CASS stock dividend – Cass Information Systems Declares $0.29 Cash Dividend

June 9, 2023

🌥️Dividends Yield

On June 8 2023, Cass Information Systems ($NASDAQ:CASS) Inc. declared a $0.29 cash dividend. This announcement means that CASS INFORMATION SYSTEMS shareholders will be receiving a 1.14 USD dividend per share this year, up from 1.13 USD and 1.09 USD in the previous two years, respectively. This dividend yield for 2021 to 2023 is 2.89%, 3.07%, and 2.59%, with an average dividend yield of 2.85%. If you are looking for a dividend-yielding stock to include in your portfolio, CASS INFORMATION SYSTEMS should be on your list of considerations.

Furthermore, the ex-dividend date for the cash dividend is June 2, 2023, so shareholders must act quickly if they want to take advantage of this opportunity. With its consistent dividend payouts, CASS INFORMATION SYSTEMS is a great option for investors that are looking for reliable returns.

Share Price

On Thursday, CASS INFORMATION SYSTEMS stock opened at $41.6 and closed at $40.4, representing a 3.5% decrease from the last closing price of $41.9. This marks the eighteenth consecutive quarter that CASS INFORMATION SYSTEMS has declared a cash dividend. This cash dividend is in line with the company’s commitment to enhancing shareholder value and demonstrating its strong financial performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CASS. More…

| Total Revenues | Net Income | Net Margin |

| 182.62 | 33.76 | 18.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CASS. More…

| Operations | Investing | Financing |

| 51.61 | -306.39 | -59.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CASS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.43k | 2.21k | 15.86 |

Key Ratios Snapshot

Some of the financial key ratios for CASS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.4% | – | – |

| FCF Margin | ROE | ROA |

| 25.0% | 12.3% | 1.1% |

Analysis

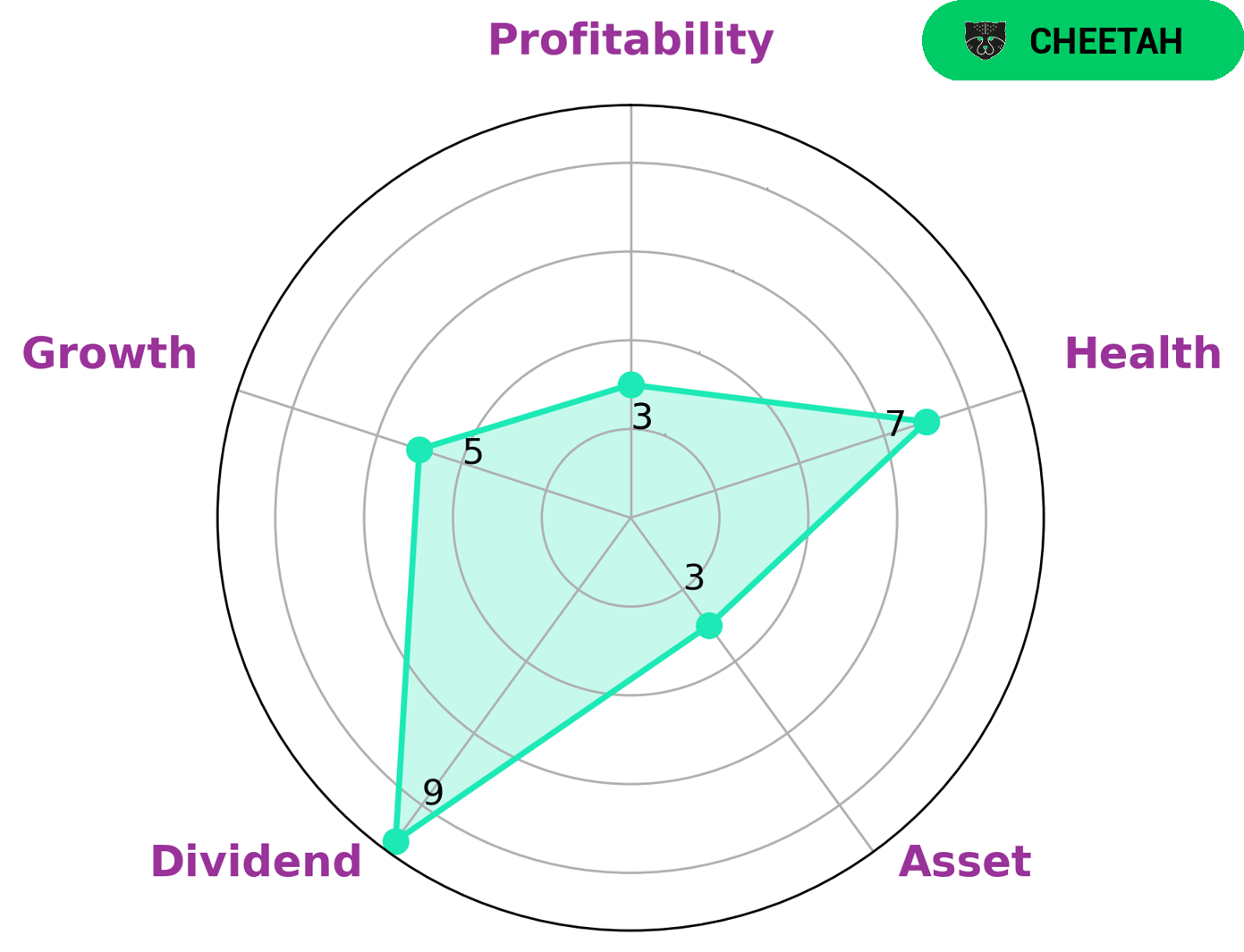

GoodWhale has conducted an analysis of CASS INFORMATION SYSTEMS’ financials and based on our Star Chart, CASS INFORMATION SYSTEMS is classified as a ‘cheetah’ type of company. This implies that the company has achieved high revenue or earnings growth, but may be considered less stable due to lower profitability. Investors who are looking for high returns in a relatively short period of time may find this type of company appealing. Additionally, CASS INFORMATION SYSTEMS has a high health score of 7/10 with regard to its cashflows and debt, making it capable to safely ride out any crisis without the risk of bankruptcy. Furthermore, CASS INFORMATION SYSTEMS is strong in dividend, medium in growth and weak in asset and profitability, which could be attractive for investors who are looking for consistent income streams and capital appreciation. More…

Peers

The company’s solutions are used by companies in a variety of industries to streamline and automate accounts payable and receivable processes. Cass Information Systems Inc’s competitors include Pasco Corp, Synchro Food Co Ltd, En Japan Inc.

– Pasco Corp ($TSE:9232)

Pasco is a global energy company with operations in North America, South America, Europe and Asia. The company is engaged in the exploration, production, transportation and marketing of crude oil and natural gas. Pasco has a market capitalization of $18.58 billion as of 2022 and a return on equity of 13.09%. The company’s primary operations are located in the United States, Canada, Brazil, Colombia, Peru and Ecuador.

– Synchro Food Co Ltd ($TSE:3963)

Synchro Food Co Ltd is a food company that produces and sells a variety of food products. The company has a market cap of 12.87B as of 2022 and a return on equity of 12.84%. Synchro Food Co Ltd’s products include snacks, drinks, and other food items. The company operates in a variety of countries and has a strong presence in Asia.

– En Japan Inc ($TSE:4849)

Japan Inc is a leading provider of financial services in Japan with a market cap of 121.67B as of 2022. The company offers a wide range of services including banking, securities, insurance, and asset management. Japan Inc has a strong focus on risk management and has a Return on Equity of 14.82%. The company is well-positioned to continue its growth in the Japanese financial services market.

Summary

Investing in CASS INFORMATION SYSTEMS can be a good choice for those looking for dividends. The company has issued dividend per share of 1.14 USD, 1.13 USD, and 1.09 USD for the past three years, yielding 2.89%, 3.07%, and 2.59%, respectively. The average dividend yield comes to 2.85%, which makes it a lucrative investment option for dividend-seeking investors. Although there is no guarantee of future performance, CASS INFORMATION SYSTEMS presents an attractive investment opportunity for those looking to diversify their portfolios with dividend-yielding stocks.

Recent Posts