Energy. More…

| Operations | Investing | Financing |

| 1.12k | -606.06 | -613.03 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Crescent Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.11k | 2.59k | 18.67 |

Key Ratios Snapshot

Some of the financial key ratios for Crescent Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 41.1% | 84.7% | 43.5% |

| FCF Margin | ROE | ROA |

| 13.4% | 94.7% | 13.6% |

Analysis

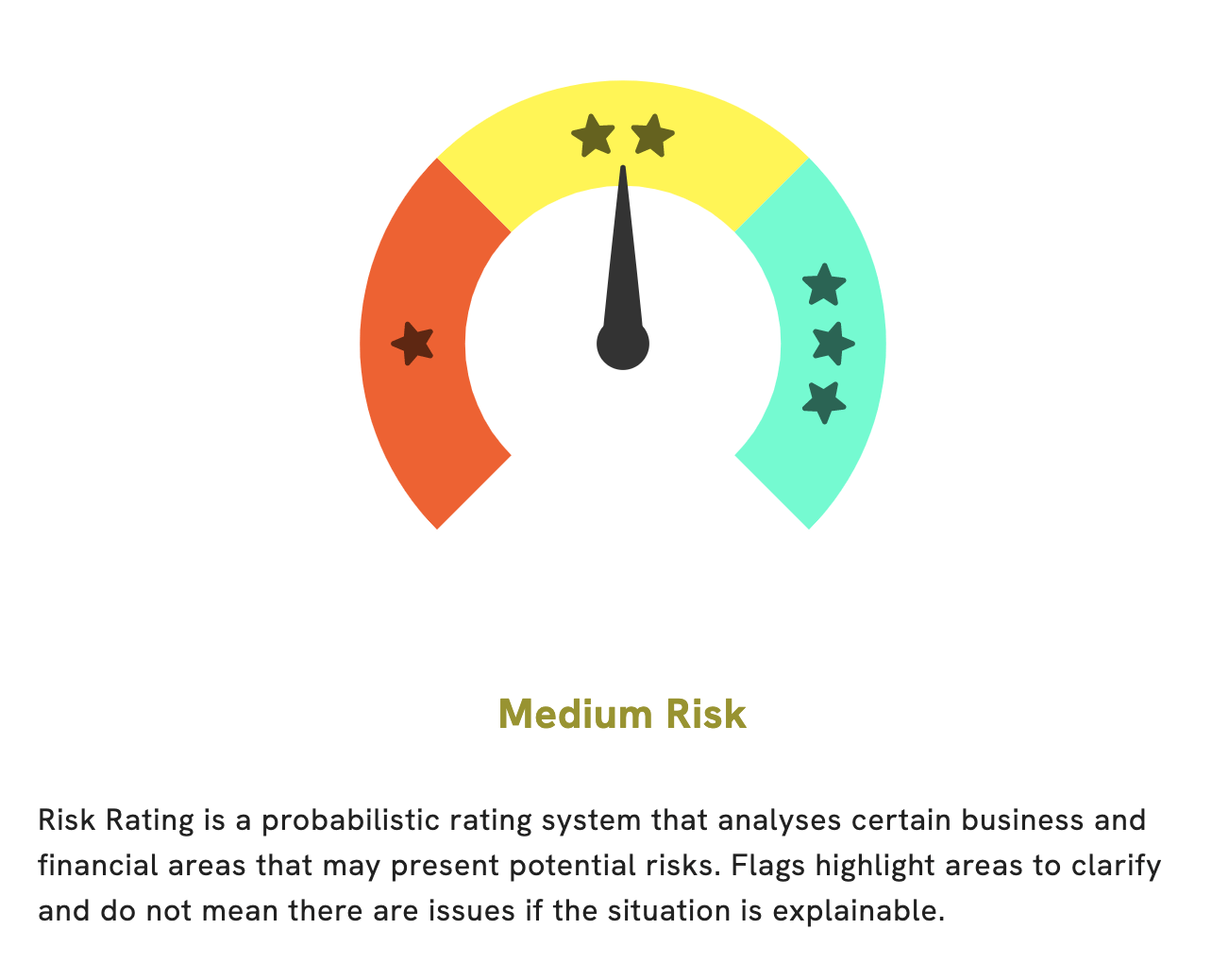

At GoodWhale, we’ve completed a financial analysis of CRESCENT ENERGY and have come to the conclusion that it is a medium risk investment. This means that while there are some risks associated with investing in CRESCENT ENERGY, the rewards could potentially outweigh the risks. We’ve also detected three risk warnings in their income sheet, balance sheet, and cashflow statement. When you register with us, you can access our full report and check out these warnings for yourself. Our report contains comprehensive information on the financial health of CRESCENT ENERGY, giving you a better understanding of what you’re getting yourself into. Ultimately, it’s up to you to decide if the potential rewards of investing in CRESCENT ENERGY are worth the risks. With our help, though, you can make an informed decision. More…

Peers

The competition between Crescent Energy Co and its competitors, Valero Energy Corp, Alpine Summit Energy Partners Inc, and AXP Energy Ltd, is fierce. All four companies are vying to provide the best energy solutions to their customers, and they are constantly innovating in order to stay ahead of the competition. With cutting-edge technology and a commitment to sustainability, all four companies are striving to be the best in the industry.

– Valero Energy Corp ($NYSE:VLO)

Valero Energy Corp is a Fortune 500 company and one of the largest refiners, marketers and transporters of refined products in the United States. As of 2023, the company has a market cap of 49.57B, which is a reflection of its strong financial performance and business model. Valero Energy Corp also boasts a Return on Equity (ROE) of 37.64%, demonstrating its ability to efficiently generate profits from the capital invested by shareholders.

– Alpine Summit Energy Partners Inc ($TSXV:ALPS.U)

Alpine Summit Energy Partners Inc is a publicly traded energy company that engages in the exploration, development, and production of oil and gas properties. Its portfolio includes assets located in the United States, Canada, and Mexico. The company’s market cap stands at 181.5M as of 2023, making it the 8th largest publicly traded energy company on the US stock market. It also has an impressive Return on Equity of 422.51%, which is significantly higher than the industry average of 11.60%. This shows that Alpine Summit has been able to efficiently utilize its resources and generate substantial returns for its shareholders.

– AXP Energy Ltd ($ASX:AXP)

AXP Energy Ltd is a leading energy company that provides energy solutions for both residential and commercial customers. The company has a market capitalization of 23.3M as of 2023, reflecting its strong financial performance. The Return on Equity (ROE) of 4.89% is a measure of how well the company is using the money invested by shareholders to generate profits. AXP Energy Ltd focuses on delivering reliable and affordable energy solutions to its customers, helping them to save money on their energy bills and reduce their carbon footprint. The company’s commitment to providing quality energy services and achieving sustainable growth and development makes it an attractive investment option.

Summary

Investing in Crescent Energy could be a wise investment for dividend seekers. The company has a market capitalization of over $3 billion and its stock price has been consistently growing. This makes it an attractive option for conservative investors. Overall, Crescent Energy offers solid fundamentals and strong dividend yields, making it a great choice for dividend investors.

Recent Posts