Ck Asset dividend yield calculator – CK Asset Holdings Ltd Announces Dividend of 1.85 Per Share

May 26, 2023

Dividends Yield

On May 25 2023, CK Asset Holdings Ltd announced a dividend of 1.85 per share. This dividend marks the 3rd year of consecutive dividends from the company, with an annual dividend per share of 2.22 HKD being distributed for the past three years. This is a yield of 4.23% from 2022 to 2023, making it a relatively safe and attractive dividend stock for investors. The ex-dividend date for this dividend payment is on May 23, 2023, meaning those who purchase prior to this date are eligible to receive the dividend.

If you’re looking for a reliable dividend stock to invest in, CK ASSET ($SEHK:01113) may be a good option to consider. With the upcoming ex-dividend date, investors should act soon to ensure they can take part in this dividend payment.

Share Price

Following the announcement, the stock of CK ASSET opened on Thursday at HK$43.2 and closed the day at HK$43.1, down by 1.0% from the prior closing price of HK$43.6. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ck Asset. More…

| Total Revenues | Net Income | Net Margin |

| 56.34k | 21.68k | 36.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ck Asset. More…

| Operations | Investing | Financing |

| 6.57k | 47.47k | -58.47k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ck Asset. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 514.82k | 121.11k | 107.5 |

Key Ratios Snapshot

Some of the financial key ratios for Ck Asset are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -11.9% | -17.4% | 42.3% |

| FCF Margin | ROE | ROA |

| 7.3% | 3.9% | 2.9% |

Analysis

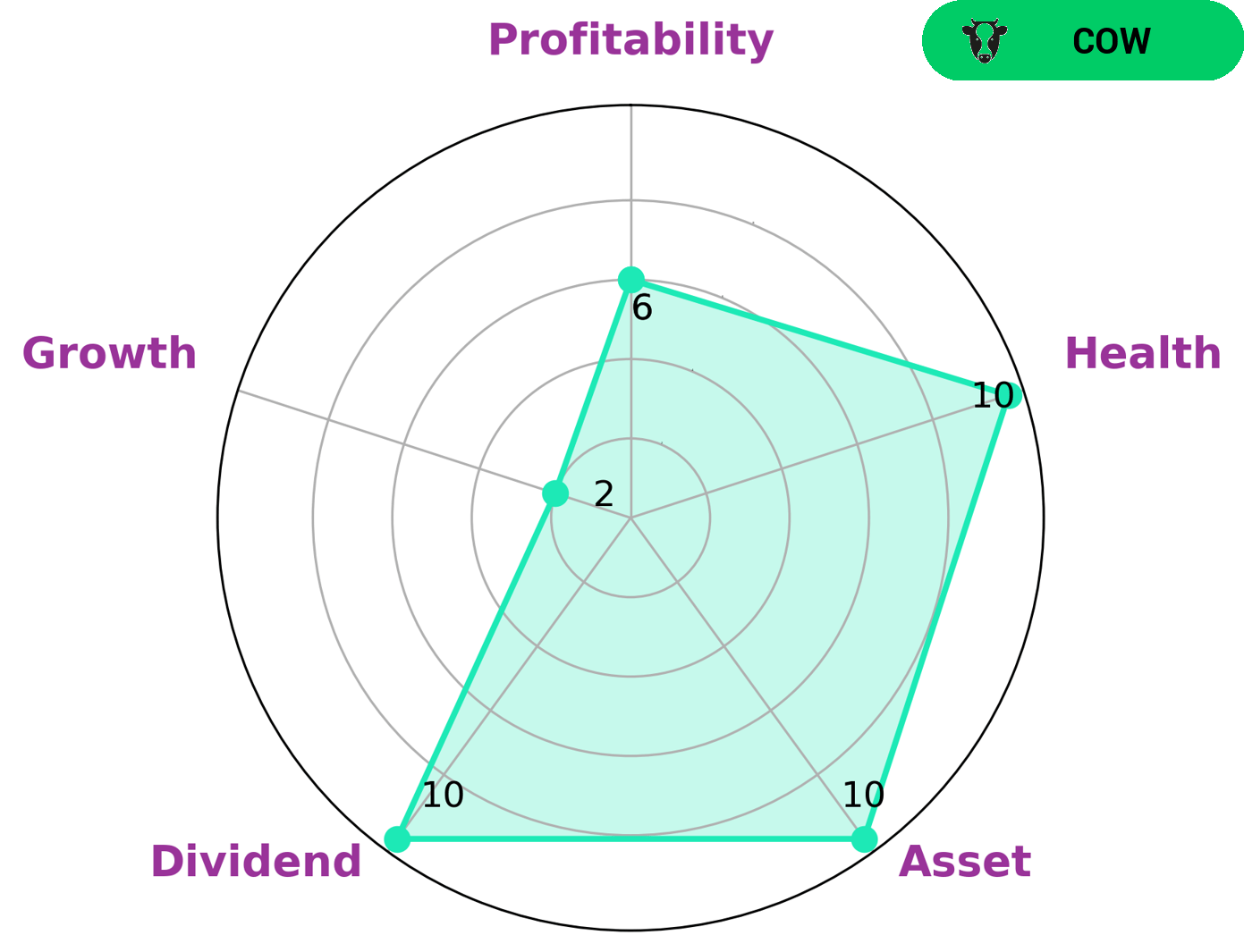

GoodWhale has conducted an analysis on CK ASSET‘s financials and our findings are positive. On the Star Chart, CK ASSET scored a 10/10 in health, indicating that the company has strong cashflows and is able to sustain operations in times of crisis. We classify CK ASSET as a ‘cow’ type company, with a track record of paying out consistent and sustainable dividends. This makes CK ASSET an attractive option for investors looking for stability and dividends. Additionally, our analysis indicates that CK ASSET is strong in terms of assets and dividends, medium in terms of profitability, and weak in terms of growth. More…

Peers

It is a publicly traded company and has seen considerable success as one of the top players in the region. While CK Asset Holdings Ltd commands a strong presence in the industry, it faces competition from other notable developers such as Hongkong Land Holdings Ltd, Sun Hung Kai Properties Ltd, and Henderson Land Development Co Ltd.

– Hongkong Land Holdings Ltd ($SGX:H78)

Hongkong Land Holdings Ltd is a leading property investment, management, and development company based in Hong Kong. Founded in 1889, the company is focused on owning and managing prime commercial real estate in key Asian cities and providing premier office space and other related services. As of 2022, Hongkong Land Holdings Ltd has a market capitalization of 9.91 billion, making it one of the largest companies in the region. The company also has a return on equity of 2.19%, indicating that it is generating a good return for its investors. The company is well-positioned to benefit from future economic growth in the region.

– Sun Hung Kai Properties Ltd ($SEHK:00016)

Sun Hung Kai Properties Ltd. is a leading real estate developer in Hong Kong, with a diversified portfolio of residential, office, retail and industrial properties in Hong Kong, mainland China, and other countries. As of 2022, the company has a market capitalization of 284.73 billion USD, making it one of the largest public companies in Hong Kong. Sun Hung Kai Properties Ltd. also has a strong balance sheet with a return on equity of 3.52%. This is an indicator of the company’s ability to generate profits relative to its shareholders’ equity and demonstrates its financial strength.

– Henderson Land Development Co Ltd ($SEHK:00012)

Henderson Land Development Co Ltd is a leading property developer in Hong Kong. With a market capitalisation of 125.87 billion dollars as of 2022, the company is one of the largest listed companies on the Hong Kong Stock Exchange. Its Return on Equity (ROE) of 2.69% indicates that it is highly profitable and has been consistently delivering positive results over the years. The company is involved in property development, investment, hotel and property management, and also retail and infrastructure projects.

Summary

CK ASSET is an attractive investment for those looking for a steady income stream. Over the past 3 years, the company has distributed an average annual dividend of 2.22 HKD per share, yielding an average return of 4.23%. Analyzing the company’s financial statements, investors can expect CK ASSET to be an attractive investment with consistent returns and a stable future outlook.

Investors should also note that CK ASSET’s dividend is paid out from profits earned in the preceding year, making it a more secure and reliable option than many alternatives. With its strong performance over the past few years and a solid future outlook, investing in CK ASSET is a decision worth considering.

Recent Posts