Cno Financial dividend yield – CNO Financial Group Inc Declares 0.14 Cash Dividend

March 19, 2023

Dividends Yield

On March 1 2023, CNO Financial Group Inc declared a 0.14 cash dividend. With stable dividends and competitive yields, CNO FINANCIAL ($NYSE:CNO) is a great option for those looking for a dependable dividend stock.

Stock Price

The stock opened at $25.5 and closed at $25.6, representing a 0.1% gain from the prior closing price of 25.6. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cno Financial. More…

| Total Revenues | Net Income | Net Margin |

| 3.58k | 396.8 | 11.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cno Financial. More…

| Operations | Investing | Financing |

| 495.4 | -1.78k | 1.2k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cno Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 33.34k | 31.94k | 12.25 |

Key Ratios Snapshot

Some of the financial key ratios for Cno Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.8% | – | 18.3% |

| FCF Margin | ROE | ROA |

| 13.9% | 30.3% | 1.2% |

Analysis

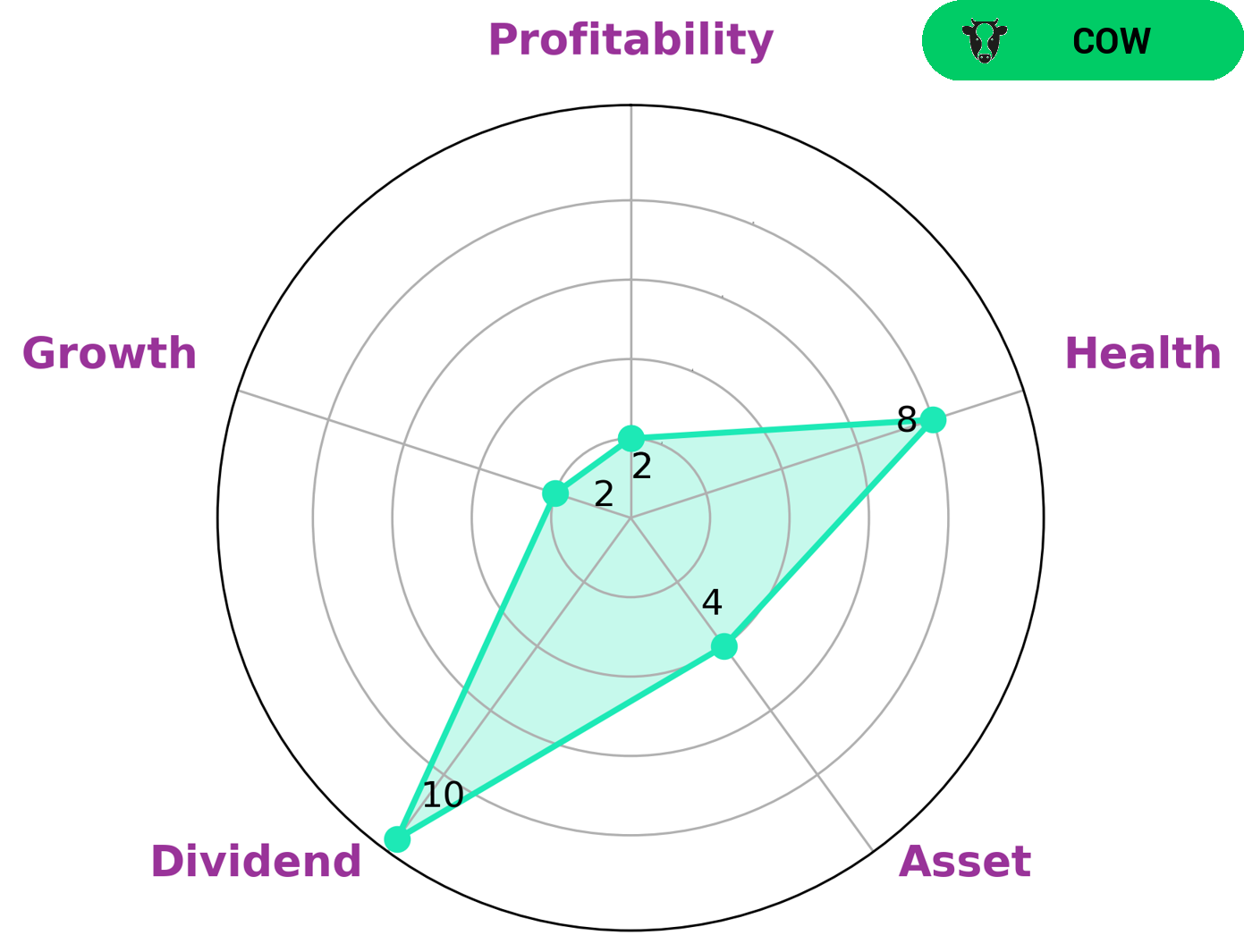

As part of our analysis of CNO FINANCIAL‘s financials, GoodWhale used Star Chart to assess the company’s performance. Using this tool, we found that CNO FINANCIAL is strong in dividend, medium in asset and weak in growth and profitability. The company scored an 8/10 on our health score, indicating that it is able to pay off debt and fund future operations. Based on this assessment, we have classified CNO FINANCIAL as a ‘cow’ – a type of company we have determined pays out consistent and sustainable dividends. We believe that this type of company may be of interest to investors looking for a stable source of income. More…

Peers

Its competitors are National Western Life Group Inc, Wustenrot & Wurttembergische AG, and iA Financial Corp Inc.

– National Western Life Group Inc ($NASDAQ:NWLI)

National Western Life Group Inc is a holding company that operates through its subsidiaries engaged in the life insurance business. Its products include whole life, term life, universal life, and annuities. The company was founded in 1906 and is headquartered in Austin, Texas.

– Wustenrot & Wurttembergische AG ($LTS:0GJN)

Wustenrot & Wurttembergische AG is a German mutual insurance company headquartered in Stuttgart. As of 2022, it had a market capitalization of €1.44 billion and a return on equity of 14.21%. The company provides a range of insurance products, including life, health, property and casualty, and pension products, as well as banking and investment products.

– iA Financial Corp Inc ($TSX:IAG)

AmeriA Financial Corp Inc has a market cap of 7.68B as of 2022. The company has a Return on Equity of 9.41%. AmeriA Financial Corp Inc is a provider of insurance and financial services. The company offers a range of products and services, including life insurance, annuities, and investments.

Summary

Investing in CNO FINANCIAL is a low-risk venture due to the company’s impressive track record of consistently issuing a dividend of 0.55 USD per share over the past three years. This dividend has yielded a steady return of 2.52% annually, making it an attractive long-term investment opportunity for those who are looking for a reliable source of income. Additionally, CNO FINANCIAL may also provide capital appreciation opportunities depending on market conditions, making it a beneficial choice for those looking to diversify their portfolio.

Recent Posts